The Australian share market opened the year 2020 with a bang, surging by 0.64 per cent on the first day of trading in the new year (2nd January 2020).

Though the beginning of a new decade was robust, the global equities market shook up thereafter amid renewed fears of aggravating geopolitical tensions between the US and Iran.

This has raised the need for appropriate investment strategies for 2020 to capture the potential gains in the equities market.

An investment strategy is a procedure or set of rules adopted to assist an investor select a stock portfolio. Such strategy is usually aligned to investors’ interests, risk appetite and time horizon. Though investment strategies vary according to investors’ requirements, they commonly involve a trade-off between return and risk.

Putting your hard-earned money into equities without following a well-defined strategy may land you in trouble. One needs an adequate investment strategy to make better and more informed investment decisions.

Given this backdrop, let us discuss five investment strategies that can help you tap higher returns in 2020:

Growth Investing Strategy: Seek Companies with Robust Earnings Growth

One of the most commonly used strategies that aims to increase investors’ capital is growth investment strategy. Under this strategy, investors look for those companies that have provided significant growth in earnings and are expected to offer above-average earnings growth in future.

Such companies usually do not provide dividends, rather they re-invest the earned profit back into their businesses. The stocks of these companies are referred to as growth stocks.

Growth companies generally possess the following qualities:

- Splendid management team focussed on raising the sales and profits of the companies.

- Compete in a fast-growing market.

- Have high profit margins and accelerating earnings growth rate.

- Target huge markets with a considerable pool of potential customers.

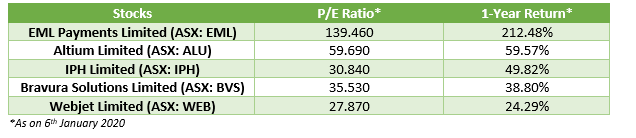

In addition, the growth stocks usually have high price-to-book ratios and high price-to-earnings (P/E) ratios. Some of the growth stocks trading on the ASX include:

To invest for a long-term, sometimes investors prefer to combine growth investing strategy with value investing strategy. This allows investors to earn returns in economic cycles favouring both the value and growth investing style.

Dividend Strategy: Choose Companies with Sustainable Dividend Yields

Investors can look for companies paying sustainable, good and quality dividends over time.

A dividend is a portion of a company’s profit that it pays to its eligible stockholders. Dividend is considered as a sign of a company’s financial well-being and is one of the easiest ways for firms to boost goodwill among its shareholders.

The stocks of companies having a track record of paying sustainable dividends are more attractive than those that prefer not to pay dividends. Dividend investing is one of the best ways to gain from shares as it lessens some of the instability associated with stock investing.

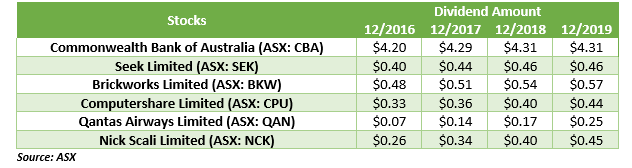

Take a look at some of the ASX-listed stocks that have delivered sustainable dividends in the last four years:

Sector-Specific Investing Strategy: Target Companies Pertaining to a Specific Sector

Investors can look for companies operating in a particular sector to tap opportunities in a specific segment of the economy. Sector investing enables investors to get a targeted exposure to the stocks of rapidly growing industries, helping them pursue growth and manage risks.

Sometimes, sector investing tends to outperform the market if one can effectively select an appropriate sector to invest in.

For instance, the gold miners and energy players enjoyed massive gains during the trading session on the ASX on Monday (6th January 2020), when the rest of the players in different sectors fell due to US-Iran trade tensions.

Another example could be S&P/ASX 200 Consumer Discretionary Index, that delivered a higher return of about 30.5 per cent in the last one year (till 3rd Jan 2020), relative to the S&P/ASX 200 index which generated a return of 19.5 per cent over the same time span.

Avoiding Behavioural Biases Strategy: Prevent Behavioural Biases while Investing

Investors that tend to avoid behavioural biases while taking investment decisions are at ease of earning potential returns, while those who take decisions based on emotions end up losing in the equity market.

As per a theory of behavioural finance, investors should avoid cognitive errors while investing to mitigate losses. Before making a decision, they should:

- Avoid being consistent with the previous actions and beliefs.

- Not accept any information validating their existing belief blindly.

- Assess only the relevant information.

- Not place more emphasis on loss aversion.

- Escape from mental accounting.

- Not Copy or follow others.

For more information on the above tips, click here.

The strategy of avoiding behavioural biases increases the chances of earning investment success for investors.

Momentum Trading Strategy: Buy High and Sell Higher

Momentum investing strategy involves looking for stocks that have been going upwards continuously and buying and selling them on the basis of the price trends.

The strategy stands on the belief that if there is a significant force driving the stock price, it will continue to move in the forward direction.

Under this approach, investors identify and buy the stocks that have delivered higher returns over the last half or full-year and sell those that have generated poor returns over the similar time period. This enables investors to re-invest the money from losing stocks into those that are starting to boil.

In a nutshell, investors should follow a disciplined investment approach, putting in money in the shares systematically and holding on their investments patiently to earn higher returns. In addition, proper research and realistic expectations are necessary while taking an investment decision.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.