BNPL or Buy Now Pay Later industry is a rapidly growing industry and has become a source of attraction for the young generation.

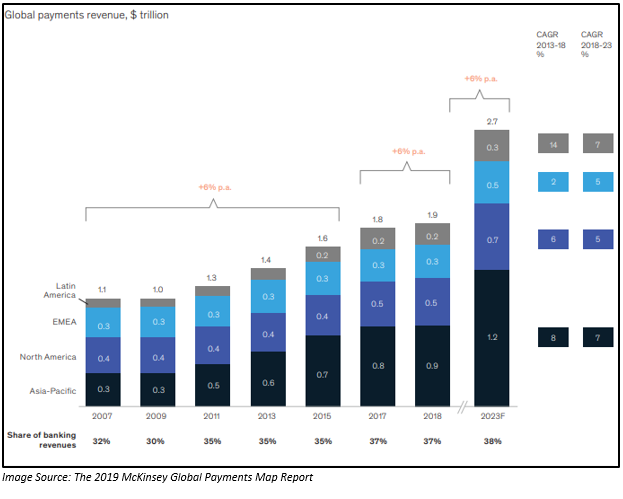

As per a report published by McKinsey & Company during September 2019, the global payment revenue was US$1.9 trillion in 2018.

The 2019 Global Payments Trends Report of J.P.Morgan states that Australia provides a market known for the rising proportion of younger population. The overall customers base in Australia is willing to embrace multiple developing e-commerce techniques like making payment in instalments with new businesses and purchasing goods via the social media platform.

In this article we will look at three ASX listed companies and see if they are primed up for global expansion.

Afterpay Limited (ASX: APT),

On 16 December 2019, Afterpay Limited (ASX: APT), a technology-driven payment company has provided an update related to the Afterpay US, Inc. 2018 Equity Incentive Plan. Earlier the company on 15 April 2019 released an announcement where it highlighted that the shareholders of APT had approved the Plan at the AGM 2018.

Afterpay US Inc. 2018 Equity Incentive Plan is an important component of the plan of the company to attract excellent talent to its US operations in a competitive labour market.

According to that Plan, Afterpay US, Inc. which is the US subsidiary of Afterpay Limited, would offer options which offer qualified participants a right to acquire common stock (or shares) in Afterpay US, Inc. In case the participants vest and exercise the option, the common stock would be assigned to them (exercised shares). Under specific circumstances, the exercised shares may be exchanged for APT shares which generally cannot take before January 2023 in the absence of mutual agreement.

Below is the list of updates confirmed by the company.

- At present, a total of 7,788,243 US Options are on issue which comprises of the options which were exercised earlier but are subjected to vesting and a re-purchase right by Afterpay US, Inc. The US Options that were issued since the prior ASX Announcement on 15 April 2019 were all issued to full-time US-based employees.

- There are 3,195,561 exercised shares on issue that are completely vested.

- US Options, as well as exercised shares, are not quoted. US Options are not permitted to dividends and doesnât have voting rights.

- APT shares which are assigned to the US Option holders and in case any exchange takes place then these shares would have equal rank with all other ordinary shares of the company on the issue.

- US Options are issued as per the US employee incentive plan and is created in a way that it offers incentives to people who are critical to the continuing achievements of Afterpay US, Inc.

- The US Options are issued for zero consideration, and the recently issued US options in December 2019 can be exercised at US$1.81 per share.

- Under this Plan, the highest count of common stock in Afterpay US, Inc. that may be issued to participants is 10%.

- The maximum shares issued under this Plan in exchange cannot exceed 21,777,661 APT shares.

As per the market release on 3 May 2019, the company signed a US$300 million receivables funding facility with Citi to assist in APTâs US business expansion.

