Pharmacy businesses are increasingly becoming a focal point for investments by businesses and market players, given the huge market opportunity that lies ahead.

As per the US National Institute of Health, the development of a new medicine is a long, expensive and risky process. The timeframe required from the R&D to marketing approval of any drug can take up to 15 years, and it also requires a tremendous amount of money to invest, usually exceeding $1.2 billion.

The key objective to develop a new drug formulation is to respond to the unmet medical need. In the past few years, many innovations have been made in the field of medicine and received approval globally. However, there is still a need for developing some new therapeutic areas because of unsatisfied therapeutic needs.

In the health care sector every year, many innovations get approved for treatment/therapy of various diseases across the globe; still, there are some therapeutic areas for which unsatisfied medical need persists.

Unmet medical needs in the therapeutic area

It is defined in terms of availability and effectiveness of the therapies, treatments, medicines and others. For specific diseases, treatment may not exist, or the available treatments are not effective or sometimes there is inadequate formulation.

Health care regulators are encouraging pharmaceutical industries to invest in their research and development initiatives with the higher unmet need and less crowded pipelines.

Australian Government is also supporting the pharma sector to invest in R&D for improving the treatments and to find out therapies for cancer and other rare diseases.

Two ASX listed stocks which are increasingly charging up their attention at the unmet needs in medical space- Mesoblast and Starpharma

Mesoblast Limited (ASX:MSB)

Mesoblast Limited (ASX:MSB) is an Australia based globally leading biotechnology company, which is developing off-the-shelf cellular medicines. The company has two commercialised products by its licensees in Europe and Japan, and it has also established a commercial partnership for some phase 3 studies in Europe and China.

Mesoblastâs commercial partnerships

Mesoblast and Lonza have recently entered into an agreement, which is for the commercial production of its allogeneic cell therapy drug candidate in the US, as per a company release on 17 October 2019. In addition to this, the company is expecting to submit the Biologics License Application (BLA) to the US FDA by the year-end of 2019.

According to an earlier ASX update, Grünenthal and Mesoblast entered into a partnership for the commercialisation and development of innovative cell therapy for the treatment of low back chronic pain. By this partnership, both companies will work together on developing MPC-6-ID, targeting towards meeting regulatory requirements in Europe.

Stock Information

The companyâs stock is trading at $1.777 on 28 October 2019 (AST: 2:03 PM), down by 2.36% with a market cap of ~ $977 million.

Starpharma Holdings Limited (ASX:SPL)

Australian based health care company, Starpharma Holdings Limited (ASX:SPL) is a global leader in developing dendrimer products for the pharmaceutical, life science and other applications. Starpharma, with innovative research and development, is engaged in developing new pharmaceutical products for unmet medical needs. The company has two main developmental programs- VivaGel® portfolio and DEP® drug delivery.

Starpharmaâs VivaGel® BV has a license in more than 160 countries, and Mundipharma is the dominant partner in many of the states. In June 2019, Mundipharma launched VivaGel® BV as BetadineTM BV in several European countries including Germany.

Source: Companyâs Report

In an ASX update, the company notified about the Annual General Meeting (AGM) of the Shareholders of Starpharma to be held on Thursday, 21 November 2019 in Melbourne, Victoria.

According to another ASX announcement on 26 September 2019, the company announced that USFDA had authorised, under an investigational new drug (IND) application, the use of AstraZenecaâs DEP® Bcl2/xL conjugate AZD0466 during clinical studies.

Source: Companyâs Report

Stock Performance

The companyâs stock is trading at $1.155 on 28 October 2019(AST: 2:13 PM), with a market cap of ~ $420.35 million. The stock has delivered a return of 6.60% on a YTD basis and a negative return of 10.67% in the last six months.

Australian Pharmaceutical Industries Limited (ASX: API)

Australian pharmaceutical industries (ASX:API) is a leading pharmaceutical distributor. It is the parent company of Soul Pattinson Chemist, Priceline Pharmacy and Pharmacist Advice. The company offers services including marketing programs, wholesale product delivery, retail service and business advisory services. The essential brands of Australian pharmaceutical industries are Priceline pharmacy, Soul petition Chemist, pharmacist advice, Club premium, Pharmacy BestBuys and others.

According to an ASX announcement, API will pay a half-yearly dividend to its shareholders for ordinary fully paid shares which will amount to $0.04 per share, to be paid on 12 December 2019.

Key highlights for FY2019

- Total revenue of the company was approximately $4.0 billion, excluding Hepatitis C sales and PBS reform impacts.

- Reported EBIT was of $94.0 million, up 14.1% on the corresponding prior period.

- A net profit after tax of $56.6 million was reported, representing an increase of 17.4% on the corresponding prior period.

Priceline pharmacy results

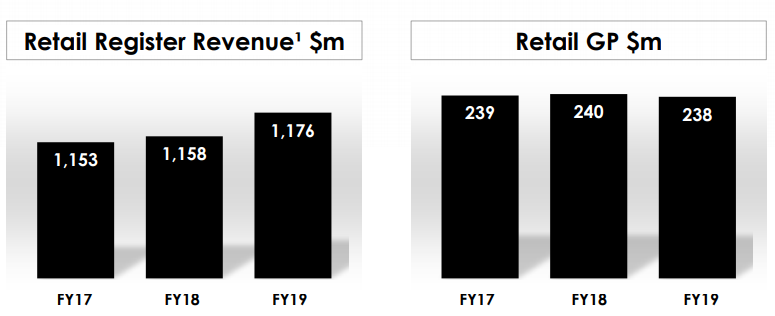

- Retail network revenue was $2.2 billion, which was increased by 2.4% and a retail register revenue of $1.2 billion was reported, up 1.5%.

- For the last complete year, 0.7% like-for-like sales was reported.

- In 2019, the store numbers increased to 488, which were 475 at the end-FY2018.

Source: Companyâs Presentation

Pharmacy distribution-

- In 2019, the revenue from pharmacy distribution was $2.9 billion, which was 1.8% less compared to the previous year.

- Overall, the sales growth was 3.3% (excluding hepatitis C medicine).

Clear skincare-

- FY 2019 revenue from Clear skincare was $45.6 million, which was up $42.7 million from last yearâs contribution.

- At the year ended on 31 August 2019, clear skincare had a total of 52 clinics in Australia and New Zealand.

The revenue received from the New Zealand manufacturing unit was $45.6 million, which was higher as compared to last year revenue. This manufacturing unit has introduced various new products, including vitamins, generic over the counter (OTC) medicines and others.

Stock Performance

The companyâs stock is trading at $1.375 on 28 October 2019 (AST: 2:46 PM), going down by ~2% with a market cap of ~$687.08 million. The stock has delivered a return of 5.68% on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.