Mid-cap stocks are those stocks whose market capitalisation falls between the market capitalisation of large cap stocks and small cap stocks. The good thing about investing in mid-cap stocks is that they are expected to grow and increase profits, productivity and market share, that has positioned them in the middle of the growth curve. An entityâs market cap is subject to 2 components: 1) Its current market price and 2) its number of outstanding shares.

A simple formula for calculating market cap is:

Total market capitalisation=Total number of outstanding shares*Current market price

Letâs now look at a few popular mid-cap stocks listed on ASX.

Magellan Financial Group Limited (ASX: MFG)

Magellan Financial Group Limited is a funds management company, with the aim of offering international investment funds to institutional investors globally, and retail investors and high net worth in New Zealand and Australia.

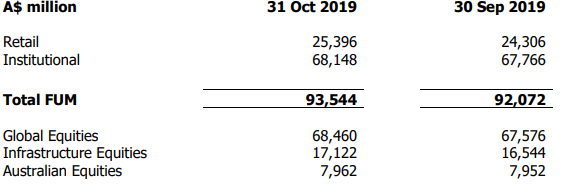

FUM Update as at 31st October 2019

In the month of October, the company experienced net inflows of $1,385 million. The company had net institutional inflows of $260 million and net retail inflows of $1,125 million. Funds from global equities and infrastructure equities increased by $884 million and $578 million, respectively on MoM basis.

FUM Update (Source: Companyâs Report)

Highlights of AGM

The company declared a total dividend of 185.2 cents per share, up by 38%, which is 75% franked. It includes interim dividend of 73.8 cents per share, final dividend of 78.0 per share and performance fee dividend of 33.4 cents per share.

The increase in dividend was almost in-line with the 39% increase in PBT for the FUM. The company has a dividend policy of paying dividend amounting to 90-95% of the PAT of the FUM segment. The main reasons behind increase in 39% PAT are:

- 31% increase in revenues due to increase in 28% of average funds under management and more than doubling of performance fees;

- Positive operating leverage due to a modest increase in expenses of 4%.

In the month of August 2019, the company raised $275 million through institutional share placement of 4.98 million shares, which represented ~2.8% of shares outstanding prior.

The funds raised will be primarily used to fund costs that are associated with the IPO of Magellan High Conviction Trust of about $55 million and to support new retirement products which are under development of about $50 million.

Stock Performance

The stock of MFG was trading at $49.450 per share on 7th November 2019 (at AEST 3:27 PM), down by 0.061%. The company has a market capitalisation of $9.01 billion (as on 7th November 2019). The total outstanding shares of the company stood at 182.16 million, and its 52-week low and high is $22.550 and $62.600, respectively. The company has given a total return of -14.63% and 12.38% in the time period of 3 months and 6 months, respectively.

ASX Limited (ASX: ASX)

ASX Limited is a fully integrated exchange that provides central counterparty clearing services, derivatives exchange and ancillary services, securities exchange and ancillary services and technical and information services. It also provides registry, depository, settlement and delivery versus payment clearing of financial products.

Activity Report of October 2019

In the month of October, $5.7 billion was raised, which was down by 54% on the pcp and the daily average number of trades was 19% higher than pcp and average value traded on market came at $4.5 billion, which was down by 2% on the pcp.

The average daily futures volumes were down 3%, option volumes were up by 1% on the pcp and the average daily F&O volumes were down by 3% on pcp.

Listing and Capital Raising (Source: Company Report)

Activity Report of September 2019

In the month of September, $5.4 billion was raised, which was down by 33% on the pcp and the daily average number of trades was 30% higher than pcp and average value traded on market came at $5.4 billion, which was up by 17% on the pcp.

The average daily future volumes were up by 15%, option volumes were up by 91% on the pcp and the average daily F&O volumes were up by 15% on pcp.

Stock Performance

The stock of ASX was trading at $80.535 per share on 7th November 2019, up by 1.022% (at AEST 3:57 PM). The company has a market capitalisation of $15.43 billion (as on 7th November 2019). The total outstanding shares of the company stood at 193.6 million, and its 52-week low and high is $56.750 and $88.316, respectively. The company has given a total return of -3.91% and 8.41% in the time period of 3 months and 6 months, respectively.

Medibank Private Limited (ASX: MPL)

Medibank Private Limited is a private health insurer, underwriter and distributor of private health insurance policies under its two brands, Medibank and ahm.

Update on FY20 Outlook

Medibank has provided additional information regarding its FY20 outlook. Medibank agrees that it has experienced higher than predicted claims, which has increased the underlying claims growth per policy unit from 2.0% reported at the full year vs 2.4% in FY19.

- It was driven by a number of factors, mainly as a result of higher private hospital payments, which reflects an increase in the average benefit size along with the continuation of elevated prosthesis costs;

- While the industry claims environment remains challenging, company continues to focus on the elements of business that it can control, including growing policyholder numbers;

- For the first quarter of this current financial year, company has achieved net resident policyholder growth of around 0.6%, which is approximately up 10,000 policyholders.

Stock Performance

The stock of MPL closed the dayâs trading at $3.160 per share on 7th November 2019, up by 1.608% from its previous closing price. The company has a market capitalisation of $8.56 billion (as on 7th November 2019). The total outstanding shares of the company stood at 2.75 billion, and its 52-week low and high is $2.274 and $3.654, respectively. The company has given a total return of -8.68% and 8% in the time period of 3 months and 6 months, respectively.

Janus Henderson Group PLC (ASX: JHG)

Janus Henderson Group PLC is one of the top global active asset managers, which aims to aid investors, by various investment solutions, attain long-term financial goals.

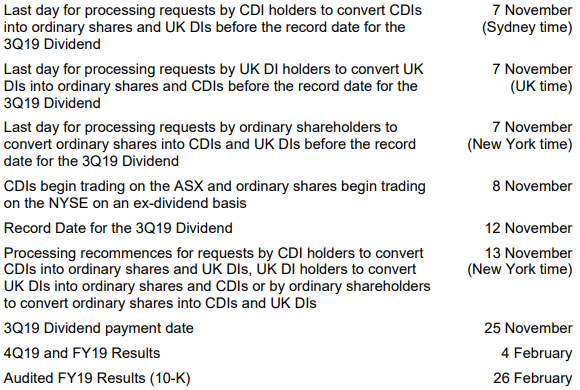

Important Dates for 4Q19

Janus Henderson has released key dates for 4Q19, which are as given below:

Key Dates (Source: Companyâs Report)

3Q19 Results Highlights

The company reported net income of US$112.1 million in 3Q19 compared to US$109.4 million in 2Q19 and US$111.2 million in 3Q18. AUM was down by 1% to US$356.1 billion, compared to the previous quarter, as a result of net inflows of US$3.5 billion. It also completed share buy backs of US$81 million during the third quarter and US$19 million remains authorised for buybacks in 2019. The company also declared a third quarter dividend of US$0.36 per share.

Stock Performance

The stock of JHG closed the dayâs trading at $35.835 per share on 7th November 2019, down by 2.197% from its previous closing price. Its 52-week low and high is $26.110 and $36.920, respectively. The company has given a total return of 29.75% and 16.87% in the time period of 3 months and 6 months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_07_01_2025_00_35_15_412895.jpg)