Infant Formula, alternatively referred to as baby formula, is perhaps the most vital topic when one discusses nutrition and food, for a simple fact that it concentrates on the youngest and most cared member of the family - a fact that remains steady across regions irrespective of cultural or social differences.

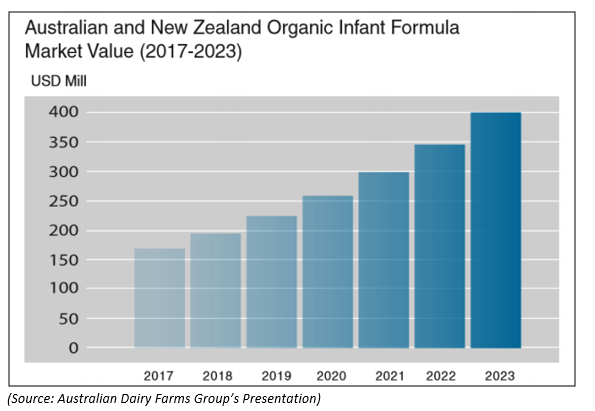

With increased vigilance on the health front and inclusion of domestic and foreign players in the business, the infant formula industry has been on a growth trajectory and given the huge expected growth in the market value, appears to be here to stay. Moreover, it should be noted that the market for organic infant formula in Australia and New Zealand is expected to grow from $230 million in 2017, to $546 million by 2023.

Why Infant Formula?

Breastfeeding is the most recommended mode of infant feeding but might not always be a feasible option. This is when Infant formula comes into picture, which is an industrially produced alternative for breast milk, inclusive of all the formula composition of breast milk.

The global infant formula market has undergone a significant growth in the past, primarily driven by the health benefits offered by infant formula ingredients- like reduced risk of cardiovascular ailments, better bone growth, enhanced digestion, lower cholesterol levels and rise in demand for lactose and milk minerals.

The constant and growing vigilance for healthy supplements has further catalyzed the market growth. Geographically, the APAC region has been leading the global infant formula market since the past few years, which is dominated by the Chinese market.

In this article, we would discuss the infant formula industry scenario between China and Australia and throw light on the developments of The A2 Milk Company Limited (ASX:A2M) and Bellamyâs Australia Limited (ASX:BAL). Let us dive right in:

Infant Formula and China

Infant formula sales in China grew at 9 per cent per annum in 2017, while organic infant formula sales in China grew at 46 per cent per annum, according to the Australian Dairy Farms Groupâs presentation release in last September.

China has been in discussion for the infant formula space; it intimated the market players that for an infant formula to be labeled as âorganicâ, a CNCA certification would be a mandate, w.e.f. 1 January 2018. The criteria states that at least 95 per cent of the productâs weight should constitute of ingredients which are included in the CNCAâs âlist of certified organic products.â

Up until last September, there were merely 17 registered organic infant formulae in the country, primarily the local brands.

A question likely to arise from the above regulation would be- what factors would aid in selecting organic formula? These would primarily be better nutritional content, food safety, brand and the country of origin.

With increasing reliance on NZ and AU imported formula products, regulatory procedures were stepped up in China to ensure quality standards. Under new regulations that got effective in January 2019, all the baby formula products for sale/distribution must have SAMR (The State Administration of Markets Regulations) approval.

Why China for the Infant Formula Industry?

China has the biggest, most dynamic retail landscape in the world and is a huge and complex consumer market with strong regional influences, along with distinctive city tier dynamics.

Apart from focusing on necessary SAMR approvals, Australian companies have been stepping up their marketing investment to stay agile and adapt to the changing consumer behaviour in the country.

There are multiple reasons to tap China for this industry, and some of them are listed below:

- Fertility rates in China are on a rise since the country changed its one-child policy in 2014 (from 1.61 to 1.63), spurring expectations of a baby boom.

- Families have been noticeably prioritising the investment in their children above other spending, compounded by the â4-2-1â family structure.

- Growing middle class in China contributes to category growth.

- Growing consumer demand for health and wellness products.

- Growing focus on food safety, naturalness and provenance.

- Wide variety of physical retail store formats in China, with several Specialty Mother and Baby Stores (national, regional and independent).

- Pace of retail innovation in China is unprecedented globally.

Chinaâs Mengniu Dairy to buy Australiaâs Bellamyâs?

In the most recent development surrounding Australiaâs infant formula player Bellamyâs Australia Limited (ASX: BAL), China Mengniu Dairy, a Hong Kong-listed company and Asiaâs second-largest dairy company, has offered A$1.5 billion to buy Bellamyâs, with the objective of expanding beyond its domestic market.

BAL also recorded its historic and record-breaking performance on the ASX, with shares up by 55 per cent on 16 September 2019, which was the best one-day performance since its listing in 2014. The surge was a consequent impact of the boardâs nod to the A$13.25 cash per share offer.

The deal is expected to be significant for the company, which offers a strong platform for growth in China, and to strengthen the success in the food industry and organic dairy in Australia. Moreover, as per Mengniuâs CEO Mr Jeffrey, Minfang Lu greatly values BALâs leading organic brand position and strong supply-chain.

On 19 September 2019, the BAL stock is trading at A$12.855, down by 0.50 per cent (as at 2:22 PM AEST), with a market cap of A$1.46 billion and approximately 113.37 million outstanding shares.

A2Mâs Investor Day

Infant formula producer, marketer and seller, The A2 Milk Company Limited (ASX: A2M) presented at Investor Strategy Day and China Market Immersion on 17 and 18 September 2019. The company notified that it was pursuing the two biggest consumer markets in the world, China and the US. The company focusses on Maximising growth from existing products in core markets and widening its product portfolio in core markets, while expanding into other targeted markets.

A2M partners, Synlait, Fonterra and CSFA Holdings Shanghai Co Ltd are greasing the fast growth and adaptability.

On 19 September 2019, the A2M stock is trading at A$12.440, down by 1.27 per cent (as at 2:25 PM AEST), with a market cap of A$9.62 billion and approximately 735.17 million outstanding shares.

The Expert Opinion

It has been widely speculated that Australia would encounter deep recession and face huge disruption if Chinaâs economy crashes (catalysed by the protracted US-China trade conflict), with jobs and income on a downturn, leading to an overall slump in Australiaâs growth.

Experts believe that with an increase in the range of consumer goods which are traded to China, including infant formula products, earnings would slump if the Chinese demand dried up in a recession, which would consequently leave a huge hole in federal and state budgets.

However, whether the consumer staples industry would survive the probable China downturn is yet to be seen.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.