Retailers around the globe are amongst those who have been severely hit by the COVID-19 pandemic with a loss of billions of dollars. The coronavirus outbreak has compelled governments to take social distancing measures and impose complete lockdown in several cities to contain the coronavirus from spreading.

The lockdown has shown encouraging results as there is news of flattening of the curve showing with the number of new coronavirus cases showing a declining trend. Governments have been carrying out testing of people extensively and have won significantly over the spread of the infectious disease by keeping people at home.

On the other side, everyone knew that the lockdown was bound to have some impact on the Australia’s economy as concerns for liquidity emerge strongly and new cases of layoffs as well as stand-downs have been reported.

Small businesses are at a significant risk of shutting down as they linger for resources and cash for liquidity. Major airlines, hotel, and travel businesses have also reported the inability to continue operations and the impact of the same on the employees.

CWN declares Stand-Down of ~95 per cent Employees

One of Australia’s largest entertainment groups, Crown Resorts Limited (ASX:CWN) has substantially reduced its workforce through a series of stand-downs due to the cessation of gaming activities and other non-essential services at its Crown Melbourne and Crown Perth.

Approximately 95 per cent or over 11,500 of its employees have faced the stand down on either a complete basis or a partial basis, with only employees in business-critical functions continue to work actively.

Moreover, the CEO & MD of Crown, along with other senior management personnel have agreed to take a reduction of 20 per cent in their fixed remuneration and the same reduction has been made by the Chair & Non- Executive Director in his fees.

With its services suspended, it is expected that the underlying operating cash costs for Crown shall come down to somewhere in the range of $20-30 million every month.

Time to Rethink Duration for Lockdown?

The lockdown at various places meant shuttering down of the stores, halt in the operations of businesses and a disruption in the supply chain. With Australia still in the mode of lockdown, it might be the time that the government rethinks the duration of the lockdown in the country.

The retailers have started to question the durability of the lockdown as worries begin to intensify. Since lockdown has proved to be a prudent step in containing the coronavirus, there are some regions where businesses, especially retailers, can start to become operational with some precautions.

Retailers with leases await government’s clarification regarding the duration of the lockdown to refresh the terms of the lease agreement and start their operations as the infection rate in Australia loses pace for good.

According to media speculations, the government should now be in a stage to plan for gradually lifting the lockdown at some places, so necessary activities and closed stores can reopen with the utmost safety in areas with lesser risk.

What do the IMF and Numbers Say?

IMF has already acknowledged that the world has entered a recession that is worse than ever. Moreover, experts have been predicting a significant slowdown in the world economic growth. This has further increased the worries of the retailers as well as businesses across all sectors.

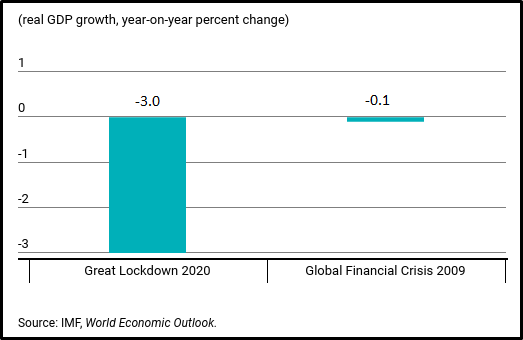

In what the US-headquartered international organization called a “major revision over a very short period”, IMF had predicted global growth in 2020 to fall to -3 per cent, which is a downgrade of 6.3 percentage points from January 2020. This further validates the premise that this is the worst recession since the Great Depression due to the prevalent Great Lockdown.

The Great Lockdown is expected to outpace the recession caused due to the great depression, and the economy shall experience the worst recession.

The mounting anxieties relating to the duration of the lockdown are starting to trigger unrest among the people and businesses. Retailers in Australia are looking up to the government to ease some restrictions at least in selected areas.

In some time from now, we might be able to see a relaxation in the restrictions related to domestic travel operations of businesses as well as shopping centres. However, rigorous measures need to be in place in high-risk areas of travel across borders.

Retailers in a Mix State

Some of the retailers in Australia have coped well with the situation, and retailers have come up with innovative strategies to ensure minimum disturbance in their supply chain and better serve their customers.

For example, a reputed brand in Australian supermarket segment, Woolworths Group Limited (ASX:WOW) has come forward with steps such as extended hours of work, dedicated shopping hours, social distancing measures as well as delivery of products through online ordering mode. The retailer has shown dramatic ability to adapt to the changes in highly uncertain times.

What to Expect Post-Lockdown?

As retailers eagerly wait for operations to resume, maintaining normalcy in the society might be lost even after the lockdown is over. Experts say that social distancing measures shall remain in place for an extended period even after the lockdown is lifted. This is bound to keep people away from making contacts and abstain from gathering, thus creating uneasiness in the shopping experience in the retail stores.

Moreover, retailers have witnessed a profound shift in the preferences of the customers to shop online during the lockdown. Companies have seen a surge in online orders and have received online orders from customers who had never ordered before through online mode.

With restrictions likely to stay for an extended period, the retailers shall have to rethink their terms of the lease and rent with the owners. Moreover, this is likely to increase the pressure on stores and landlords in choosing whether to maintain or sacrifice their incomes.

It holds to some extent that the world will not be the same once the lockdown is lifted. It shall take some time for the people to regain normalcy in their lives. But the important part is how the businesses will deal with the situation in upcoming times to increase ease and convenience for themselves as well as for the customers.

The role of the government remains highly imperative in enforcing as well as maintaining the measures to contain the COVID-19 as well as securing business operations at the same time.

Also Read: A ray of hope for the UK retail sector’s workforce