Leaving one’s home and moving into an aged care home is not an easy choice. However, it does not have to be a frightening experience. An aged or residential care facility can provide the services and care which is required to maintain the quality of life. An aged care or a residential aged care facility is a home for elder people who can no longer live or do not want to live at their home and require health care or support for performing everyday activities.

The Australian government funds several aged care homes to deliver care and other support services to the people who need it. Residential aged care homes could help with everyday activities, personal as well as nursing care by providing accommodation, hotel type services and care services.

The government supports a variety of aged care residences in Australia. This means reasonable support services and care can be retrieved by persons who need it. The government directly pays subsidies to the aged care residents and the amount of funding a resident receives is based on:

- the assessment of a person’s care requirements by the home, and it is processed by using a tool named as the Aged Care Funding Instrument (ACFI).

- how much an individual can afford to contribute to the cost of care and lodging. This can be done by evaluating the income of the individual and his/her assets.

The aged care homes that receive subsidies from the government are also regulated by it. The subsidies received help make care more affordable. However, the private aged care homes do not receive such subsidies from the government.

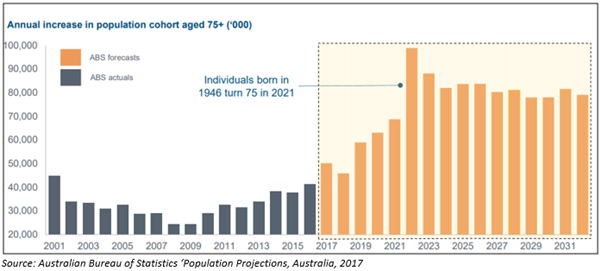

The Australian Bureau of Statistics studied about the future demand of aged care places and it was observed that the demand for aged care places would go up and there is a good opportunity for aged care service providers in the upcoming years:

As per the projection by the Australian Bureau of Statistics, it is predicted that in upcoming years there would be a higher number of the aging population so the requirement of aged care groups could increase.

In this article, we are discussing three ASX listed aged care stocks - RHC, SNZ, JHC

Ramsay Health Care Limited (ASX:RHC)

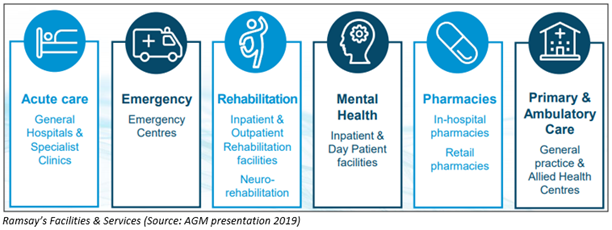

A global health care company, Ramsay Health Care Limited is engaged in providing high-quality services and offering excellent patient care as well as hospital management. Ramsay is one of the biggest and most diverse private health care companies across the globe and provides primary and acute health care services from its 480 facilities through 11 countries. Emphasising on relationships with the staff and doctors and delivering consistent, high standard patient outcomes have been the key factors contributing to the success of the company.

Outlook 2020

In its annual general meeting (AGM) presentation of 2019, Ramsay discussed its outlook for 2020. Key highlights are:

- The company predicts a stronger volume growth in the FY2020.

- Ramsay health care would continue to target core earnings per share (EPS) growth in the range of 2%-4% (like-to-like basis) in FY2020 corresponding to negative core earnings per share growth of -6% to -4% under the accounting standard AASB16 of the recent lease.

- The guidance of the company is based on core EBITDAR growth of 8%-10% that is unaffected by the new lease parameters.

- Throughout FY2020, Ramsay health care would aim to finalise its major Brownfields project.

Stock Performance

On 15 January 2020, the RHC stock was trading at $75.210 (At 1:58 PM AEDT), up by 0.454% from its last close. The company’s market capitalisation stood at approximately $15.13 billion, with nearly 202.08 million shares outstanding. The stock has delivered a positive return of 28.31% in the last year and 3.61% in the previous six months. The P/E ratio of the stock stands at 28.260x.

Japara Healthcare Limited (ASX:JHC)

Southbank, Victoria-headquartered aged care service providing company, Japara Healthcare Limited, is a leader in providing retirement living service and residential aged care in Australia. The company provides all types of aged care facilities from high to low care for short as well as long term.

Half-year financial results release date-

On 20 December 2019, the company updated the market that it would release its half-year FY 2020 (ended 31 December 2019) financial results to the ASX on Friday 28 February 2020.

Outlook

In its annual report for the year ended 30 June 2019, Japara Healthcare provided the outlook for the upcoming years:

- Japara Healthcare has eight greenfield and seven brownfield projects under development which are scheduled to deliver more than 1,100 net new places by the end of the financial year 2022.

- The significant refurbishment program, operating six homes at present, continues with a further six scheduled for renovation during the fiscal year 2020 for the benefit of residents.

- For the fiscal year 2020, Japara anticipates an EBITDA that will be 5% to 10% lower as compared to the financial year 2019 which is primarily due to the removal of temporary subsidy increase provided by the Government’s which was applicable for the period from 20 March 2019 to 30 June 2019.

- The company continues to focus on the delivery of its development program with more than 300 net new places projected to commence in the fiscal year 2020 after the completion of its existing brownfield and greenfield projects.

Stock Performance

On 15 January 2020, the JHC stock was trading at $1.030 (at 1:58 PM AEDT), down by 0.962% from its last close. The company’s market capitalisation stood at approximately $277.94 million, with nearly 267.25 million shares outstanding. The P/E ratio of the stock stands at 16.880x with an annual dividend yield of 5.91%. JHC stocks 52 weeks high and low price was noted at $1.550 and $0.960, respectively.

Summerset Group Holdings Ltd (ASX:SNZ)

An ASX listed health care company, Summerset Group Holdings Ltd is a profit-oriented entity and operates and owns rest homes, integrated retirement villages, and hospitals for the aged people within New Zealand. Summerset Group has 25 retirement villages across the country that offer various care options and completely independent living. The company offers a variety of care services and living options to over 5,500 residents and in 2019, the Summerset Group won the Silver Award of the Reader’s Digest Quality Service.

Release date for full-year results

On 14 January 2020, the company revealed that its full-year financial results for 2019 would be released pre-market on Tuesday 25 February 2020.

Metrics for the fourth quarter (ended 31 December 2019)

- For the quarter, Summerset Group reported 209 sales, consisting of 116 new sales and 93 resales.

- During the period, the company’s build programme of 2019 provided 354 retirement units.

- In Casebrook and Rototuna, the main buildings are properly progressed, and the completion is due in 2020.

Stock Performance

On 15 January 2020, the SNZ stock was trading at $8.310 (at 1:58 PM AEDT), down by 0.964% from its last close. The company’s market capitalisation stood at approximately $1.9 billion, with nearly 226.83 million shares outstanding. The stock has delivered a positive return of 42.69% in the last year. The P/E ratio of the stock stands at 8.560x with an annual dividend yield of 1.17%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.