In October this year, China turned out to be the hot spot for investors due to the positive changes seen in trade disputes and impetus plans. The prolonged trade struggle between the United States and China at last appears to have improved, as both the countries have entered into the phase one pact. As per the pact, The United States will nullify the tariff hike on Chinese products in the barter of an agreement that China will purchase more farm products and would join into a currency deal.

Finally, it was felt that the technology companies that have been severely shaken by the trade war will see some signs of relief.

US-China Trade War: Digging into the Details

- In January last year, President Donald Trump had levied import tariff from China on solar panels and washing devices.

- On 5 April 2018, Trump revealed another series of tariffs worth US$100 billion on Chinese imports.

- Further in May, Trump again increased steel and aluminium import taxes by 25% and 10%, respectively. This impacted the sale of Chinese goods worth $2.7 billion. These tariffs would continue to focus on U.S. agriculture from Americaâs hub, which includes wheat, chicken, sugar and other U.S. imports. This may possibly raise tariffs on greater than 5000 U.S. goods.

- By September 2019, China levied 5% to 10% tariffs on one-third of 5,078 U.S. goods. America has also inflicted tariff of 15% worth US$112 billion on Chinese import, including shoes, food and nappies.

- Recently, in December this year, there was another major impediment on the U.S.-China trade war front, which saw Trump condemn Chinaâs attempts to achieve the phase-one trade agreement. According to the report by a market expert, Chinese representatives have requested U.S. trade mediators to Beijing.

Ups and Downs in the US-China Trade Ties

According to the report by a market expert, exports to the United States dropped around 23% to $35.6 billion as compared to the previous year. The import of products (American) were down by 2.8 percent standing at $11 billion, providing China an excess, with the US of the amount standing at $24.6 billion.

Worldwide China's exports fell 1.1% from the previous year to just $221.7 billion in spite of declining global demand. Imports inched up 0.3% to $183 billion, offering China a world-wide glut of $38.7 billion.

Why Trade Resolution is Vital for Technology Companies

China is the biggest trade-off companion of the US. Moreover, it is is the low-cost seller of transitional products and gives more inputs to high-tech U.S. industries. U.S. enterprises that depend on Chinese imports are disappointed due to tariff imposition move, as it boosted the costs of equipment (high-tech) and numerous electronics goods.

Then again, a trade quarrel with the United States has stemmed in a considerable slump of Chinaâs market. However, an improved Chinese economy will provide a boost to the U.S economy as China remains the largest market for the U.S technology items.

Chinese companies are investing in tech heartland, as the country rallies toward its technology leadership position. Hence, U.S.-China trade war solution is expected to rebuild Chinese and global economic growth.

3 Chinese Stocks That Can Show Momentum

Though a lot of investors have been cautious about investing in Chinese stocks because of the mixed bag of sentiments the trade war has created, there are still some Chinese companies that have witnessed robust returns. The trio of Chinaâs biggest tech behemoths has long been known by the abbreviation BAT, where âBâ stands for Baidu, âAâ stands for Alibaba, and lastly âTâ stands for Tencent. These three companies are engaged in search, e-commerce, and social media, respectively. âBATâ together is currently priced at around $1 trillion USD.

Letâs dig in the details of each of these three stocks and have a look at the long-term prospects for investors considering playing the field.

Baidu, Inc. (NASDAQ:BIDU)

A Chinese-language Internet search provider, Baidu, Inc. was previously known as Baidu.com, Inc. The Beijing-based company also offers Japanese search services, which incorporates Web search, image search, video search, and blog search facilities.

Baiduâs Endless Endeavours in AI Space

The company is making all the efforts to strengthen its foothold in artificial intelligence (AI) space. According to a recent finding from the research division of Chinaâs Ministry of Industry and Information Technology (MIIT), it has been demonstrated that Baidu has filed 5,712 AI-based patent application in China. The move certifies the ever-increasing Chinese Internet companyâs long-term loyalty in technological innovation.

AI skills have gained an enormous grip over the past few years due to an immense need for exploring unstructured data such as social-media posts, tweets across various industries.

In August this year, the company formed a strategic alliance with the municipal government of Chongqing, one of the highly populous municipality in China. According to the agreement, both will work in smart cities, autonomous vehicles, smart government and blockchain emulsions.

