Australian health care sector is growing potentially by generating significant profits in a short period, and that is something the investors are also closely monitoring. Australiaâs public healthcare system is one of the worldâs best, jointly run by federal, state and local governments. Private healthcare players are also rapidly advancing their clinical trials, drug development and R&D initiatives to strengthen their foothold in the competitive lucrative environment. In this article, we will be highlighting the topmost market-moving healthcare stocks concerning their latest developments.

Sienna Cancer Diagnostics Ltd. (ASX:SDX)

Australia based medical technology company, Sienna Cancer Diagnostics Ltd. operates in the United States and Australia. The company distributes its products in the United States, Europe, Asia and Latin America with the vision to secure a pivotal position for the development and commercialisation of in-vitro diagnostic (IVD) tests for the global pathology market.- On 16 October 2019, the company updated regarding stepping down of companyâs CEO, Matthew Hoskin, to be replaced by Carl Stubbings, currently a non-executive Director.

- On 8 October 2019, Sienna announced regarding business and is moving to a new location. The company has signed lease for its new premises located near the Monash Technology Precinct and CSIRO. This premises will have new R&D laboratories, office space, and manufacturing facility for SIEN-NET product line.

- Sienna has recently received an amount of $404,955 as R&D Tax Incentive Refund for the FY 2019.

- In its recently released annual report, the company posted a loss of $2.7 million with a gross profit of $0.48 million.

- A US patent has been granted to Sienna by the US Patent and Trademark Office. This new patent entitled as âMethod of detecting cancerâ claims a method for detecting bladder cancer epithelial cells and cover performance of test with a variety of antibodies and antibody derived detecting agents. This patent provides intellectual property rights to the company for its hTERT test and will expire in 2035.

- A Chinese patent for methods for liquid biopsy sample preparation technology, SIEN-NETTM has been granted to Sienna. Sienna acquired this technology from Sevident Inc. in April 2019.

ICS Global Limited (ASX: ICS)

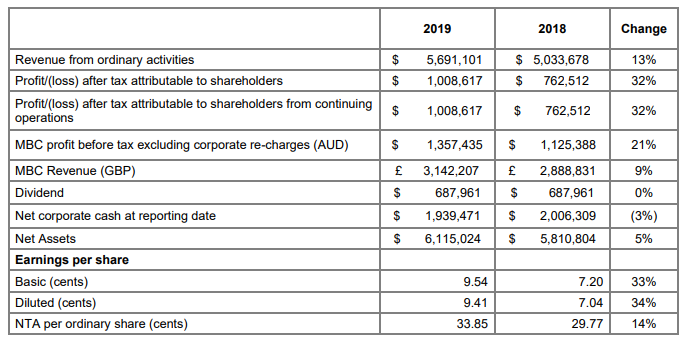

ICS is an Australia based technology investment company which is currently in Australia and the UK. The Company is engaged in working for growing the Medical Billing and Collections (MBC) business as the market commander. Financial Year 2019 Results (for the period ended 30 June 2019)- ICS recognised a revenue profit of 32% amounting to $1,008,617 for FY2019 as compared to the previous corresponding year. In FY 2019, sharp progression observed as compared to FY 2018 results.

- The net corporate cash was $1,939,471 after paying dividends of $687,961 during FY 2019

- MBC highlights:

-

- Revenue up 9 % to £3,142,207.

- Profit (before tax and internal charges) up 17% to £751,127.

Key financial information, Source: Companyâs report

The company recently announced 20-40% uptick in the FY2020 profit guidance to $1.2-1.4 million.

Stock Performance- The companyâs stock is trading at a price of $ 1.450 with a market capitalisation of approximately $15.35 m with the close of market on 17 October 2019.

Analytica Ltd (ASX:ALT)

Analytica provides an e-healthcare system for women who are suffering from stress urinary incontinence, named as PeriCoach® System.

PeriCoach® System

This system comprises a device, web portal and smartphone app. This device transfers the information recorded in the pelvic floor muscles to the smartphone app from where the data can be loaded to a cloud database for keeping track on patient progress by the physician. PeriCoach has regulatory approval for urinary incontinence in Australia and has CE mark and USFDA 510(k) clearance.

Key financial information, Source: Companyâs report

The company recently announced 20-40% uptick in the FY2020 profit guidance to $1.2-1.4 million.

Stock Performance- The companyâs stock is trading at a price of $ 1.450 with a market capitalisation of approximately $15.35 m with the close of market on 17 October 2019.

Analytica Ltd (ASX:ALT)

Analytica provides an e-healthcare system for women who are suffering from stress urinary incontinence, named as PeriCoach® System.

PeriCoach® System

This system comprises a device, web portal and smartphone app. This device transfers the information recorded in the pelvic floor muscles to the smartphone app from where the data can be loaded to a cloud database for keeping track on patient progress by the physician. PeriCoach has regulatory approval for urinary incontinence in Australia and has CE mark and USFDA 510(k) clearance.

Elements of Pericoach system, Source: Companyâs Report

Stock Performance- The companyâs stock is trading at a price of $ 0.003, down 25% with a market capitalisation of approximately $14.08 m with the close of market on 17 October 2019.

Elements of Pericoach system, Source: Companyâs Report

Stock Performance- The companyâs stock is trading at a price of $ 0.003, down 25% with a market capitalisation of approximately $14.08 m with the close of market on 17 October 2019.

Medibio Limited (ASX:MEB)

Medibio is an Australian based health technology company which is focusing on the aid in the early detection and screening of mental health conditions. During the year ended 30 June 2019, the company entered into a funded Research Agreement with the Department of Biomedical Sciences of Humanitas University in Milan, Italy. Dr Giampaolo Perna, a Medibio Scientific Advisory Board member, is supervising this collaboration. This Research Agreement will help the companyâs continued growth of mental wellbeing software products based on companyâs Intellectual Property. Regulatory updates- Medibio announced a new regulatory and commercialisation strategy during fiscal 2019.

- Medibio withdrew the initial De Novo submission in April 2019, which was filed on July 2018.

Neuren Pharmaceuticals (ASX:NEU)

Neuren Pharmaceuticals Limited having its headquarters in Australia is a biopharmaceutical company which is engaged in developing new treatments for neurodevelopmental disorders by using synthetic analogues of neurotrophic peptides that are naturally formed in brain. Neuren Pharma announced on 16 August 2019 that the company received a grant on a new patent for NNZ-2591 by the Japan Patent Office with July 2034 as expiry. The company announced on 16 October 2019 that it received a grant for Orphan Drug Designation to Neurenâs NNZ-2591 from FDA for the treatment of Phelan-McDermid syndrome and Pitt Hopkins syndrome. Key milestones in Q4 2019 On 20 September 2019, Companyâs Executive chairman Richard Treagus shared his views on the companyâs outlook for Q4 2019 by saying that the company is approaching an exhilarating fourth quarter-- The companyâs North American partner ACADIA is planning to commence the âLAVENDERâ Phase 3 trial of trofinetide in Rett syndrome.

- He also mentioned that company is expecting USFDA to complete its review of the three applications for Orphan Drug designation for NNZ-2591 in each of Phelan-McDermid syndrome, Angelman syndrome and Pitt Hopkins syndrome that Neuren submitted at the end of July.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.