Summary

- FTSE 250 index reflects UK’s domestic economy and has always made a huge contribution to the UK’s economy.

- With a backdrop of an FTA with the US and the coronavirus crisis, FTSE 250 stocks have gained importance

- Investing in the FTSE 250 index companies could provide ideal exposure to the investors who believe in the strength of the UK’s economy

The UK’s economy was on the path of recovery after Brexit and the general elections until it was struck by the pandemic. As per the Prime Minister, UK seems to have passed its peak and is gearing up for lockdown easing. The FTSE 250 index is a set of 250 stocks ranked in the order of their market capitalisation. The set of stocks reflects UK’s domestic economy and is looked upon as a yardstick by institutional investors and market experts. In addition, investing in the FTSE 250 businesses helps in diversification of the portfolio

With domestic businesses being allowed to operate with sector specific guidelines access to easy credit and free trade negotiations with the United States under development, investing in the FTSE 250 businesses might lead to a new realm of opportunities. The UK-US trade pact would lead to increased investments, increased exports of goods & services along with digital trade and exchange of professional services will lead to increased employment. Furthermore, the UK is likely to benefit in terms of regulation of financial services with trade pact from the United States.

FTSE 250 listed businesses have always made a huge contribution to the UK’s economy. In the present scenario, when the countries are formulating a prudent approach towards international trade. US-China row has escalated in recent times and has sent jitters to the international trade relations amongst various countries, this calls for a major rerouting for global supply chains.

Moreover, UK manufacturers are looking to bring most of the operations back home. This is conceptualised to reduce dependencies on global supply chains, which got exposed due to the catastrophe caused by the coronavirus pandemic. According to a leading information provider, IHS Markit, UK’s PMI (Purchasing Managers Index), which indicates manufacturing trends jumped to 53.6 in July of 2020 pointing to the strongest increase in factory activity following the easing of lockdown measures to contain the spread of the coronavirus disease.

All these factors would force the indigenous businesses to innovate and contribute their bit to the domestic economy. In the post-pandemic era, nations would look forward to promoting home domiciled industries. The coronavirus pandemic has taught the world enough lessons after devastating the global economy both in terms of human and economic costs.

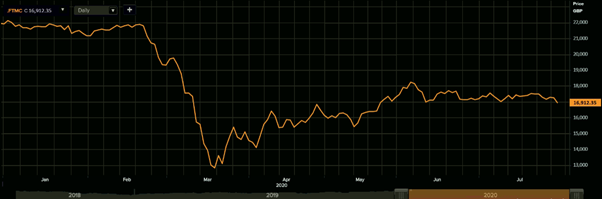

Investing in the FTSE 250 index companies could provide ideal exposure to the investors who believe in the strength of the UK’s economy. FTSE 250 index has recovered by more than 30 per cent after slipping to 12,500 level during the peak of the unprecedented crisis. According to some market experts, the market has been steadily moving towards a ‘V’ shaped recovery, while the others believe that the UK’s economy is presently in unchartered territory and they are hinting towards a ‘U’ shaped recovery. The markets have seen a considerable amount of correction in stock prices, which could tempt the investors to include them in their watchlist.

(YTD-Chart of FTSE 250 index, Source: Refinitiv, Thomson Reuters)

In this article, we would be discussing some FTSE 250 stocks with decent dividend pay-out ratio. (All figures are taken from Refinitiv, Thomson Reuters).

- City of London Investment Trust Plc : Dividend Payout Ratio-161.7%

City of London Investment Trust Plc (LON:CLIG) is an institutional asset manager, primarily focusing on closed-end fund investments.

The company’s funds under management were US$5.5 billion on 30 June 2019 (2019: US$5.4 billion), representing a 2 per cent increase for the year. City of London Investment Trust Plc shares were trading at GBX 424.00 at the time of writing (at 10:08 AM GMT+1) on 31 July 2020, up by 2.91 per cent versus the previous day closing price. Stock's 52-weeks High is GBX 474.00, and 52-weeks Low is GBX 275.00.

- Workspace Group Plc: Dividend Payout Ratio-90.7%

London-based Workspace Group Plc (LON: WKP) is a real estate investment trust, engaged in property investment.

Workspace Group Plc’s customer demand improved through the June quarter with enquiries in June at 765, up from 272 in April. Workspace Group Plc shares were trading at GBX 594.00 at the time of writing (at 9:36 AM GMT+1) on 31 July 2020, down by 0.68 per cent versus the previous day closing price. Stock's 52-weeks High is GBX 1,307.00, and 52-weeks Low is GBX 550.50.

- PayPoint Plc : Dividend Payout Ratio-86.2%

United Kingdom-headquartered PayPoint Plc (LON:PAY) is a holding company providing specialist consumer payment, and other services and products, transaction processing and settlement.

Since 31 March 2020, there was an increase of PayPoint’s One sites of 452 to 16,550 primarily due to a reduction in sites halted due to Covid-19. PayPoint Plc shares were trading at GBX 598.52 at the time of writing (at 8:54 AM GMT+1) on 31 July 2020, down by 2.08 per cent versus the previous day closing price. Stock's 52-weeks High is GBX 1,088.00, and 52-weeks Low is GBX 446.50.

- Investec Plc: Dividend Payout Ratio-80.6%

Investec Plc (LON:INVP) is a specialist bank and asset managing company. It is engaged in providing financial products and services, operating across various regions such as the United Kingdom, Europe, South Africa, Asia and Australia.

Investec PLC recorded an increase in the earnings attributable to the ordinary share by 235.5 per cent to £645 million for the year ended 31 March 2020. Investec Plc shares were trading at GBX 153.85 at the time of writing (at 9:18 AM GMT+1) on 31 July 2020, down by 0.87 per cent versus the previous day closing price. Stock's 52-weeks High is GBX 498.00, and 52-weeks Low is GBX 128.80.

- IG Group Holdings Plc: Dividend Payout Ratio-66.4%

United Kingdom-based IG Group Holdings Plc (LON:IGG) is engaged in online trading. It provides contracts for difference (CFDs) over 17 countries all over the world.

The company performed well in Q1-Q3 FY20 boosted by exceptional Q4 FY20 results. The full-year net trading revenue grew 36 per cent to £649.2 million (FY19: £476.9 million). IG Group Holdings Plc shares were trading at GBX 742.00 at the time of writing (at 9:53 AM GMT+1) on 31 July 2020, up by 0.47 per cent versus the previous day closing price. Stock's 52-weeks High is GBX 864.50, and 52-weeks Low is GBX 530.60.

People seeking regular income can look for dividend-paying stocks. The ability and consistency of a business to pay dividends is seen as one of the essential indicators while investing. In addition, dividend-paying stocks could be an ideal source of passive income. These stocks could be analysed by looking at their Dividend Pay-out Ratio (DPR), which is the amount that the shareholder realises in proportion to the net income of the company. In addition, the dividend yield of a stock could be looked upon by the investors to compare against its peers or the stock market to identify various buying or selling opportunities.