In June this year, Baidu inked a deal with Neusoft Group, to build AI knowhows in the healthcare and city administration. The strategic alliance is likely to positively impact both the companies in developing new products and boosting their AI technologies.

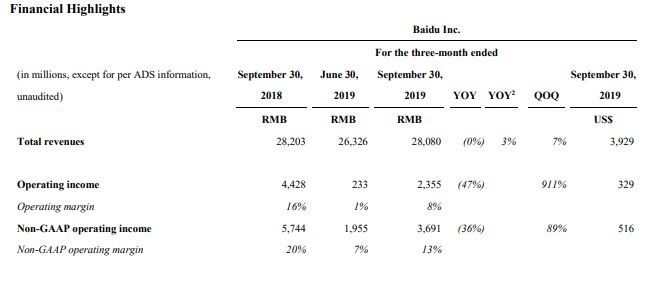

Revenues up by 7% in third quarter results

The Company announced results for third quarter of fiscal 2019 for the period closed 30 September, on 6th November 2019, a few pointers from the same are as follows:

- Revenues stood at RMB28.080 billion, up by 7% sequentially.

- The company reported non-GAAP earnings per ADS of $12.61 cents per share, up 25% sequentially.

- Operating margins on a Non-GAAP basis came in at 13% as compared to 7% in the previous quarter. Non-GAAP net margin was 16% as compared to 14% reported in the previous quarter.

- Adjusted EBITDA for the quarter was noted at RMB5.116 billion as compared to RMB3.355 billion reported in the previous quarter.

- By the closure of the quarter, the companyâs cash and cash equivalent came in at RMB14.56 billion.

(Source: Company Report)

Expect What?

For the fourth quarter of fiscal 2019, the company expects revenues to be in the range of RMB27.1 billion (or $3.78 billion) to RMB28.7 billion (or $4.02 billion), demonstrating a year-over-year increase of (1)-6%.

Stock Performance

Baidu has a market cap of $40.10 billion and the stock closed at $115.06, down by 0.68% relative to the previous close (as on 9 December 2019).

Alibaba Group Holding Limited (NYSE: BABA)

Founded in 1999 and headquartered in China, Alibaba Group Holding Limited is an e-commerce company that primarily serves to its local market. The company is involved in core commerce, cloud computing, digital media and entertainment plans and aims to offer a marketplace wherein customers or companies without any geographical obstacles can buy and sell products online.

Recent Updates

Recently, a three Memoranda of Understanding (MoU) was signed between the Ethiopian Government and Alibaba forming an eWTP (electronic world trade platform) Hub in Ethiopia. The Hub is meant to facilitate cross-border trade, offer enhanced logistics and fulfilment services, support Ethiopian small and medium-sized enterprises (SMEs) and offer talent teaching.

Improvement in data technology, growing usage of big data and expanding certification for Taobao and Tmall portals, is a key positive for the company.

The company had acquired from NetEase an import e-commerce business worth $2 billion. The pact is expected to boost Alibabaâs cross border e-commerce movements.

Further, both mobile and PC aided an increase in Alibabaâs online marketing inventory. The company also recorded an elevated monetisation rate. These factors are likely to boost Alibabaâs profits. An increasing number of paying customers and better-than-expected spending by them, indicates expanded usage of services, which is another key catalyst for the company.

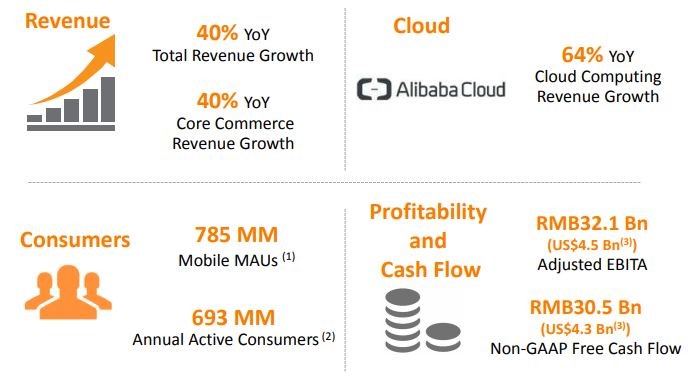

Analysing Second-Quarter Fiscal 2020:

The company has recently provided the financial results for second-quarter fiscal 2020, for the period ended 30 September 2019 and some of the highlights are as mentioned below:

- Revenues for the quarter came in at RMB119.02 billion (US$16.65 billion), an increase of 40% year over year, mainly due to strength in its China Commerce Retail business and robust adoption of Alibaba Cloud.

