As the world is transitioning into a tech-savvy environment, Financial technology (Fintech) companies are getting increasingly important for a countryâs economy. In many countries, Fintech companies are providing innovation, employment, and are contributing largely to the nationsâ GDP.

In Australia, due to steady regulatory and low-risk environment, many Fintech companies are flourishing at an increasing pace. We have made a list of ASX-listed five fintech stocks with strong operations.

Afterpay Limited (ASX: APT)

Whenever there is a discussion about fintech stocks of Australia, one stock that canât go un-mentioned is Afterpay Limited (previously known as Afterpay Touch Group Limited). This Buy Now Pay Later (BNPL) stock has almost tripled its shareholdersâ wealth in the last one year.

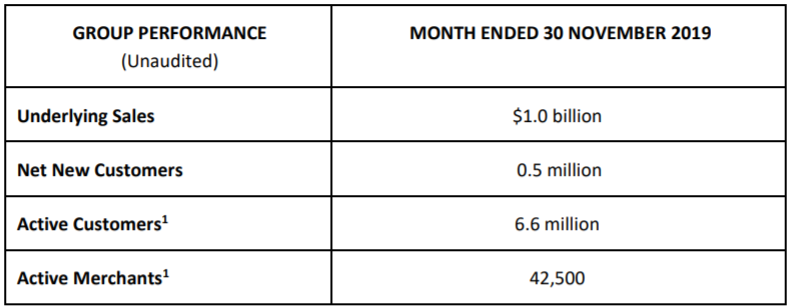

Last month, the company achieved $1.0 billion of monthly underlying sales, which is the highest ever monthly performance of the company since its inception.

November Months Performance (Source: Company Reports)

At the end of November 2019, the company had over 6.6 million active customers. Both, Black Friday (on 29 November 2019) and Cyber Monday (on 2 December 2019) were record trading days for the company.

In FY2020, the company is focusing on the following key areas:

November Months Performance (Source: Company Reports)

At the end of November 2019, the company had over 6.6 million active customers. Both, Black Friday (on 29 November 2019) and Cyber Monday (on 2 December 2019) were record trading days for the company.

In FY2020, the company is focusing on the following key areas:

- Merchants

- Customers

- Platform + Partnerships

- Performance

- Capability

- ReST - #1 smart bed in Editorâs Picks in the upcoming Sleep Retailer Magazine (North America)

- Plus Shop - leading reseller of hype footwear and apparel (North America)

- Slabway - online retailer of luxury massage chairs (North America)

- Yoga International - one of the worldâs largest online yoga platforms servicing 500,000 users in 150 countries

- Dick Smith - one of Australia's most recognisable electronic retail brands (APAC)

- Reds Baby - one of the largest and highly rated online baby retailers in Australia (APAC)

- BecexTech - a specialist Australian online electronics retailer (APAC)

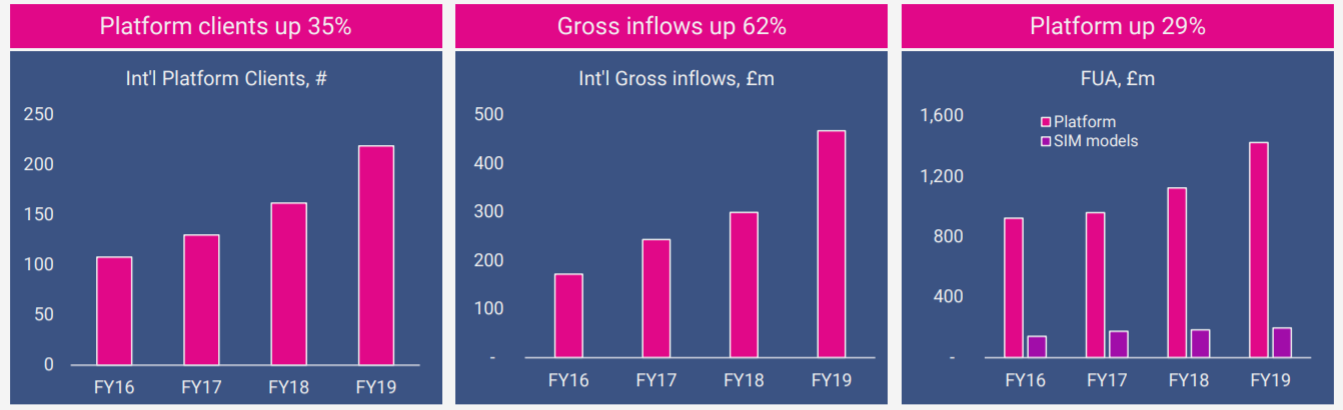

- Record annual gross inflows across Australia and International markets of $3 billion

- Platform Funds under Administration (FUA) of $9.5 billion at June 2019 and increasing further to $10.3 billion by the end of September 2019, and

- IMA contributing a rapidly growing 8% of overall FUA growth since its launch in February

International growth (Source: Company reports)

By AEST 3:23 PM, PPS stock was trading at a price of $0.482 with a market cap of around $196.02 million.

EML Payments Limited (ASX: EML)

Payment solutions provider, EML Payments Limited (ASX: EML) recently through its wholly owned subsidiary, EML Payments USA, LLC struck a deal with global shopping mall operator Simon Property Group for the distribution of multiple payment card products through select Simon shopping malls as well as Business to business (B2B) distribution channels in the USA.

Over the last five financial years, the companyâs EBITDA has grown at a CAGR of 82%.

Major growth drivers

International growth (Source: Company reports)

By AEST 3:23 PM, PPS stock was trading at a price of $0.482 with a market cap of around $196.02 million.

EML Payments Limited (ASX: EML)

Payment solutions provider, EML Payments Limited (ASX: EML) recently through its wholly owned subsidiary, EML Payments USA, LLC struck a deal with global shopping mall operator Simon Property Group for the distribution of multiple payment card products through select Simon shopping malls as well as Business to business (B2B) distribution channels in the USA.

Over the last five financial years, the companyâs EBITDA has grown at a CAGR of 82%.

Major growth drivers

- Gaming - Expand European and North American programs

- Salary Packaging- Transition contracted benefit accounts

- Gift and Incentive- Expand mall programs and use of instant gift

- Delegated Authority- Launch delegated authority to new verticals

- VANS- Processing plus solution gaining traction

- six product systems to one web-origination platform

- three buyer management systems to one CRM system

- three fraud engines to one fraud platform; and

- seven credit decisioning instances to one single platform that is scalable for growth and works across markets.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)