Summary

- With subsiding coronavirus spread and supportive government measures, markets are rebounding and businesses getting back to work

- Transurban Group resuming several toll activities with gradual reopening

- Bapcor boosted financial position with recent capital raising position

- APE boasting strong balance sheet, enabling to address any uncertain operating environment

- CAR supporting Australian dealer customers with discounts and waived advertising charges

- ALX added new Board member, bringing extensive board and executive experience in the financial services sector

Given the COVID-19 impacts, benchmark index S&P/ASX 200 started moving in the downward direction from 21 February 2020, reaching its lowest level on 23 March 2020. However, since April 2020, there has been some rebound in the market, primarily driven by the roll out of government stimulus packages, easing restrictions, subsiding coronavirus spread, and gradual reopening of the economy.

In this backdrop, let us discuss few transport stocks along with their market updates and stock performance on ASX.

Transurban Group (ASX: TCL)

Stock of Transurban Group (ASX: TCL), owner, operator and developer of electronic toll roads and intelligent transport systems, closed at $16.26 a share on 20 February 2020 and dropped to $10.04 on 19 March 2020. However, by the market closure on 26 May 2020, the stock closed at $14.74, up 0.683% from the previous close. On 27 May 2020 (AEST 02:40 PM), the stock was trading at $14.365.

Recently, the Company updated that toll activities on the A25 have resumed with the gradual reopening of the Greater Montreal region post stay-at-home orders imposed by the Government due to the coronavirus crisis.

Investor Briefing:

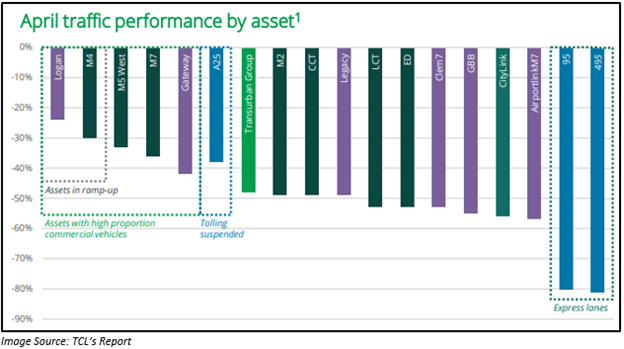

In its investor briefing, released on 4 May 2020, the Company discussed its trading update and outlook, along with traffic insights.

TCL remains committed towards the health and safety of its employees, contractors, and customers, while focusing on getting essential goods and services where they need to go during the crisis. Moreover, its roads are fully operational, and the Company boosted its financial support for customers and other members of the community that needed support during this pandemic.

Besides, the Company confirmed to have sufficient liquidity to meet capital needs and debt refinancing obligations until end-FY2021.

Bapcor Limited (ASX:BAP)

Bapcor Limited (ASX:BAP) is a distributor of automotive aftermarket parts. Its stock price went down from $7.11 on 12 February 2020 to $3.15 on 25 March 2020. At the market closure on 26 May 2020, the stock settled at $5.900, up 0.855% from the previous close. However, on 27 May 2020 (AEST 02:58 PM), the stock was trading at $5.890.

Capital Raising - SPP and Underwritten Institutional Placement Completed

Recently on 20 May 2020, the Company announced completion of a share purchase plan following the successful closure of the $180 million underwritten institutional placement in April.

BAP received valid applications totalling ~ $122 million from qualified shareholders for the share purchase plan. Around 12.8 million new shares were scheduled to be issued on 25 May 2020.

Proceeds through the capital raising program would support the Company in strengthening balance sheet as well as boosting funding flexibility. The capital raising program complements several operational initiatives rolled out for cash preservation and cash flow management.

A.P. Eagers Limited (ASX: APE)

A.P. Eagers Limited (ASX:APE) is a pure automotive retail group, engaged in the sale of new and used motor vehicles, distribution of parts, accessories and car care products as well as repair and servicing of motor vehicles.

