During an economic downturn, every investor looks for a defensive investment, which can help in fighting with the crisis and provide a level of protection to the portfolio. As the market players are aware, the Australian economy is currently experiencing growing uncertainty due to the COVID-19 pandemic, which rose from China and has now spread to the entire globe. Investors are withdrawing their money from the markets because of the increasing impact of infectious disease.

In the current scenario, investment in the agricultural sector can be beneficial as this is a defensive sector and plays a significant role in times of uncertainties in the markets. There is a saying that Individuals can leave anything but cannot leave food or essential goods. There’s been news that us spreading around the world, highlighting that the increasing fear of pandemic has led the consumers stockpile essential goods.

While investing in the agricultural sector, an investor should look for key attributes such as a robust product and a high-end brand value. To understand this further, we will look at some of the agricultural and food supply companies that possess these essential attributes:

Bega Cheese Limited (ASX:BGA)

Bega Cheese Limited is engaged in the processing, manufacturing, cutting and packaging traditional cheese products. The company also produces other high-value dairy products.

Reduced Milk Supply Impacted Underlying Earnings

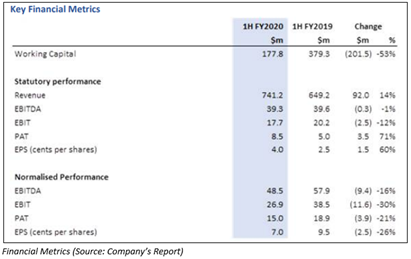

Bega Cheese recently released its results for the first half of the financial year 2020 and outlined the following:

- BGA reported statutory EBITDA amounting to $39.3 million against $39.6 million in 1H FY19. Statutory PAT stood at $8.5 million.

- Reduced milk supply and margins in the dairy industry mainly in Northern Victoria has impacted the underlying earnings of the company.

- While responding to the continuing competitive and supply challenges in the dairy industry, the company has continued the transition towards its vision to become The Great Australian Food Company.

- Bega Cheese has continued the practice of stepping up the development of numerous new products as well as format extensions throughout the snacking, spreads as well as the dairy portfolio. It has also continued to increase the distribution in retail and foodservice businesses in Australia as well as global regions.

- During the period, the statutory net cash inflow from operating activities stood at $38.1 million against net cash outflow of $128.3 million in 1H FY19.

In another update, the company announced that Perpetual Limited and its related bodies corporate have made a change to their substantial holdings in the company on 27 March 2020 and the current voting power remains at 11.10% as compared to the previous voting power of 12.15%.

The company is in regular discussions with domestic and international suppliers and customers concerning the potential impact of COVID-19 on its business and their partners’ businesses.

The stock of BGA closed the day’s trading session at $4.700 per share on 02 April 2020, indicating a rise of 0.642% against its previous closing price. The market capitalisation of Bega stood at $1.00 billion while the total outstanding shares were 214.24 million. During last three months and six months, the stock of BGA has provided shareholders with returns of 8.10% and -2.51% respectively.

Tassal Group Limited (ASX:TGR)

Tassal Group Limited is involved in the farming of Tiger Prawns and Atlantic Salmon. The Group also processes and distributes salmon, prawns and other seafood.

Strategy to drive future earnings growth

During 1H FY20, the company’s strategy was to place the business to drive growth in earnings & returns in FY20 and beyond.

- Concerning salmon, the strategic focus of the company was to grow operating EBITDA per kilogram through a period of investments in the enhancement of size and biomass. This decision was in accordance with the strategy of TGR to produce and commercialise less salmon in the first half of the financial year 2020 for supporting growth in salmon and prawn biomass, which is expected to provide earnings growth across FY20 and FY21.

- For 1H FY20, the operating cash flow stood at $41.0 million, which was in line with the expectations.

- To support sustainable growth in long-term returns, the company is planning to maintain its focus on responsible working capital as well as capital spending. It also anticipates benefit from ongoing 2H FY20 and onwards.

- TGR is well placed to generate growth earnings and returns in FY20 and beyond aided by the robust growth in salmon and prawn biomass business through improved sales and efficiencies in cost management in the second half of the financial year 2020 and continuing in FY21.

In order to please the shareholders, TGA paid interim dividend amounting to 9 cents per share (25% franked) on 31 March 2020.

The stock of TGR closed the day’s trading session at $3.670 per share on 02 April 2020, indicating a rise of 1.944% against its previous closing price. The market capitalisation of Tassal Group stood at $746.55 million while the total outstanding shares were 207.37 million. During last three months and six months, the stock of TGR has provided shareholders with returns of -13.67% and -15.29% respectively.

Bio-Gene Technology Limited (ASX:BGT)

Bio-Gene Technology Limited is involved in the development and commercialisation of insecticide products. It officially got listed on the ASX in 2017.

Store Grain Trial Results

- Recently, BGT reported results from its stored grain trial, which stated that the Flavocide continues to control a key pest over 13 months in laboratory and field conditions. These results further cement the commercial viability of Flavocide in stored grain beyond 9-months.

- The company has been aided with an excellent platform for the expanded trial program, which is currently on track with BASF, Department of Agriculture & Fisheries Queensland Government & the Grains Research & Development Corporation.

When it comes to financial position, the company managed to retain strong a cash position of $3.5 million as on 18 March 2020. Also, its CEO’s visit to the US has resulted in positive discussions with current and potential commercialisation partners. So far, the company has not experienced any impact on its business processes or commercialisation strategies from the arising fear of COVID-19.

During 1H FY20, the company also continued its engagement with several other international companies, many of which have received samples of Flavocide and QcideTM under MTA's, with which they will undertake their own testing.

The stock of BGT closed the day’s trading session at $0.150 per share on 02 April 2020, in line compared to the previous closing price. The market capitalisation of Bio-Gene stood at $19.93 million while the total outstanding shares were 132.86 million. During last three months and six months, the stock of BGT has provided shareholders with returns of -26.83% and -11.76% respectively.