Iron ore prices are on a surge and are above the $90 mark amid supply constraint on the global market and rising demand in China. The mills in China are expected to ramp up steel production in April 2019 to gain from high steel price environment in Chinaâs domestic market. The prices of long-steel (rebar) and hot-rolled coil (HRC) steel in China are on a surge amid the high demand in Chinaâs economy.

In March 2019, major steel producing provinces such as Hebei in China has marked a suspension on mills activities amid environmental concerns, but the ban is now lifted in the steelmaking provinces in China as air quality improved in the region. The mills in those provinces, which marked a temporary suspension are expected by the market participants to ramp up the production; which in turn, is expected to support the raw material demand.

On the supply side, the recent Cyclone Veronica damaged the production of significant Australian iron ore miners such as Rio Tinto (ASX: RIO) and BHP Billiton (ASX: BHP) and other giant producer Vale is in shackles over the recent dam collapse in Brazil. The recent ban on the Brazilian miner Vale led the company to declare a production loss, along with the production loss from BHP and Rio Tinto, which was caused by the cyclone in the Pilbara region.

The accumulative effect of production loss created a supply gap in the global market and coupled with high demand in China it prompted the iron ore prices above $90 mark.

Now, the dilemma which is taking roots among the market participants is whether the market price appreciation in shares of the companies such as Rio Tinto and BHP to continue due to high iron ore prices or market price corrects amid production loss from both the companies.

In a recent update, Liberum (a London-based Investment bank) mentioned that the supply and demand dynamics estimated by the market participants are less accurate and the iron ore market does not look so blooming as expected by the market participants. Thus, Liberum maintained a sell rating on the shares of significant iron ore miners such as Rio Tinto and BHP.

However, despite the sell rating on its shares, Rio Tinto crossed the A$100 mark and is currently sustaining above the same. To address the dilemma of the market participants on both the companies let us have a look at the Charts of both the miners.

Rio Tinto (ASX: RIO)

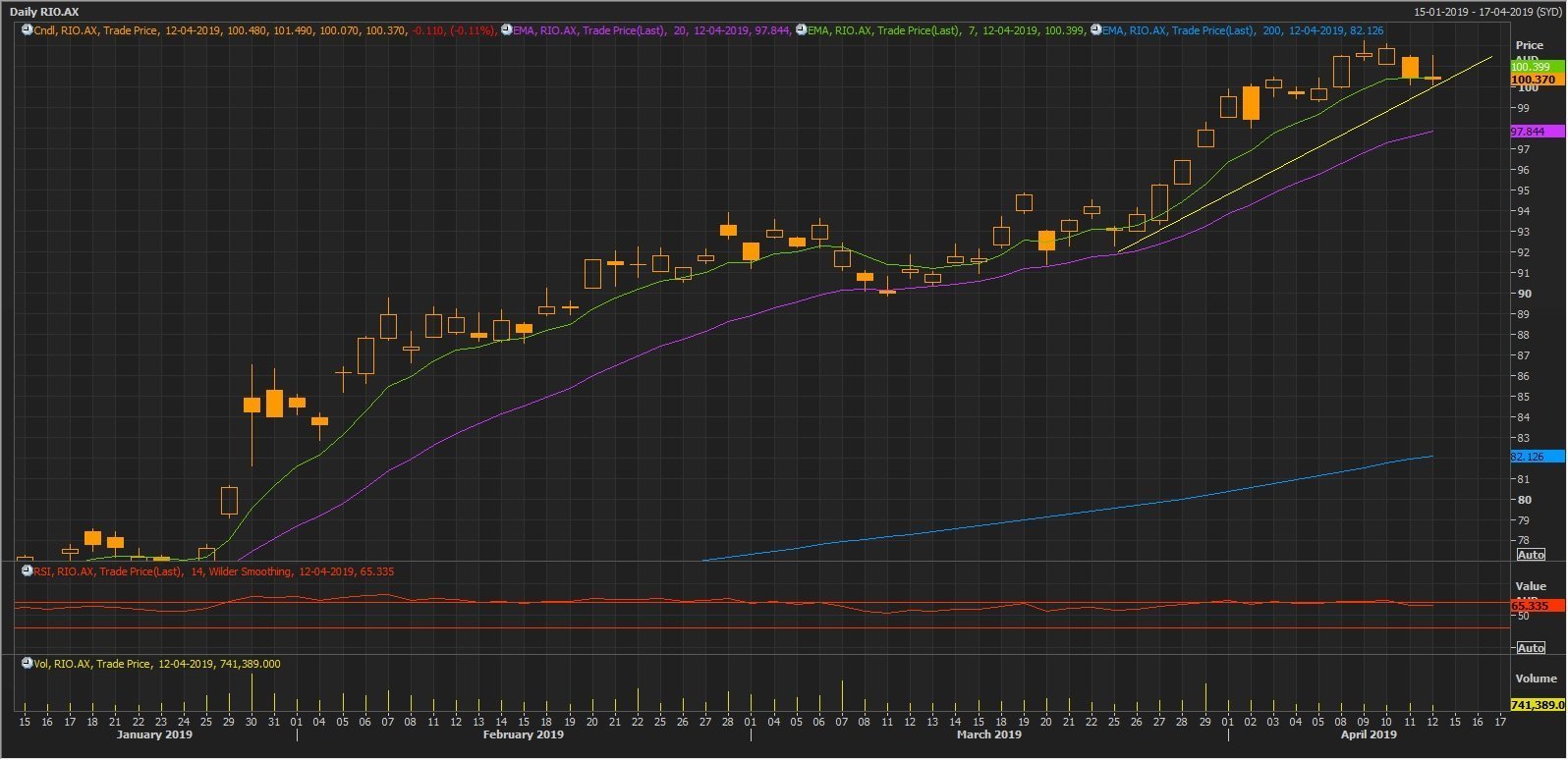

Source: Thomson Reuters: RIO Daily Chart

Source: Thomson Reuters: RIO Daily Chart

On following the development on a daily chart, it can be seen that the share prices of the company are continuously moving in an uptrend; however, the prices are currently running downside from the recent high A$102.21 made on 9th April 2019. The prices as of now are above the short-term exponential moving average of 7-days, which is at A$100.399 and well above the medium-term exponential moving average of 20-days, which is at A$97.844. The Relative Strength Index (14-days) is at 65.335, which is above its mean value of 50.

BHP Billiton (ASX: BHP)

Source: Thomson Reuters: BHP Daily Chart

Source: Thomson Reuters: BHP Daily Chart

On following the development on a daily chart, it can be seen that the share prices of the company are continuously moving in an uptrend; however, the prices are currently running downside from the recent high A$40.13 made on 9th April 2019. The prices as of now are above the short-term exponential moving average of 7-days, which is at A$39.565 and well above the medium-term exponential moving average of 20-days, which is at A$38.805. The Relative Strength Index (14-days) is at 62.714, which is above its mean value of 50.

In can be observed that the current prices of both the company took a U-turn from their respective recent highs and the future movement in the prices will depend upon the accumulative market analysis on iron ore demand and supply dynamics along with the fundamentals of both the miners.

Technically the current prices of the company are above their 7 days, 20 days, and 200 days exponential moving average.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.