A common confusion for investors is whether to focus on short-term gains or patiently wait for the long-term returns, including higher capital gains. Some investors manage to get lucky and generate good returns in short-term investments, most likely through informed decisions for a range of assets, such as equities, bonds, and debentures among others, to create their portfolio.

The shares of the companies that generate positive, substantial and sustainable cash flows, and whose income and revenues are expected to grow at a rate higher than the average of companies within the same industry, are called growth shares.

As per conventional wisdom, growth shares do not lay emphasis on delivering dividends to their shareholders as they reinvest their profits into their businesses intending to generate long-term values for their shareholders. In such cases, investors can earn capital gains only by selling their stock holdings at a price higher than the initial purchase price. In general, the companies that are actively involved in innovating and improvising are likely to become growth shares.

From an investor’s point of view, successful investment is subject to the choice of right asset classes constituting his/her portfolio. Historical trends depict a topping pattern in growth stocks that can be easily identified by a seasoned investor.

No matter how intense emotions get in the market, an investor is always advised to cash out at the right time rather than relying on feelings, including cases where the trade has been facilitated by a broker.

It is holiday season and investors are expecting sweet returns along with the hope for a robust Santa Rally this year since some growth shares are nearing their peak. However, the growth that we are witnessing today may not stretch for a long time and can be affected by various cyclical factors.

In this article, we will look at the latest developments of three ASX-listed growth stocks – Altium Limited, Bravura Solutions and Webjet Limited. But first, let us look at the stock performance of these companies.

Stock performance

|

Stock Detail |

Altium Limited (ALU) |

Bravura Solutions (BVS) |

Webjet Limited (WEB) |

|

Last traded price on 30 December 2019 |

$36.060 |

$5.330 |

$13.300 |

|

Growth/Decline |

0.362% |

-0.187% |

0.681% |

|

Market Capitalisation |

4.71 billion |

1.3 billion |

1.79 billion |

|

Stock Increase in three months |

5.18% |

30.88% |

15.88% |

|

Stock Increase in one year |

75.35% |

37.63% |

20.86% |

|

52-Weeks High |

$38.490 |

$6.270 |

$17.190 |

|

Annual Dividend Yield |

0.95% |

- |

1.67% |

|

PE Multiple |

62.110x |

35.600x |

28.110x |

Altium Limited (ASX: ALU)

Altium Limited, headquarters in California, the US, is engaged in the commercialisation of PCB design software, PCB component and data management software and is also the host of AltiumLive, a conference for PCB designers and engineers in the industry. The company primarily focuses on the development and sales of computer software for the design of electronic products.

ALU’s is committed to becoming a market leader and aims to be the foremost provider of PCB design software by the year 2025 and on achieving the milestones of:

· US$500 million in revenue, and

· 100,000 subscribers

The company is confident about reaching its milestones through its:

· Mission, defined by its vision and strategy to achieve it;

· Superior product and technology;

· Growing worldwide user community;

· Unique direct sales model;

· Strong financial strategy and disciplined execution;

· Strategic approach to industry partnership;

During the FY19 (year ended 30 June 2019), the company operating revenue grew by 23.1%, and net profit grew by 41.1% compared to FY18. Some of the key financial highlights for FY19 are as follows:

· Worldwide operating revenue increased by 23.1% to US$171.8 million;

· Boards and Systems (ALU’s core PCB business) revenue grew by 17% to US$126.8 million;

· Earnings per share (EPS) of US$40.57 (up 41%);

· Profit before tax (PBT) increased by 45% to US$57.6 million;

· Net cash was US$80.5 million as at 30 June 2019 (up 54%);

· Dividends paid during the year were AU 34 cents, up 26% from AU 27 cents in fiscal 2018;

The company anticipates meeting or exceeding its target, set four years ago, of USD 200 million in revenue for the financial year 2020.

Bravura Solutions (ASX: BVS)

Bravura Solutions is a pioneer in providing software solutions for wealth management, life insurance, and funds administration industries. The company’s products and services are strengthened by functionally rich technology that empowers modernisation, consolidation, and simplification. Backed by over 30 years of experience, BVS’ software solutions enable its clients to increase speed to market, provide a seamless digital experience and address ongoing changes in financial services regulation.

BVS has a strong team of over 1400 people to serve its clients and customers through its 12 offices across Australasia, and across several other countries.

BVS believes that the business witnessed strong operating and financial performance across the business during the year. Bravura has reported four consecutive years of excellent full-year results post its successful IPO in November 2016. BVS now ranks among the top 200 listed companies in Australia after it was admitted into the S&P/ASX 200 Index in October 2018.

Bravura is confident about a stable growth outlook of its business. The company continues to advance towards its long-term strategic goals and take advantage of a significant and growing addressable market under the leadership of Tony Klim and his experienced executive team.

Bravura is well placed to continue its growth trajectory with a healthy sales pipeline, a broad suite of products accompanied by enhanced digital solutions, and several compelling acquisition opportunities.

Webjet Limited (ASX: WEB)

Webjet Limited is engaged in the digital travel business and encompasses both global consumer markets - through its B2C operations (Webjet OTA and Online Republic), and wholesale markets -through its B2B operations (WebBeds).

Webjet, as a consolidated entity, operates in the travel, tourism and hotel sector, and engages in the online sale of travel products, including flights and hotel rooms.

A recent media speculation regarding the expressions of interest in the company was brought to WEB’s notice. Responding to the speculation, the company mentioned its intent to generate value for its shareholders and contemplate acquisition interest in the business from time to time. Further, Web clarified that as of now, there was no such proposal. However, if there existed any proposal, it would be brought to the notice of the shareholders.

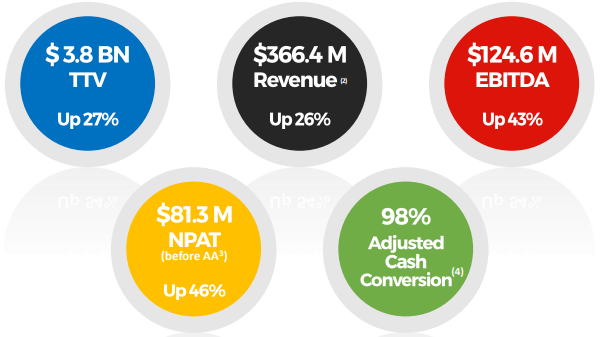

Group FY19 Highlights (Source: Company's Report)

Webjet believes that it has a good business with powerful momentum across 2 of its three business units and is optimistic about a long run of profitable growth in the future for all businesses.

Bottom line

The above-discussed stocks have shown strong performance through FY19 and have provided impressive returns to their shareholders. Investors are keeping a close watch on these growth shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.