Consumer Staples

Consumer Staples sector comprises of industries â food & staples retailing, food, beverage tobacco, household & personal products. As on 29 October 2019, the S&P/ASX 200 Consumer Staples (Sector) Index has delivered an annualised return of +12.65% over the past three years. The return of the index on a YTD basis is +19.55%.

The annualised return of the sector index in the past one year is +19.95%, implying its increasing popularity. Meanwhile, in the similar period, the S&P/ASX 200 Consumer Discretionary (Sector) Index has an annualised return of +18.48%, and the S&P/ASX 200 (Sector) Utilities has an annualised return of +11.71%.

Essentials: The sector includes companies that produce essential items such as butter, milk, meat etc. It is said that the sector is less sensitive to economic slowdowns due to the revenues that are tied to the basic needs of humans.

Stability: It is also said that the sector is less volatile, which means the ability of the sector to provide stable returns to the investors. Further, it is also said that the sector has delivered growing dividends even in the economic slowdown in 2008 and 2009.

High Valuations: As the sector is alternatively known as consumer defensive, the market participants tend to push valuations to higher levels due to the sectorâs relative safety amid increasing prospects of slow economic growth.

Bega Cheese Limited (ASX: BGA)

Founded in 1899, the company is a live testament of the Australian heritage with a position among the largest dairy producers in Australia.

FY 2020 Outlook

In a release on 29 October 2019, the company has cited tightening market conditions, attributing to competitive milk supply conditions and easing demand from the third party branded businesses.

As a result, the company has updated the profit outlook for this year. According to the latest outlook, it is expected that the normalised EBITDA would be in the range of $95 million to $105 million for FY2020.

Market Conditions

It is being said that the continuing drought conditions and additional deterioration in the Australian milk production have resulted in an escalated competition in Q1 FY 2020. As a result of the competition, the producers are facing an ongoing higher cost of milk across the industry.

Further, the company previously noted that these conditions had impacted the business in FY2019, and it would continue to impact in FY 2020 as well. However, the conditions are deteriorating much faster than anticipated.

In the meantime, the company has witnessed a slowdown in the key growth categories that include export market products, which would adversely impact the earnings outlook in FY2020.

Nevertheless, the company remains committed to managing its portfolio proactively. It is well advanced in its plans to restructure their manufacturing capacity to cope up with dynamic supply environment.

These restructuring plans include the development of toll and third-party manufacture relationships to ensure its efficient use of capital within the dairy industry. Besides, the company is reviewing its supply chain and overhead costs to remain competitive.

FY 2019 Review

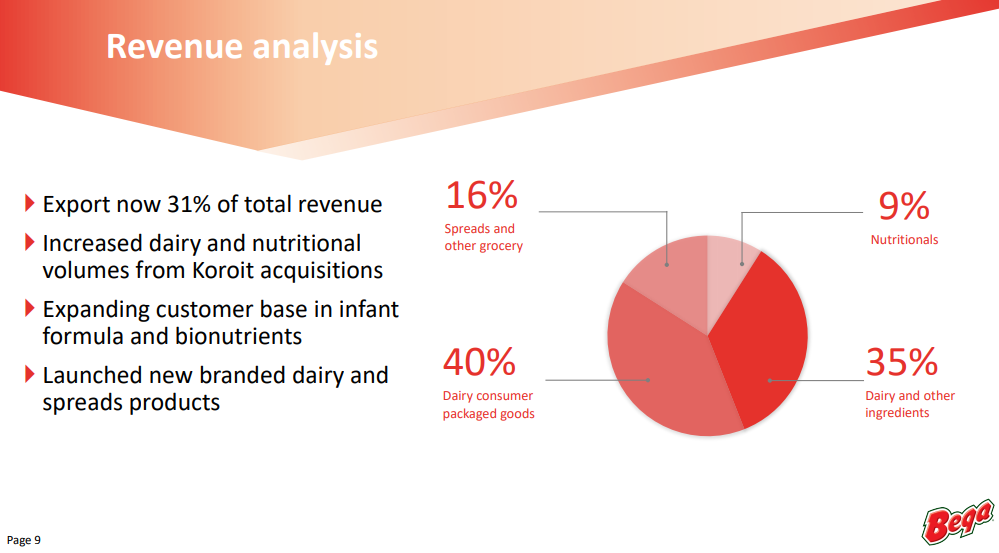

In the year ended 30 June 2019, the company witnessed strong growth in core branded consumer and food service business in both the domestic and international markets. The export of branded consumer and food service products represented 31% of revenue.

