Waste generated as a result of health-care activities is categorized as Health care waste that ranges from contaminated needles to radioactive isotopes. These waste products are extremely infectious and can cause injury and hence their mishandling or improper management may inflict significant public health effects and detrimental effects on the environment.

Safe and sustainable management of waste from health-care activities has become a necessity.

Types of Health care Waste

Health-care waste and by-products cover a diverse range of materials, as the following list illustrates:

- Contagious waste includes waste contaminated with blood and other bodily fluids, waste from autopsies, infected animals from laboratories, or waste from swabs, bandages & disposable medical devices,

- Medical waste includes human tissues, organs or fluids, body parts and contaminated animal carcasses,

- Sharps waste comprises disposable scalpels and blades, syringes, needles, etc.

- Chemical waste includes solvents and reagents used for laboratory preparations, disinfectants, sterilants and heavy metals contained in medical devices & batteries;

- Pharmaceutical waste includes expired, unused and contaminated drugs and vaccines

- Cytotoxic waste comprises waste containing with genotoxic, mutagenic, teratogenic or carcinogenic substances, for instance such as cytotoxic drugs used in cancer treatment and their metabolites.

- Radioactive waste that includes products contaminated by radioactive diagnostic material or radiotherapeutic materials

- Non-hazardous or general waste is a waste that does not create any particular biological, chemical, radioactive or physical hazard.

As per World Health Organisation, of the total amount of waste produced by health-care activities, almost 85% accounts for general, non-hazardous waste, rest 15% is deemed hazardous material that may be contagious, noxious or radioactive.

Therefore, steps need to be taken to create safe and sustainable management of health care wastes to prevent the adverse health and environmental effects wastes, in turn, protecting the health of patients, health workers, and the general public.

Australian Waste Management industry has been gaining investorsâ tremendous attention since quite long time for the increasing necessity of creating sustainable future and generating renewable energy.

Let us now zoom lens over an ASX-Listed Waste management company; Cleanaway Waste Management Limited (ASX: CWY) and dive deep into its health care waste segment providing sustainable solutions.

Cleanawayâs Technology Pertaining to Clinical & biohazardous waste containment and destruction

Australiaâs leading waste management, industrial and environmental services company Cleanaway Waste Management Limited (ASX:CWY), is focused on recovering more resources from waste, thereby Returning valuable commodities to the value chain, in turn, creating more sustainable future possible.

With respect to Health Care and Biohazardous Waste, Cleanaway is the leading provider of medical waste services delivering a safer, sustainable solutions for the health care sector as well. Medical waste refers to the waste generated by health care sector that might cause infection if not properly handled or disposed off in a correct manner.

Cleanaway offers safe and secure systems certified to Australian standards for storage of a wide range from general waste to clinical waste/cytotoxic waste to pharmaceutical waste.

The company also processes following kinds of wastes-

- human tissue waste,

- laboratory waste,

- animal waste,

- waste resulting from dental, medical or veterinary research,

- other potentially hazardous waste.

Medical Waste Segregation- A Smarter Approach

Cleanawayâs medical waste management systems use a smarter way to segregate medical waste right at the source, minimizing risk of infectious diseases and seepage of hazardous materials into the environment, thus, guaranteeing safe and environmentally sustainable handling of hazardous waste while eliminating risk to healthcare workers and patients.

Waste segregation is done by using different color-coded containers for different types of wastes.

Cleanaway also provides solutions for health care generated waste fully compliant with all local and federally mandated regulations via training, site mapping and online reporting to alleviate the risk of fines and violation penalties.

Spectrum of Cleanawayâs Health Care Waste Management Systems

- Clinismart system - new standard of safe clinical waste management

- Medical sharps management solutions- Strategically engineered Sharpsmart sharps disposal container

- Laparoscopic surgical waste solutions for waste generated from laproscopic surgery.

- Cytotoxic waste management solutions: CY64 point-of-use cytotoxic disposal system providing a transformative novel approach of isolating and securing trace cytotoxic waste in an oncology setting such as vomit bags, dressings and bandages, gloves, laboratory research waste, Urine and faeces etc.)

- P22 Pharmasmart pharmaceutical waste management system including partly emptied bottles or glass vials, prescription drugs (hard capsule or tablet medication), broken ampoules, drawing up needles, connecting tubing).

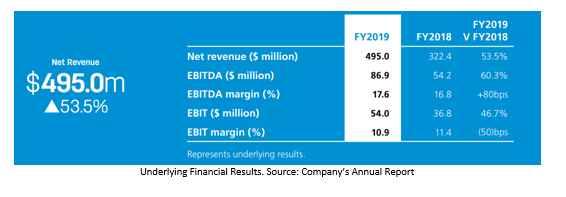

Cleanawayâs Liquid and Health Services Segment Reports $495.0 million Revenues

Liquid and Health Services segment of the company generates profits from the process of collection, treatment & processing, refining, recycling and demolition of hazardous and non-hazardous liquids, Hydrocarbons (used oil recycling), chemical waste, specialised package and hazardous waste, and e-waste.

For the fiscal year 2019, Cleanaway reported an increase in net revenue by 53.5% amounting to $495.0 million with growth in both EBITDA and EBIT of 60.3% and 46.7% respectively. The EBITDA margin also soared during the year.

CWYâ stock settled the dayâs trade at $2.040, climbing up by 1.49% on 20 December 2019. The companyâs market capitalization stood at $4.12 billion with 2.05 billion outstanding shares. The 52 weeks high and low of the stock was noted at $2.52 and $1.535 with an average volume of 12,116,986. The PE ratio was noted at 33.5x with EPS $0.060. CWYâs stock generated a return of 22.56% on a year-to-date basis.

Let us now look at another player operating in similar industry group - BINGO Industries Limited (ASX: BIN)

Australian waste management company, Bingo Industries Limited (ASX:BIN) is a fully integrated recycling and resource management entity that provides complete waste management and environmental solutions across the entire waste management supply chain.

Bingoâs offer services including

- skip bins

- liquid waste

- recycling centers

- commercial waste

- contaminated soils

- sand & soil supplies

Bingoâs strategically designed network of resource recovery and recycling facilities are operational across New South Wales and Victoria and generate recycled products, including recycled soil, recycled aggregate, recycled road base, recycled bedding sand.

FY2020 Market Update

During the annual general meeting 2019, the company provide a market update for FY2020.

- The integration of Dial a Dump (DADI) has advanced well with its completion expected by June 2020.

- For the financial year ending 30 June 2020, the company anticipates generating Underlying EDITDA in the range of $159 - $164 million.

- A one-year funding support from West Melbourne Recycling Centre, Patons Lane Recycling Centre and Landfill, and DADI along with the related cost synergies, Bingo expects a strong YoY growth in fiscal year 2020.

- Bingo is expecting to continue headwinds in residential construction throughout FY2020 with more opportunities expected for ongoing growth in its C&I business.

- In July 2019, the New South Wales pricing rise was executed after the Queensland Waste Levy has been introduced, this has now stablised and it is expected that it would deliver a net benefit to the business in fiscal year 2020.

Also Read: Is BINGO regaining traction as the stock of choice among investors?

BINâs stock settled the dayâs trade at $2.96, climbing up by 0.34% on 20 December 2019. The companyâs market capitalization stood at $1.93 billion with 653.78 million outstanding shares. The 52 weeks high and low of the stock was noted at $3.02 and $1.17 with an average volume of 2,322,649. The PE ratio was noted at 75.64x with EPS of $0.039. BINâs stock generated a return of 61.64% on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.