Department of agriculture and water resource has set up a âNational Aquaculture Strategyâ to achieve the growth target of $2 billion a year by 2027. In order to achieve this outcome, a strong collaboration is needed between aquaculture industry participants and federal authorities. To understand further about aquaculture sector, let us now look at the performances of a few aquaculture industry participants trading on ASX.

Tassal Group Limited (ASX: TGR)

Seafood processing company, Tassal Group Limited (ASX: TGR) recently released its FY20 (year ended 30 June 2020) trading update wherein it announced that it is on track to deliver 2,400 tonne harvest biomass for FY20. TGR expects positive market dynamics for both salmon and prawns to continue in FY20. The total capital expenditure, including the acquisition of Exmoor Station, is expected to be $156 million in FY20.

The companyâs strategy of optimising the growth and biomass of salmon by leaving them in the water to grow in the key growing time of July to October has caused the YTD export sales to decline, compared to pcp, which reduced Tassalâs exposure to export prices.

FY20 Outlook

- Positive market dynamics for both salmon and prawns expected to continue;

- A more gradual growth in salmon supply over the short-term should allow the company to optimise pricing to provide increasing returns;

- Ramp-up in prawn production volumes following redevelopment of existing pond infrastructure and appropriate stocking of Mission Beach, Yamba and Proserpine.

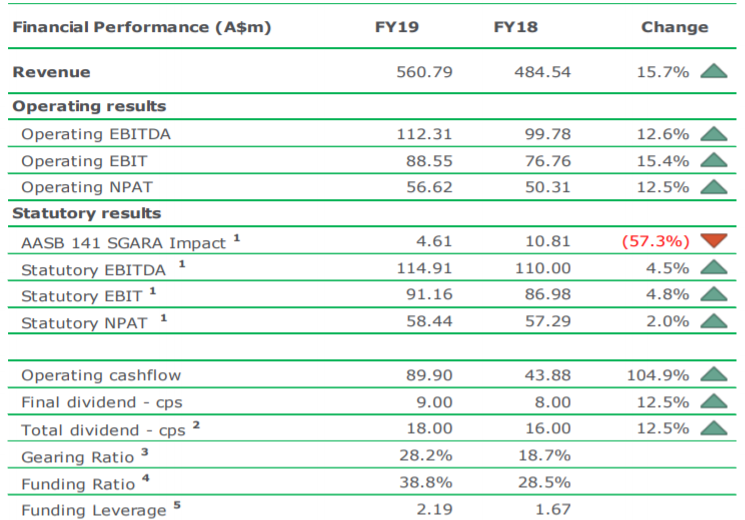

The companyâs FY19 financial performance is summarized in the below image:

FY19 Summary (Source: Companyâs Report

FY19 Summary (Source: Companyâs Report

On the stock performance front, TGR stock has declined by 14.37% in the last six months. By AEST 12:58 PM on 20 November 2019, TGR stock was trading at a price of $4.190, up by 0.48% intraday, with a market cap of $864.75 million.

Huon Aquaculture Group Limited (ASX: HUO)

Australiaâs leading producer of Tasmanian grown Atlantic salmon, Huon Aquaculture Group Limited (ASX: HUO) is primarily involved in hatching, farming, processing, sales and marketing of Atlantic salmon and ocean trout. In FY19 (year ended 30 June 2019) the company delivered revenues of $282 million, supported by an increase in salmon prices which were underpinned by a shortfall in supply.

During the year, the companyâs sales volume fell by 18% on the previous year mainly due to a significant reduction in biomass at the commencement of FY2019 following challenging operating conditions over the previous summer. During the year, the companyâs operating margins declined from 22.6% to 16.8% as a result of the lower sales revenue and increased per kg production costs.

For FY19, the company declared a final dividend of 3.0 cents per share, franked at 50%, bringing the total dividend payment for the year to 6.0 cents per share, down from the total dividend payment of 10 cents in the previous year.

The company is currently in the early stages of developing Yellowtail Kingfish operations in Western Australia and have initiated a 2-year environmental monitoring program to assess if its new lease site.

At the recently held AGM, the company assured that it is positioned to almost double production capacity over the next 3 to 5 years and is focused on driving operating efficiencies through the business. The company currently has fish in production that will support a 30,000 tonne production in FY2021.

By AEST 12:58 PM on 20 November 2019, HUO stock was trading at a price of $4.600, up by 0.218% intraday, with a market cap of around $400.88 million.

Seafarms Group Limited (ASX: SFG)

Leading aquaculture operators in Australia, Seafarms Group Limited (ASX: SFG) recently completed its first delivery of Black Tiger Prawns to Nippon Suisan Kaisha Limited. The company intends to supply 15% of its Queensland production to Nissui.

For the 12 months reporting period to 30 June 2019, Seafarms has reported a loss in the order of $30.9 million, of which approximately $3.9 million was contributed by the Queensland operations. The Queensland loss was substantially impacted by the lower first half production outcomes as a direct result of poor wild black tiger broodstock availability, an ongoing and industry wide issue in FY2019 and as a direct consequence lead to a higher proportion of banana prawn production.

By AEST 12:58 PM on 20 November 2019, SFG stock was trading at a price of $0.079 with a market cap of $160.45 million.

Clean Seas Seafood Limited (ASX:CSS)

The global leader in the full cycle breeding, production and sale of Yellowtail Kingfish, Clean Seas Seafood Limited (ASX:CSS) achieved double-digit sales in FY9 with revenue growth, higher farm gate prices, improved underlying profitability and a significant increase in the positive cash flow from Operations.

In FY19, the companyâs Spencer Gulf Hiramasa Kingfish remained the market leader in Australia and Europe with sales volumes growth of 13% and sales revenue growth of 16%. During 2019, the company continued to strengthen its competitive position in both its existing and growth markets through the Companyâs Chef Activation Program, and by promoting its SensoryFresh products in Europe, North America and Asia.

Last year in April, the company introduced its SensoryFresh product, a frozen product. In FY19, premium frozen product sales volumes increased by 38% at higher Farm Gate prices.

Clean Seas believes that it is on the right trajectory to achieve the scale required to deliver on its âVision 2025â. In the next three years, Clean Seas will be focused on further increasing the scale of its operations to become cash flow sustainable and globally competitive. The company intends to increase its annual sales of ocean farmed Kingfish by around 50% to 4,000 tonnes by FY22, primarily via market share growth in North America and Asia leveraging SensoryFresh. The company seeks to achieve a sustainable reduction in the cost of production through scale, investment in automation and selective breeding. The company is planning to expand annual sales of ocean farmed Kingfish to 5,000 â 6,000t by 2025.

In the last one year, CSS stock has declined by 39.66%. BY AEST 12:58 PM on 20 November 2019, CSS stock was trading at a price of $0.740, up by 5.714% intraday, with a market cap of around $68.69 million. It is to be noted that the stock is trading near to its 52 weeks low price of $0.700.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_07_02_2025_07_09_20_593716.jpg)