Graphite markets across the globe are gaining much interest over the stabilised lithium prices and reviving economic conditions in China, which previously exerted pressure on the natural flake graphite and impacted the offtake of the ASX graphite miner- Syrah Resources Limited (ASX: SYR).

To Know More, Do Read: Syrah Resources Under Duress; What to Expect from the Graphite Miner Ahead?

The prices for natural graphite remain soft in China; however, the outlook over lithium and the penetration of the battery storage devices into the global energy storage market is keeping the graphite interest alive across the battery material space.

Graphite Market Update

The graphite market witnessed a sharp downfall as the consumer sentiments in China was damaged by the change in the subsidiary policies for electric vehicles.

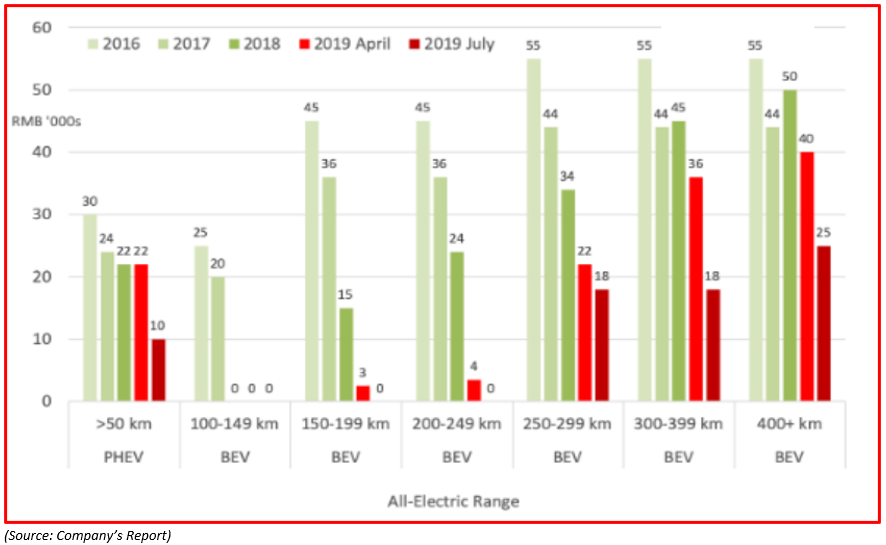

The Chinese government reorganised the subsidiary policies in favour of the high-end specifications in the electric vehicles, and by the second half of the year 2019, the subsidy was reorganised for all EVs as below:

- The electric vehicle with the driving range below 250km would no longer be eligible for the subsidy.

- The subsidies for longer-range vehicles were slashed by nearly 50 per cent.

Another jolt to the graphite market came from the domestic economic conditions in China. The prolonged stretch over the trade war hampered the economic conditions of China and depreciated the domestic currency.

The decline in the economic conditions affected vehicle sales in China, and the overall Chinese car market witnessed a downfall for over a year. As per the data, the total vehicle sales in China over the initial nine months of 2019 plunged by 10 per cent to stand at 18.4 million units.

The EV sales declined by 15 per cent in the third quarter of the year 2019 against the previous corresponding quarter to stand at ~245k units.

The deteriorating economic conditions, along with slashed subsidies, impacted the EV industry and the lithium and graphite market.

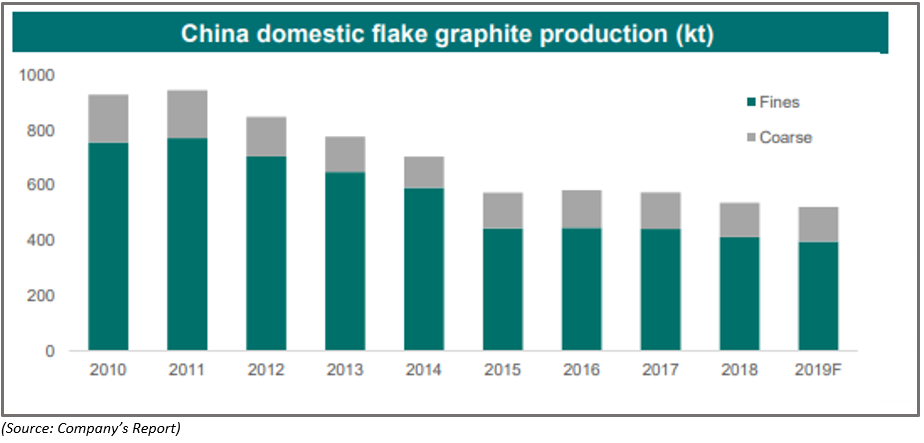

However, the recent pause in the lithium price correction along with the trend of falling graphite production in China is now raising hope among the battery material enthusiasts.

Sneak Peek At the Chinese Graphite Supply Chain

The supply chain of the Chinese flake graphite is losing the momentum, which could provide an advantage to Syrah as the company holds its flagship project in Mozambique, which supplied 17 per cent of the global graphite market in 2018.

