The outbreak of the coronavirus has impacted the economy of various countries on a global scale not sparing Australia either.

On this front, the Australian government is acting firmly in the national interest to assist households as well as businesses to tackle the significant consequences. In the present scenario, the full economic effect of the virus remains ambiguous. The situation has further worsened since the support package announced by the government on March 19, 2020.

The spread of the virus has expanded and is predicted that it would last longer. The government in Australia as well as in other countries have announced strict measures to reduce the spread of this deadly disease which is resulting in significant economic impacts.

As reported by the Australian government on 4 April 2020 at 3:00 pm, the number of COVID-19 cases has reached 5,548, and 30 people have been declared dead.

On 30 March 2020, the Australian government announced $130 billion JobKeeper payment to assist companies affected by COVID-19, to retain the Australian citizens in their job positions. With this amount, the total support for the economy reached $320 billion across the forward estimates, that represents 16.4% of the annual GDP.

The steps taken by the government would assist the affected workers, businesses, as well as the broader community.

As highlighted above, most Australian companies have been impacted considerably by the coronavirus outbreak. Companies in this situation have either slashed their dividend or decided to withdraw their guidance. However, there are some companies whose businesses have been less impacted by this pandemic. Still, because of the rising cases in Australia, uncertain surrounding, and with no end of the coronavirus impact known, these companies have also decided to withdraw their guidance. These companies have implemented their business continuity plan wherein to ensure safety and wellbeing of their clients and employees they have asked their employees to work remotely.

In this article, we would be discussing one such company Hansen Technologies Limited and see the impact on their business.

Hansen Technologies Limited

Hansen Technologies Limited (ASX: HSN) is a top global provider of data management, customer care solutions, billing software, and catalog driven technologies to the energy, water, tele-communications, and pay-tv industries. Having an experience of more than 40 years with offices across the globe and over 1500 employees, its products help clients to ensure the delivery of cost-effective end to end business solutions to their customers.

Products:

Hansen’s established, scalable solutions enable flexibility to more than 500 clients.

The energy solutions of Hansen include BannerCX, PeaceCX, NirvanasoftCX, HubCX, SolutionsCX, UtilisoftCX, EnoroCX, GenerisCX, UtilyticsCX.

Pay-TV & telco Solutions includes ICX and NavibillingCX.

Water solutions include: BannerCX and HiAffinityCX.

Market Update:

On 3 April 2020, Hansen Technologies Limited provided an update related to its global business operations after the arrival of the COVID-19 pandemic.

People and Customer of Hansen:

Hansen considers its top priority during the period of coronavirus crisis is the health and wellbeing of its employee as well as customers. On this front, the company has provided its employees with flexible working arrangements. The employees worldwide have been operating remotely. The company is working on customer projects using long established remote work methods and simultaneously co-ordinating with the client to make sure that the service delivered are uniform and effective.

The company is engaged in the business of providing mission critical software to suppliers of important services like water, energy and communications. The Company own the intellectual property, and the delivery is not impacted by the third-party supply chains. The recurring revenue of the Company, which is expected not to be affected deeply, earned through customers relationships provides a solid base to deal with current COVID-19 pandemic.

Hansen’s Funding:

Hansen has substantial funding available to support cash flow management. In May 2019, the company had secured $225 million syndicated multi-currency facility with a maturity date 30 April 2022 and is subjected to renewal upon discussion with its external financiers. At present, $186 million is being already withdrawn, and there is still $39 million that is unused.

1H FY2020 Highlights:

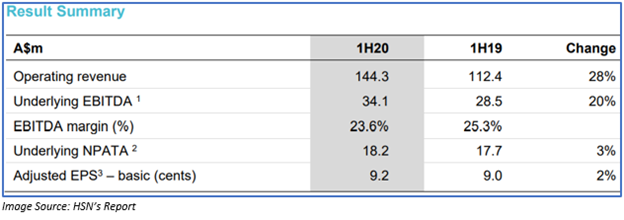

In 1H FY2020 for the period ended 31 December 2019, the company reported 28% growth in its revenue to $144.3 million as compared to the previous corresponding period. The revenue was propelled by the contribution from Sigma after being acquired in June 2019. The revenue of the company ex-Sigma was $3 million down from 1H FY2019 to $109.4 million. On the other hand, recurring revenue improved by $1.2 million while non-recurring dropped by $4.2 million. A drop was seen in the service revenue by $1 million mainly because of the closure of the consulting business within Enoro in the second half of 2019 along with the continued reduction in the revenue from the call centre in the US. Recurring revenue improved from 62.4% in 1H2019 to ~ 67% in 1H2020.

Underlying EBITDA improved by 20% to $34.1 million and underlying NPATA by 3% to $18.2 million.

The board declared an interim dividend of 3 cents per share partially franked with record date as 5 March 2020 & the payment date being 26 March 2020.

Outlook

For FY2020, the company expects its operating revenue to range from $300 million to $305 million and underlying EBITDA to be in between $72 million and $77 million.

Operating revenue in 2H FY2020 was expected to lie in between $156 million to $161 million.

As per the market release on 3 April 2020, the company confirmed that it has performed as anticipated. However, the company is not sure about the extent that revenue from projects as well as new customer wins will slow during this period of the pandemic therefore considers it a wise decision to withdraw its formal earnings guidance for FY2020.

By the closure of the market on 4 April 2020, HSN shares dropped by 2.817% and settled at $2.760.