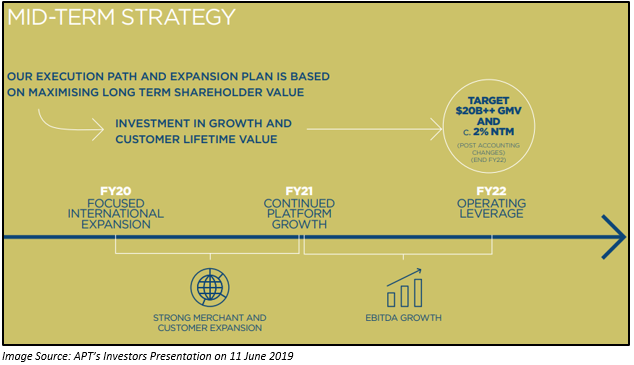

In the Investor Presentation released by the company on 11 June 2019, the company highlighted that the company continues to grow strong in the US. Afterpay US GMV was ~ $780 million for the period of 11 months ended 31 May 2019. It had more than 1.5 million active clients along with 3,300 active merchants and another 1,100 integrating merchants at 31 May 2019.

On 12 June 2019, the company announced that it raised $317.2 million through fully underwritten institutional placement successfully. Each share under the placement was issued at $23, and it received huge support from the existing as well as the new shareholders. The company also announced its Plan to raise ~$30 million via a Share Purchase Plan under which the eligible shareholders will have an opportunity to acquire further new shares in the company. However, the SPP got deferred after the company received a notice from AUSTRAC to appoint an external auditor to carry out the audit process pertaining to its AML/CTF compliance. The SPP will be deferred till the outcome of the final audit report is obtained along with the recommendation.

After receiving the final audit report from the external auditor on 25 November 2019, APT offered the eligible shareholders a chance to purchase new shares in APT under the Share Purchase Plan at the lower of $23 per share or the 5-day VWAP of the stock up to the closing date of the SPP.

The fund raised through the placement as well as SPP would support the company towards its mid-term Plan.

After having an idea about Afterpayâs US Journey, we would also like to know about its competitor companies as well.

Other companies belonging to the same industry is Zip Co Limited (Z1P: ASX) and Splitit Payments Ltd (ASX:SPT). Letâs check if these companies also have any global expansion plan.

Zip Co Limited (Z1P: ASX)

On 2 December 2019, Zip Co Limited (Z1P: ASX), a leading player in the digital retail finance & payments industry, with operations in Australia, New Zealand and the UK announced that it received commitments to raise $60 million before costs via placement of 16,216,216 ordinary shares at $3.70 per share. The company received immense support from the new and existing institutional, sophisticated and professional investors. Earlier, the company announced its plan to raise $50 million through placement.

It has also offered the eligible shareholders an opportunity to participate in the Share Purchase Plan, capped at $10 million.

The funds raised through Placement and SPP would support the company in its global expansion into the UK market, expand its product range which comprises of Zip Bizâs launch, grow its investment in product and technology and simultaneously strengthen its balance sheet.

Splitit Payments Ltd (ASX: SPT)

Splitit Payments Ltd (ASX: SPT) is a leading global monthly instalment payment solution that is headquartered in Israel and have operations in Australia and the US.

Recently, on 12 December 2019, the company released an global operations update along with the Black Friday & Cyber Monday sales trading, new strategic partnerships along with new merchant deals.

The company reported a record underlying sales over the Black Friday and Cyber Monday long weekend, where there was 83% growth in the key US market. The company has entered into a new strategic partnership with Magento, iPay88 and BlueSnap.

The company remained on course to expand its merchant network by signing new contracts with numerous brands across different customer verticals in APAC, North America and EMEA regions. These merchants include:

- ReST

- Plus Shop

- Yoga International

- Slabway

- Dick Smith

- Reds Baby

- BecexTech

- Buckley London

- Mobvoi

On 14 October 2019, the company entered into a partnership with Shopify and Divido. It also signed new merchant agreements with leading US consumer brands Chili Technology, Eight Sleep, Ashford, BlueFly, Ace Marks, Nili Lotan.

It also entered into new B2B agreement with accountancy platform, 1800-Accountant and strengthened its US go-to-market infrastructure and established existence in Canada.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.