Revenue Analysis (Source: BGAâs AGM Presentation)

The company has a capacity to process 900 million litres of milk into a range of milk powders and butter products that would continue to be fundamental to service the domestic markets, international markets, food service and nutritional customers.

In addition, the companyâs nutritional and bio-nutrient business has delivered strong profit growth amid ongoing diversification of product categories, customers and markets. The company penned a processing deal with Bubs for goat milk infant formula.

It was also said that the demand for organic infant formulae is growing, and the company is working with domestic and international customers on new formulations and supply, which would be launched in FY 2020.

Reportedly, the sales for the period increased by 13% $1.42 billion in FY2019, largely driven by the acquisition of Koroit. On a statutory basis, the company generated NPAT of $11.8 million, which was down 59% due to high depreciation and amortisation from recent capital investments, interest on borrowings and working capital and a higher effective tax rate from the tax treatment for acquisition costs.

On 30 October 2019, BGA was trading at $3.67 down by 7.089% (at AEST 3:26 PM). On a YTD basis, the stock has delivered a return of -20.04%. In the past three-month, the return of stock has been +12.03%.

Elders Limited (ASX: ELD)

Elders operates in Australia, China and Indonesia. The company has a presence in rural services, and closely works with the Australian primary producers to access products, and marketing services. It also operates a top-tier beef cattle feed and processing business. In addition, the company provides financial planning, real estate, insurance and home loans.

AIRR Acquisition

On 29 October 2019, the company announced that the Federal Court of Australia had approved the scheme of arrangement for the proposed acquisition of 100% of the issued shares in AIRR Holdings Limited. On 25 October 2019, the company had reported that the scheme in relation to the acquisition of AIRR was approved at the AIRR scheme meeting and general meeting.

In July, the company had reported about the acquisition of Australian Independent Rural Retailers for $10.85 per share. The target company is a large-scale wholesale business with a strong track record.

The acquisition would enable the company to leverage AIRRâs distribution and logistics coverage. It is expected that the acquisition would provide short term benefits in improving the companyâs supply chain, and a solid long-term initiative to adapt with the changes to consumer demand.

In addition, the company also reiterated the FY 2019 guidance, and it was confident to deliver, excluding any contribution from AIRR. The company expected:

- Underlying EBIT in the range of $72 â 75 million.

- Underlying NPAT in the range of $61 - 64 million.

Refinancing Terms

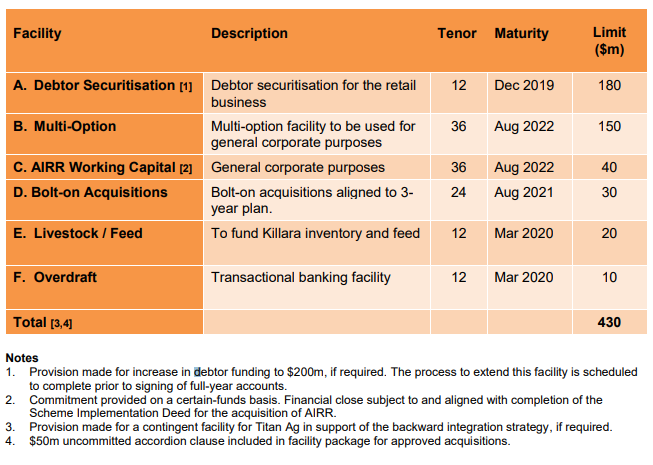

In August 2019, the company announced the refinancing of its debt facilities for an extended tenure with improved terms and commitment for working facilities for AIRR. The refinancing was agreed with the companyâs existing financiers, and the tenor of new facilities ranges between 12 and 36 months.

Outline of Elders Refinance Structure (Source: Companyâs Announcement)

Outline of Elders Refinance Structure (Source: Companyâs Announcement)

The re-finance package offers the following:

- A $40 million commitment for working capital facilities for AIRR, depending on the completion of the acquisition.

- An uncommitted $50 million accordion clause to finance acquisitions, subject to financier consent.

- A committed $30 million âbolt onâ acquisition to provide fund for strategic expansion over the next 24 months.

On 30 October 2019, ELD was trading at $5.935, down up by 0.252% (at AEST 3:53 PM). On a YTD basis, the stock has delivered a return of -13.94%. In the past three-month, the return of stock has been -19.16%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.