- Alibaba reported earnings of $1.83 per share, an increase of 36% year over year.

- Segment wise, revenues from Core Commerce during the quarter came in at RMB101.2 billion (US$14.2 billion), up 40% year over year. Cloud computing revenues were at RMB9.3 billion (US$1.3 billion), an increase of 64% year over year. The companyâs revenues from Digital Media and Entertainment stood at RMB7.3 billion (USD1.02 billion), up 23 percent from the prior yearâs quarter period. Innovation Initiatives revenue increased by 14% and came in at RMB1.21 billion (US$169 million).

- Adjusted EBITDA for the quarter was RMB37.1 billion (US$5.19 billion), up 39% year over year.

- Cash and cash equivalents and short-term investments at the end of the quarter was RMB235.3 billion (US$32.9 billion).

- Cash flow from operations during the quarter came in at RMB47.33 billion (US$6.6 billion).

Financial Highlights (Source company Report)

On the flip side stiff competition from peers like Amazon and Jd.com, remains a headwind for the company.

Stock Performance

Alibaba has a market cap of $533.16 billion and the stock closed at $198.74, down by 1.56% relative to the previous close (as on 9 December 2019).

Tencent Holdings Limited (HKG: 0700)

An internet-based platform company, Tencent Holdings Limited offers value-enhanced mobile, Internet, telecom services and online advertising connecting business with technology. A few of the Tencent's Internet platforms includes of QQ.com, QQ Games, Qzone, 3g.QQ.com, SoSo, and Tenpay in China.

Key Factors to Consider

Tencent is one of the largest game suppliers in China. Ongoing impetus for Honor of Kings and Perfect World Mobile is a key positive. Further, in May this year it unveiled Peacekeeper Elite that surpassed 50 million DAU by the end of the second quarter.

Furthermore, Tencent released three smartphone games namely KartRider Rush, Game of Thrones and RPG Dragon Raja. Moreover, the PUBG MOBILE and the latest games such as Speed Drifter and Chess Rush has increased the companyâs user base internationally.

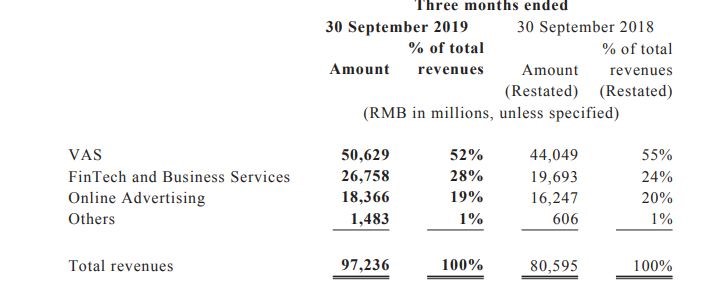

Highlighting third-Quarter Fiscal 2019 Results:

The company has recently provided the financial results for third-Quarter Fiscal 2019, for the period closed:

- Revenues during the quarter came in at RMB97.24 billion, up 21% year over year.

- Non-GAAP earnings were RMB2.548 per share, an increase of 24% year over year.

- Gross profit during the quarter came in at RMB42.48 billion, 19.7%.

- Adjusted EBITDA came in at RMB38.12 billion, an increase of 28.9% year over year.

- Non-GAAP operating profit came in at RMB28.54 billion, up 27% year over year

- Cash and cash equivalents at the end of the quarter were RMB145.61 billion and net debt was RMB7.17 billion. Free cash flow for the period was RMB37.73 billion.

Segment Details (Source: Company Report)

Stock Performance

Tencent has a market cap of HK$3.21 trillion and the companyâs stock was trading at HK$337.00, up by 0.24% (at GMT+8 11:05 AM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.