As the COVID-19 pandemic has created unprecedented economic and investment market uncertainty, insurance companies around the world are being urged to alter their insurance policies to cover the COVID-19 cases, and some companies have already done that. Given the highly volatile climate, insurance companies are responding with an increased premium and seeking to raise more and more capital in case of a higher number of claims. At the same time, these businesses are working to ensure that they proactively attend to such claims and in an expedited manner.

Australian-based QBE Insurance Group Limited (ASX:QBE), one of the world’s top 20 general and reinsurance companies, has launched support measures for its small and medium business (SME) customers experiencing financial hardship.

Comprehensive Capital Plan to Lift Regulatory Capital

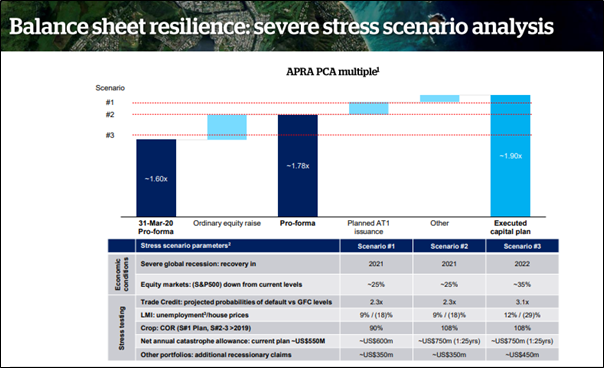

The Group is taking pre-emptive and decisive action to increase regulatory capital from 1.6x PCA currently to around 1.9x (which will also lift capital above S&P ‘AA’ levels) through a combination of an underwritten institutional placement and a non-underwritten share purchase plan for retail shareholders.

Recently on 15 April 2020, QBE Insurance Group announced to have successfully raised ~US$ 750 million via an Institutional Placement (fully underwritten) of around 145.5 million new fully paid ordinary shares to institutional investors at an issue price of $8.25 per New Share. The Placement received significant interest from existing domestic and offshore institutional investors and was exclusively placed to existing shareholders on a pro-rata basis.

QBE Chief Executive Officer, Pat Regan commented that the Group believes that the success of the latest equity raising is a clear endorsement of its capital plan to bolster the capital footing, reduce gearing and improve earnings resilience.

The Placement is expected to be settled on Friday, 17 April 2020 and the New Shares would be issued on Monday, 20 April 2020 with subsequent commencement of trading on the ASX on a normal settlement basis on the same day.

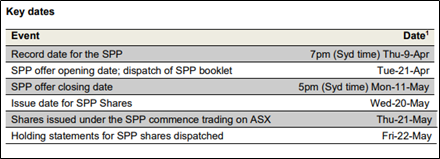

The Group also simultaneously announced a non-underwritten Share Purchase Plan (SPP), to raise up to ~US$75 million from the existing eligible shareholders. Under the SPP, the eligible QBE shareholders would have the chance to apply for approximately $30,000 worth of shares without incurring brokerage or transaction costs.

The issue price of the shares under the SPP would be lesser of the Placement Price and 5-day VWAP of QBE shares up to, and including, the closing date of the SPP (11 May 2020), less a 2% discount rounded to the nearest cent.

Source: Company’s announcement dated 15 April 2020

Capital Plan Rationale and Use of Proceeds

The equity raising is prudent and would position QBE with demonstrable capital strength to navigate a broad range of severe economic scenarios and also capture organic growth opportunities in the future.

Some of the Initiatives Completed by QBE include:

- Material de-risking of the investment book, including exit from all equities, emerging market, and high yield debt.

- Additional reinsurance to cede 90% of Crop hail exposure; and

- More targeted corn price hedging to counter the potential impact of oil price weakness on the price of ethanol and thus corn prices.

Other Initiatives Underway include:

- QBE has planned issuance of around US$400 million of Additional Tier 1 capital.

- Additional catastrophe reinsurance to reduce the Group’s North American peak peril catastrophe retention to US$150 million from US$275 million– this extra cover would largely lower the likelihood of QBE materially exceeding its annual catastrophe allowance of US$550 million.

- A portfolio transfer for around US$300 million of North American excess & surplus lines reserves and other non-dilutive initiatives.

Ultimately, with the execution of the whole complete capital plan, the Group’s PCA multiple would be lifted to around 1.9x and head office liquidity to around US$1.8 billion while also providing flexibility to return gearing to within the Group’s internal 25-35% benchmark over the next 12 months.

The Group’s PCA multiple is currently estimated to be nearly 1.6x, down from 1.71x at 31 December 2019, primarily reflecting the payment of final 2019 dividend and a negative first quarter investment return of around 2% or nearly US$500 million due to extreme volatility across all asset classes including a material increase in global fixed income credit spreads and falls in equity markets globally.

First Quarter CY20 (1Q20) Trading Update - Strong Pricing and Premium Growth

Despite this COVID-19 disruption, the Group’s premium rate momentum and underlying premium growth accelerated during 1Q20 against a turbulent market landscape. The insurance trading conditions across the Group strengthened further in 1Q20 in the following ways:

- Across the Group, the premium rate increased 8% on an average, depicting an increase from 4% in the prior corresponding period 1Q19, including a continuation of strong premium rate momentum across all divisions but especially in North America and Internationally.

- The Gross written premium rose over 9% to US$4,533 million, indicating premium rate increases along with a robust volume growth supported by improved retention in every division.

Thus, QBE Insurance is in a sound position to sail through the current market turmoil as it continues to fortify its balance sheet for near term resilience and long-term leadership.

Source: Investor Presentation

Stock Information: QBE Insurance Group has a market capitalisation of around $11.46 billion with ~1.31 billion shares outstanding. On 17 April 2020, the QBE stock closed the day’s trade at $8.800, climbing up 0.686% compared to the previous day’s close. Approximately 22.32 million shares traded during the trading hours.