Webjet Limited (ASX: WEB) is a company that forms a part of the Consumer Discretionary sector and is into the digital travel business spanning both global consumer markets as well as wholesale markets.

The business of WEB includes B2C Travel and B2B Travel. The B2C travel business of WEB operates the leading online travel agency consumer brand Webjet. It also operates market leading products in complementary travel items within Online Republicâs business. WEBâs B2B Travel business was established in 2013 and generates Total Transaction Value (TTV) of above $50 billion.

Recently, on 14 May 2019, the company announced that UBS Group AG and its related bodies corporate had become the substantial holder of 7,352,860 ordinary shares of Webjet on 9 May 2019 with the voting power of 5.42%. However, on 10 May 2019, WEB notified that UBS Group AG and its related bodies corporate ceased to become a substantial holder of the Webjetâs shares.

Recently, at the J.P. Morgan Emerging Companies Melbourne Conference, which was held on 17 April 2019, the company introduced its B2B division and B2C Hotel division.

Further, the company highlighted the reasons for winning the market share in the B2B hotel business. The WebBeds business of WEB provides an easy solution to distribution challenge as well as global hotel room supply. WebBeds has more than 250,000 hotels across 10,000 destinations across the world with more than 20,000 travel provider clients. It acts as an intermediary between hotels who are looking for clients to fill the hotel rooms and clients who are finding rooms for their customers.

Besides, in the UBS Emerging companies Conference held on 10 April 2019, the company discussed how it competes with the changing technology. The presentation highlighted RezChain and Umrah Holidays International.

RezChain is the blockchain solution of the WebBeds businesses of the company, that helps in reducing cost, improve efficiency, as well as remove friction at customer check-in.

On the other hand, Umrah Holidays International focuses on providing the ultimate Umrah and Hajj experience. Through this, the company has the opportunity to target 30 million religious tourists expected to visit the Kingdom of Saudi Arabia by 2030.

Although, WebBeds rank 2 as the global B2B player, still it has less than 4 percent market share.

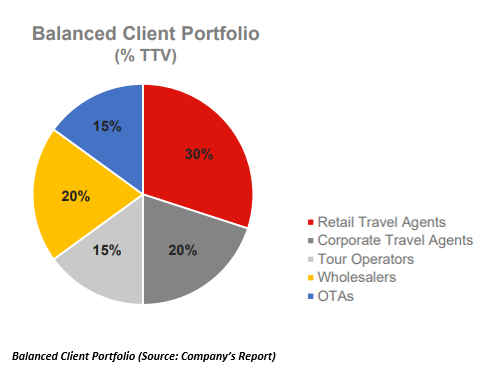

Letâs look at the balanced client portfolio of WebBeds.

The key financial highlights of the company in 1H FY2019.

- The total transaction value had grown up by 29% to $1.9 billion.

- The revenue during the 1H FY2019 increased by 33%.

- EBITDA during 1H FY2019 increased by 42 percent to $58 million.

- The net profit after tax was up by 59% to $31.8 million

- Webjet declared a fully franked dividend of 8.5 cps.

By the closure of the trading session on 17 May 2019, the closing price of the shares of WEB were A$16.80, down by 0.415% as compared to its previous closing price. WEB has a market cap of ~ A$2.29 billion with ~ 135.6 million outstanding shares and a PE multiple of 41.90x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.