Stock of APE which settled at $9.33 on 21 February 2020 reached $2.94 on 27 March 2020. The stock price has shown a gradual improvement, reaching $6.46 on 26 May 2020. On 27 May 2020 at AEST 03:07 PM, the stock was trading at $6.270. The current stock price of the Company is trading around its mid-March price.

Ongoing impact of COVID-19 pandemic:

A late-April 2020 market update provided by the Company on its response to ongoing impact of the COVID-19 pandemic highlighted

- Dealerships remained operational;

- Priority given to the health and safety of employees and customers;

- Proactive initiatives taken to reduce cost base and reflect dealership activity;

- A range of cash preservation measures rolled out to strengthen liquidity profile;

- With a strong balance sheet, the Company is well position to sail through the crisis and address any uncertain operating environment in the future.

carsales.com Ltd (ASX:CAR)

Stock of carsales.com dipped significantly from $18.99 on 13 February 2020 to reach $10.47 on 23 March 2020, which represents an approximate decline of 45%. However, the stock bounced back from 24 March 2020 is presently positioned at a level that prevailed during 6 March 2020.

At the market closure on 26 May 2020, the stock improved by 2.998% from its previous close and settled at $16.49. However, on 27 May 2020 (AEST 03:14 PM), the stock was trading at $16.210.

Trading Update; Actions to support Australian dealer customers and reduce cost:

In an update on business provided by the Company on 23 April 2020, CAR highlighted that it is not in a position to provide specific FY2020 guidance. The Company withdrew its FY20 outlook statement during late-March 2020.

The Company, operating an online automotive, motorcycle and marine classifieds business, introduced several measures like waived all its fixed and variable advertising charges for April 2020 and provided a 50% discount in May to support its Australian dealer customers. Other than this, the Company implemented cost reduction measures and capital management to mitigate the near-term financial impact of COVID-19, owing to the lower revenue and reduced market activity.

Remuneration of the Board and executive team was also reduced by 20% from 1 April 2020 till 30 June 2020. Around 250 employees in Australia were stood down on a temporary basis, with most of these on a partial basis.

Atlas Arteria (ASX: ALX)

Stock of Atlas Arteria (ASX: ALX), operator and manager of a portfolio of toll road assets, dropped significantly from 4 March 2020 till 23 March 2020. The stock price that settled at $8.13 on 4 March 2020 reached $4.33 on 23 March 2020, representing a dip of nearly 47%. The stock has, however, shown gradual improvement till date, reaching $6.69 on 27 May 2020 (AEST 03:22 PM).

Board Changes:

On 19 May 2020, the Company released a market update on Board changes, with Ms Caroline Foulger joining as an independent non-executive director to the Board of Atlas Arteria International Limited. Ms Foulger has extensive board and executive experience in the financial services sector, primarily related to insurance and advisory services. Meanwhile, Mr James Keyes retired from the ATLIX Board post the AGM on 19 May 2020.

Q1 2020 Toll Revenue and Traffic Statistics:

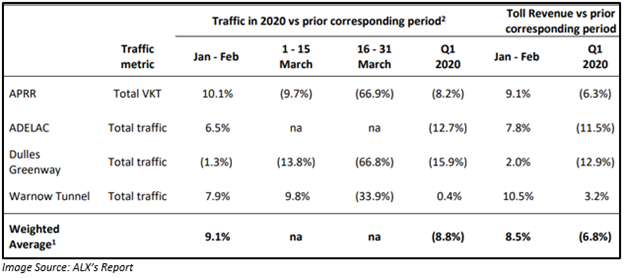

Late-April 2020, the Company provided an update on its toll revenue, traffic stats and liquidity for Q1 2020 ended 31 March 2020.

- Weighted average toll revenue for Q1 2020 dropped 6.8% from the previous corresponding period (pcp);

- Weighted average traffic declined by 8.8% on pcp;

- Well placed in terms of liquidity.

Note: $ used refers to Australian dollar unless stated otherwise