In the current reporting season, various Australian companies are coming up with their half year and full year results. Investors need to keep a close eye on stocks which are disclosing their earnings and guidance for the upcoming period.

We have identified four resource sector stocks which have released their financial results today. Let’s take a closer look at these stocks and their results.

Iluka Resources Limited (ASX: ILU)

International mineral sands company Iluka Resources Limited has announced an Ore Reserve estimate for the Eneabba Mineral Separation Plant (MSP) By-Product deposit wherein the company informed that the reserve is estimated to contain a total Ore Reserve of 0.96mt at a Heavy Mineral (HM) grade of 83.5%, to contain 0.80mt of HM and the total Ore Reserve mineral assemblage in HM is estimated to contain around 26% zircon and 20% monazite.

The company also advised that the first phase of Eneabba mineral sands recovery project involves extraction and sale of zircon-monazite concentrate via a simple process. Site construction and off-site fabrication activities for the project are underway with expected project capex for Phase 1 less than $10 million. The project is due for commissioning to commence in the first half of 2020, and first sales are expected in Q3 2020.

In the last six months, ILU stock price has increased by 13.78% on ASX. At market close on 18 February 2020, ILU stock was trading at a price of $9.365, down by 2.244% intraday, with a market cap of around $4.05 billion.

Sims Limited (ASX: SGM)

Recycling company, Sims Limited incurred an underlying EBIT loss of $23.2 million in 1H FY20 compared to an underlying EBIT of $109.6 million in 1H FY19, mainly due to the rapid collapse in ferrous scrap prices in September 2019, combined with historically low zorba prices, severely compressed margins.

Over the half year period, the company’s sales revenue declined by 18.7% as compared to pcp, mainly due to lower volumes and pricing but benefited from weakness in the Australian dollar. An underlying NPAT loss of $34.7 million, resulted in an underlying diluted loss per share of 17.1 cents for 1H FY20. The company has announced an interim dividend for 1H FY20 of 6.0 cents per share, 100% franked, payable on 24 March 2020.

Over the half year period, the company made good progress across three of the growth areas:

- Sims Resource Renewal tested Sims auto shredder residue (ASR) with two technologies which supported previous IRRs and showed emissions better than regulatory requirements;

- Sims Lifecycle Services cloud volumes achieved 8.9k tonnes in 1H FY20 and is on track to reach the FY20 target of 20k tonnes; and

- Sims Municipal Recycling won an additional contract in Florida with contract terms mitigating commodity risk.

The company is expecting its 2H FY20 Underlying EBIT to be within the previously guided range of $40 million to $60 million.

At market close on 18 February 2020, the stock was trading at $10.780 with a market cap of $2.2 billion.

Oz Minerals Limited (ASX: OZL)

Mining company, Oz Minerals Limited has reported strong operating and financial performance for the year ended 31 December 2019. Over the year, the company was able to create a solid foundation to progress its growth strategy and bring on new assets in Carrapateena and the Carajás during 2020.

For 2019, the company reported gross revenue of $1,174 million which was lower than the previous year by $17 million with lower copper sales largely offset by the higher Australian dollar realized copper and gold prices. The consistent strong operating performance at Prominent Hill has helped the company to earn Underlying EBITDA of $462 million in 2019 with a robust margin of 42%. The company earned Net profit after tax (NPAT) of $164 million which lower than last year principally attributable to lower copper sales as Prominent Hill transitions from its higher copper grade open pit stockpiles.

The company believes that the year 2020 will be a transition year for OZ Minerals as its ramp-up production at Carrapateena, its strong operating cash position and balance sheet, combined with the Board’s confidence in its project pipeline, has enabled a final fully franked dividend of 15 cents per share to be declared in line with the policy of prioritising a sustainable ordinary dividend. In 2020, the company will focus on the Carrapateena ramp-up and maintaining its reliable production and cost performance at Prominent Hill as expansion studies in each of these provinces reach significant milestones.

At market close on 18 February 2020, OZL stock was trading at $10.100 with a market cap of around $3.28 billion.

Western Areas Ltd (ASX: WSA)

Nickel explore and producer, Western Areas Ltd has announced the financial results for the first half of Financial Year 2020 wherein it announced higher sales revenue of $156.2 million driven by the stronger nickel price. Further, the company earned an EBITDA of $69.7 million which is 128% higher than pcp.

The significant increase in profits and cashflow in the first half of FY20 has allowed the company to declare its first interim dividend since 2015. The Company believes that it is in a strong financial position, with the dividend considered to be a prudent and appropriate return.

The company’s half year results demonstrates the Company’s leverage to the stronger nickel price, which combined with reliable operational performance, provided a significant uplift in financial performance for the half.

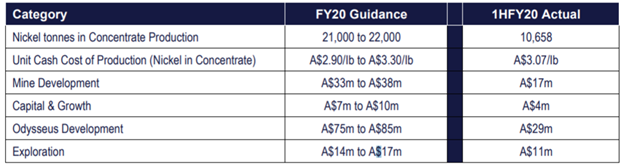

Nickel production into concentrate for the 1HFY20 totaled 10,658 nickel tonnes at a cash cost of nickel in concentrate of $3.07/lb. Over the period, Nickel sales were impacted by a delay in deliveries to Kambalda due to bushfire-related road closures and an export shipment missing the half year end, leaving port on 1 January 2020. Importantly the delayed deliveries will report into second half earnings.

Western Areas Ltd continues to maintain a strong debt free balance sheet, with cash at bank of $184.9 million at the half year end, up from $144.3 million at the end of FY19.

The company’s FY20 guidance is as follows:

At market close on 18 February 2020, WSA stock was trading at $2.575 with a market cap of $697.89 million.