Commonwealth Bank of Australia

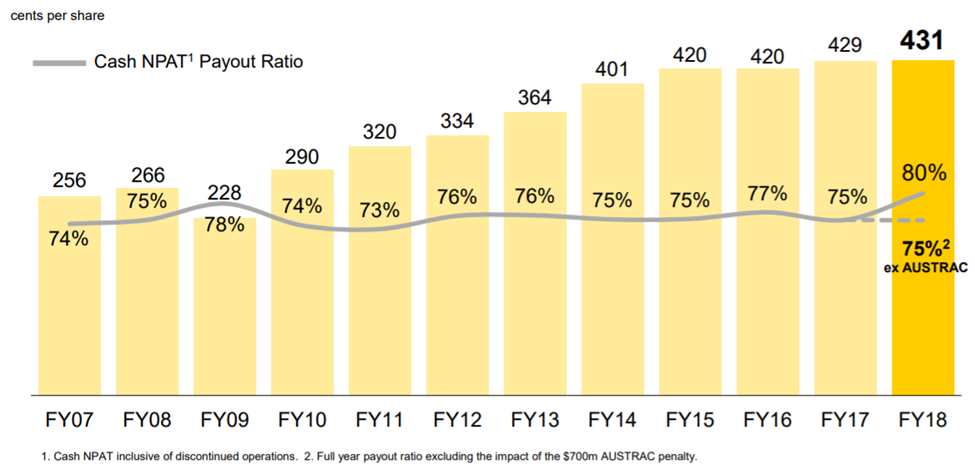

Solid dividend yield: Commonwealth Bank of Australia (ASX:CBA) is simplifying their business to focus on their core banking businesses. They are divesting or demerging their wealth management, mortgage broking and life insurance business. This financial performance has supported a strong dividend for shareholders and enabled the management a final dividend of $2.31 per share, leading to the overall year dividend to $4.31 per share, fully franked, up 2 cents on last year. The stock has an outstanding dividend yield of 6.1%.

Rising dividends (Source: Company reports)

Westpac Banking Corp

Settlement with ASIC: Westpac Banking Corp (ASX:WBC) who is as issuer of Self-Funding Instalments (âSFIâ) directed SFI holders with dividends being applied to decrease the finishing Payment of the SFIs. SFIs would start trading ex-distribution on the same date as the underlying securities are ex-distribution. The firm recently made a settlement with ASIC, to pay a $35 million penalty for contravening the National Consumer Credit Protection Act. The settlement is subject to Court approval. The firm also accepted that during December 2011 and March 2015 over 10,500 loans would not have been approved through their automated decisioning process and should have been referred to a credit officer for manual assessment. WBC stock has been under pressure this year to date falling over 10.8% (as of September 25th, 2018) leading the stock trade at an outstanding dividend yield of 6.7% and a cheap P/E.

BHP Billiton Limited

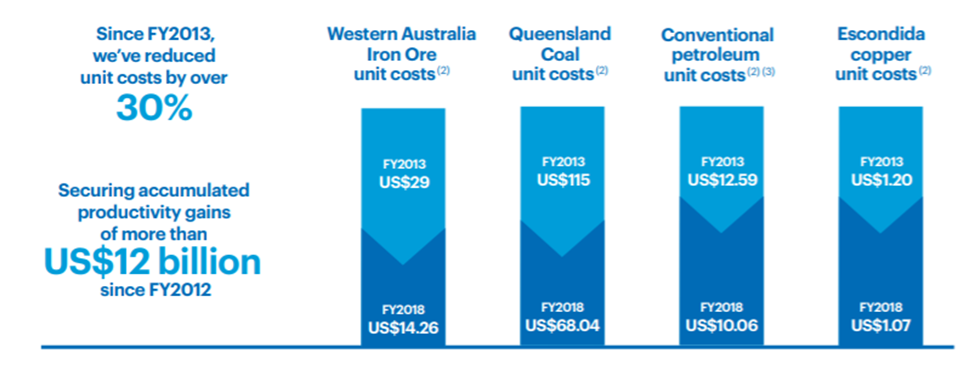

Cost control, positive performance driving the stock sentiment: BHP Billiton Limited (ASX:BHP) reported an underlying attributable profit rise of 335 to US$8.9 billion in FY18. There was a growth of 8% in annual production on year on year basis while a record output was noted at Western Australia Iron Ore, Spence copper mine in Chile and Queensland Coal. For the second consecutive year, the firm generated over US$12 billion of free cash flow and is selling their Onshore US assets for US$10.8 billion. BHP reported annualised productivity gains exceeding US$12 billion from 2012. The firm is well positioned to deliver over US$1 billion of further productivity gains by the end of FY2019, and sees positive momentum into FY2020. The firm is also looking for new oil and copper deposits via targeted exploration. In Petroleum, the firm made discoveries in four out of the six prospects tested over the past two years, across two key basins. The firm has more than 100 highly prospective blocks in the Gulf of Mexico, and acquired the Trion discovered resource in Mexico after a competitive process. BHP has 4.7% dividend yield.

Focus on productivity (Source: Company reports)Â Â [optin-monster-shortcode id="wxhmli4jjedneglg1trq"]

National Australia Bank

Improving asset quality: National Australia Bank Ltd. (ASX:NAB) managed to deliver a revenue rise during the third quarter despite rise in short term wholesale funding costs, while asset quality and balance sheet metrics remain strong. The group forecasts further provisions in the 2H18 result, while further costs would be excluded from the expense growth guidance of 5-8% for FY18. NAB stock has an outstanding dividend yield of 7.2%.

Transurban Group

Boosting capital position: Transurban Group (ASX:TCL) recently finished the retail component of its fully underwritten pro-rata accelerated renounceable 10 for 57 entitlement offer raising gross proceeds of over $1,222 million from the issue of approximately 113.2 million new securities at an issue price of $10.80 per new security. TCL has 5% dividend yield.

Tabcorp Holdings Limited

Focusing on EBITDA synergies: Tabcorp Holdings Limited (ASX:TAH) delivered EBITDA synergies and business improvements of $8 million in FY18 while the decisions would underpin $50 million in FY19. Target remains at least $130 million in FY21. The firm refinanced $1.8bn bridge loan into long-dated maturities in US market. TAH reported a full year dividend of 21.0 cps, including final dividend of 10.0 cp. The firm expects a positive 2H18 performance, driven by Wagering & Media and Lotteries & Keno while enhancing digitalization across the company. They are also launching new products while renewing Licences. TAH stock rose over 12.7% in the last six months (as of September 25th, 2018; Source: ASX) and has a decent stock dividend yield of 4.3%.

The Income available from dividends remains attractive for many investors.

We take a look at the best yields on the market and assess what they say about a companyâs prospect.

One Thing is certain, though, Australia interest rates are still low, making income difficult to come by and keeping the focus for many investors on high yielding stocks. Kalkineâs team of analysts bought you handpicked report for âTop 25 Dividend Stocks For 2018.â

ASX-relevant Special Reports are published year-round to provide a detailed analysis into an investing opportunity or a potential risk to your portfolio.

Click here to get your free report.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkinemedia.com and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.