To Know More, Do Read: Graphite-Anode Leap Pushes ASX-Listed Syrah and Magnis Into Anode Formation

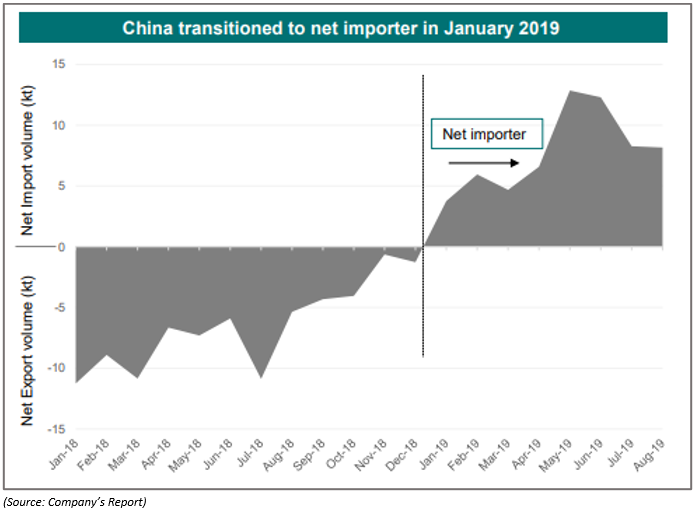

The gradual decrease in Chinaâs flake graphite chain led the country to start importing natural graphite from January 2018, which further progressed to make China a net importer.

The fundamental shift in the graphite market is supportive for Syrah as the potential offtake partners of the company are largely China-based battery manufactures.

Syrah sold about 220kt of graphite in the 21 months of operations, in which the company supplied about 146kt in the initial nine months of the year 2019.

How is Syrah Taking Advantage of the Fundamental Shift?

The company is leveraging the Balama asset to develop an integrated battery anode material and industrial products. The supportive factors for the companyâs business remain as below:

- The global stance towards decarbonisation is supporting the penetration of electric vehicles, albeit at a slower than anticipated rate, which could now support the demand for battery materials in the global market.

- The company has established itself as a significant global natural graphite producer and as a pioneer in exporting natural graphite to China.

- SYR is also ramping up the production capacity while the natural graphite market is in a phase of disruption, and apart from that, the company is producing spherical and anode products outside China to supply active anode material into emerging ex-China EV supply chains.

During the third quarter of the year 2019, the company produced 45kt from the Balama Graphite operation and achieved optimised yielding results.

The company also improved the recovery rate of the Balama Graphite to 69 per cent and achieved recovery of 71 per cent in September 2019. The total production from the Balama Graphite project stood at 137kt at the initial nine months of the year 2019 at an average of 15kt per month with C1 or operating cash cost of USD 577 per tonne.

Battery Anode Material (or BAM)

During the quarter, the Syrah moved near completion for the construction of the BAM plant in Louisiana, USA and commissioning of the purification circuit.

Syrah notified the shareholders on 4 November 2019 that the company produced the first purified spherical graphite from its BAM plant by utilising natural graphite from the Balama project. SYR also mentioned in its report that the construction activities for BAM plant milling along with purification circuit had been completed.

The downstream processing mechanism for the anode material remained as below:

Stock Action, Returns, and Charts

SYR reacted sharply over the production of the anode material, and the share price of the company rose from the level of $0.410 (close on 3 November 2019) to the level of $0.470 (high on 5 November 2019, AEST: 2:33 PM), which in turn, underpinned a price appreciation of over 14.50 per cent.

SYR Daily Chart (Source: Thomson Reuters)

On the daily chart, the stock gave a breakout from the short-term trend and established a low around the breakout levels ($0.435). If the share prices sustain the given breakout, it could face the primary hurdle at the long-term downward sloping trendline.

The investors should monitor and analyse fundamentals to gauge the potential of the stock to cross the long-term downtrend line. However, technically, the volumes are increasing with a sudden upside in the 14-day Relative Strength Index, which further suggests a short-term interest in the stock, but the primary trend seems to remain on the downside.

SYR Daily Chart (Source: Thomson Reuters)

On applying the 200-day and 50-day exponential moving averages, we could notice that the stock is trading below the 200- and 50-days EMAs, which could further act as the resistance for the share prices of the company. However, the momentum indicator is testing the base value of 0.00, and if the momentum crosses the base to step in the positive territory, it could lead towards a small upside momentum, as witnessed previously by the price actions of the stock.

As per yesterdayâs closing, the stock delivered a return of -70 per cent on a YTD basis and a return of -58 per cent over the last six months. The stock delivered a positive return of 12.6 per cent in the last five days.

SYR Daily Chart (Source: Thomson Reuters)

On applying the Ichimoku on the daily chart, we can observe that the conversion line (mean of 9 days high and low) is moving up to shorten the distance from the baseline (mean of 26 days high and low (purple)). If the conversion line passes the baseline from below, it could lead towards a short-term upside in the stock; however, the stock is below Span A (mean of conversion and baseline), which could provide resistance to the share prices of the company.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.