Recognised as world-leading and innovative financial market exchange, the Australian Stock Exchange (ASX) help companies grow, and investors build wealth. The exchange provides a facility for companies to list, raise capital and have their securities publicly traded.

Though the stocks of several companies are listed on the ASX, there are some well-known âWâ stocks that have been garnering investorsâ attention for a long time. These stocks include Woolworths Group Limited (ASX: WOW), Wesfarmers Limited (ASX: WES), WiseTech Global Limited (ASX: WTC) and Westpac Banking Corporation (ASX: WBC).

Woolworths Group Limited (ASX: WOW)

Operating primarily in New Zealand and Australia, Woolworths Group Limited (ASX:WOW) had around 196,000 employees and 3,292 stores by the end of the financial year 2019. The Group is majorly engaged in the retail operations across New Zealand Food, Endeavour Drinks, Australian Food, Hotels and BIG W. For its primary trading divisions, the Group also has online operations.

Extended current investment in Marley Spoon Together with Union Square Ventures

Recently, the Group has extended its current investment in Marley Spoon AG (ASX: MMM), together with Union Square Ventures by $4 million each, for a total amount of ~$8 million.

Marley Spoon notified that Union Square Ventures has extended its investment via its two affiliated funds, initially by means of a commercial loan facility, that bears interest at a fixed rate of 12 per cent p.a. and has a term of three years.

Woolworths Group has also approved a senior secured commercial loan agreement, which bears interest at a fixed rate of 7 per cent p.a. and has a term of six months.

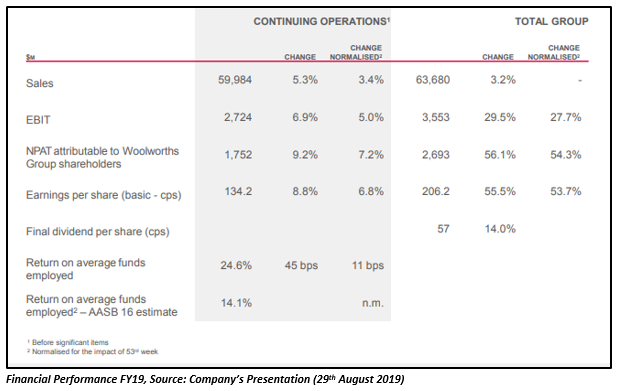

Reported Decent Financial Results in FY19

During the year ended 30th June 2019, the Group recorded an increase in Normalised sales and EBIT from continuing operations by 3.4 per cent and 5 per cent, respectively. The increase in its sales and EBIT figures was driven by the rise in second-half sales and EBIT growth of 4.7 per cent and 10.0 per cent, respectively.

The Group completed and commenced multiple landmark transactions during the year, one of them being the sale of its Petrol business to EG Group that was finalised in April. The Group also notified about its intention to merge Endeavour Drinks and ALH, that will be followed by a value-accretive alternative or a demerger in 2020 calendar year.

Announced Dividend of 57 cps

The Group announced a fully franked final dividend amounting to 57 cents per share in FY19, that brought its full-year dividend to 102 cents per share, denoting an improvement of 9.7 per cent on the prior year.

WOW closed the trading session at $37.93 on 25th October 2019, with a rise of 1.01 per cent relative to the last closed price. The stock has delivered a YTD return of about 29 per cent.

Wesfarmers Limited (ASX: WES)

Headquartered in Perth, Wesfarmers Limited (ASX: WES) has grown into one of the largest listed companies of Australia since its origin in 1914. The Group covers diverse businesses, including office supplies; apparel and general merchandise; home improvement and outdoor living and an Industrials division with businesses in industrial and safety products, energy and fertilisers and chemicals.

Launched New Sustainability Website

The Group has recently informed about the launch of its new sustainability website via an ASX update. The website is dedicated to offering enhanced information and additional frequent updates on issues and areas vital to the Groupâs persistent long-term performance.

Reported Revenue of $27.9 billion in FY19

On 25th September 2019, the Group published its consolidated financial report for the year ended 30th June 2019, reporting a rise of 4.3 per cent in its revenue from continuing operations to $27.9 billion. The Group also recorded a rise of 13.5 per cent in its NPAT from continuing businesses to $1.9 billion. Wesfarmersâ NPAT rose by $4.3 billion to $5.5 billion on a statutory basis during the period.

During FY19, Group repositioned its portfolio by:

- Demerging its Coles (ASX: COL) business in November 2018, retaining a 15 per cent share in the business.

- Selling its 40 per cent interest in the Bengalla coal mine during the year for $860 million in August 2018, with a pre-tax gain on disposal of $679 million.

- Approving the sale of the Kmart Tyre and Auto Service business in 2018 for $350 million in August 2018, with a pre-tax gain on disposal of $267 million.

- Divesting its 13.2 per cent interest in Quadrant Energy for around USD 170 million in November 2018, with a pre-tax gain on disposal of USD 98 million.

Announced Dividend of 78 cps

Wesfarmers announced a fully franked final dividend amounting to 78 cents per share in FY19, bringing the total fully franked dividend to $2.78 per share, which included a special dividend of $1.00 per share paid in April 2019 and a full-year ordinary dividend to $1.78 per share.

WES closed the trading session at $41.05 on 25th October 2019, with a rise of 1.21 per cent relative to the last closed price. The stock has delivered a substantial return of 107 per cent in the last ten years.

WiseTech Global Limited (ASX: WTC)

WiseTech Global Limited (ASX: WTC) is an Australian-headquartered company that develops and delivers software solutions to the logistics execution industry across the world. The company has a robust customer base, with more than 12,000 logistics companies in over 150 countries. The companyâs leading platform, CargoWise One, executes above 50 billion data transactions each year and shapes an integral link in the international supply chain.

Reported Significant Revenue Growth in FY19

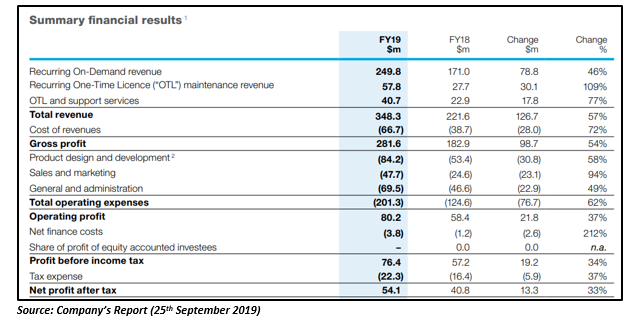

WiseTech published its annual report for the year ended June 30th, 2019 on 25th September 2019, reporting a strong revenue growth of 57 per cent on the prior corresponding period.

The company reported a revenue of $348.3 million in FY19 and mentioned that its revenue has grown at a CAGR of 49 per cent over the four years (FY15-FY19). The revenues of the company were of high-quality, with its recurring revenue being 99 per cent of total revenue for CargoWise One.

The company noted that its relentless product development and efficient commercial model delivered high recurring, high quality, organic revenue growth in FY19.

Attained Consistent Increase in NPAT and EBITDA Since FY17

The company has observed a consistent increase in EBITDA and NPAT since FY17. The EBITDA of the company has improved from $53.9 million in FY17 to $108.1 million in FY19. On the other hand, the NPAT has risen from $31.9 million in FY17 to $54.1 million in FY19.

The company notified that its FY19 results were fuelled by:

- Development of multiple product enhancements and features for the technology platform, CargoWise One.

- Substantial organic growth in revenues across all its global businesses.

- Acquisition of numerous strategic assets in new sites and adjacent technologies.

The company provided FY20 guidance for EBITDA of $145 to $153 million and revenue of $440 to $460 million, representing growth of 34 per cent to 42 per cent and 26 per cent to 32 per cent, respectively.

Announced a Dividend of 1.95 cps

The company also announced a final fully franked ordinary dividend of 1.95 cps for FY19, which was relatively higher than the dividend of 1.65 cps announced in FY18.

WTC ended the trading session at $26.37 on 25th October 2019, with a fall of 0.8 per cent in comparison to the last closed price. The stock has generated a return of 56 per cent on a YTD basis.

Westpac Banking Corporation (ASX: WBC)

The first bank and the oldest company of Australia, Westpac Banking Corporation (ASX: WBC) is one of the largest banks in New Zealand and one of four key banking organisations in Australia. The bank offers numerous services to its customers, including business and institutional banking, consumer and wealth management services.

Reported an Improvement in its stand-alone credit profile

On 25th October 2019, Westpac informed that S&P Global Ratings has upgraded its stand-alone credit profile by one notch from âa-â to âaâ. S&P has also boosted its Economic Risk assessment of Australia from 4 to 3.

S&P has increased the rating by one notch on certain capital instruments issued by Westpac, adding that the senior debt rating of Westpac is stable at AA-.

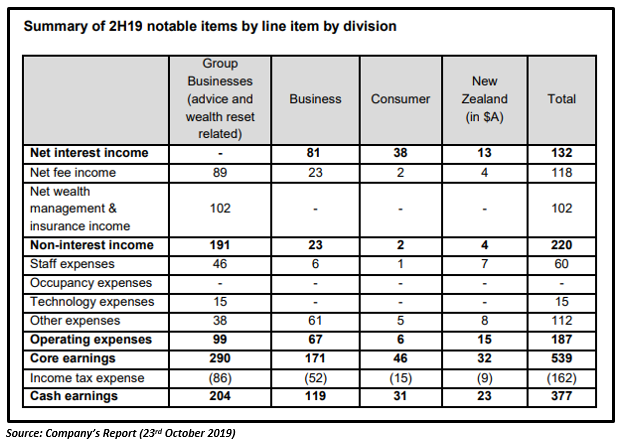

Updated on 2H19 Notable Items

Westpac expects its cash earnings to get reduced by approximately $341 million in 2H19 due to customer remediation programs. In aggregate, the bank has anticipated a decline in earnings by $377 million in 2H19, owing to both the wealth reset and customer remediation programs.

The bank also notified that out of $341 million impact on cash earnings, around 72 per cent is likely to be related to customer payments while the rest relating to costs linked with operating the remediation programs.

The bank expects the following changes in notable items in 2H19:

On 25th October 2019, WBC closed the dayâs trade at $29.05, with a rise of 0.52 per cent in comparison to the last closed price. The stock has generated a return of 18 per cent on a YTD basis.

Owing to their significant importance in ASX, it would be interesting to keep a watch on any further updates on âWâ stocks.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.