Interest rates are currently very low around the world and in some economies, there is an expectation of a little further monetary easing. In Australia, where the interest rates and long-term government bond yields are at record low levels, investors continue to include ASX dividend stocks in their portfolio to maintain a regular flow of cash in today’s uncertain times.

Although the outlook for the global economy is currently reasonable and global growth is expected to be a little stronger this year, investors are currently getting worried due to two main sources:

- Trade and technology dispute between the US and China

- Coronavirus, which is having a significant effect on the Chinese economy at present.

We have identified few ASX stocks with growing dividends, which we believe investors should take a close look on. Lets us take a quick look at these stocks and their recent updates.

Premier Investments Limited (ASX: PMV)

Operator and manager of retail, consumer products and wholesale businesses, Premier Investments Limited, delivered Net Profit After Tax of $106.8 million in FY19, up almost 28% on the previous year.

During last year, the Premier Retail management team, led by Mark McInnes, continued to relentlessly pursue the successful rejuvenation of its apparel brands while growing Smiggle, Peter Alexander and its online businesses. As a result, Premier Retail delivered total global sales of $1.27 billion, up 7.5% on the prior year; and underlying earnings before interest and tax of $167.3 million1, up 11.5%.

Recognising the company’s strong result, and reflecting its confidence in Premier Retail’s growth strategies, the company’s Board of Directors declared full year ordinary dividends totalling 70 cents per share, fully franked. This was a record for Premier and an increase of almost 13% on the prior year.

In the last year, PMV provided a return of 39.06% to its shareholders. The stock is currently trading at a PE multiple of 29.480x. By AEDT 2:24 PM on 10 February 2020, PMV stock was trading at $19.800 with a market cap of around ~$3.15 billion.

Washington H. Soul Pattinson & Company Limited (ASX: SOL)

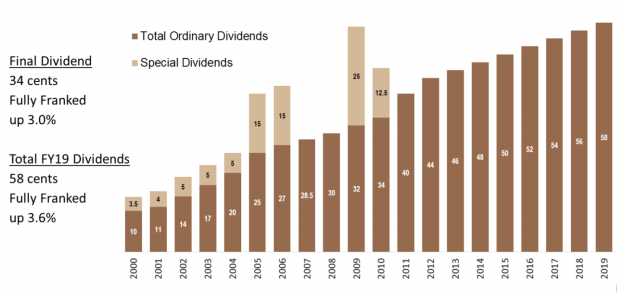

Australia-based investment house, Washington H. Soul Pattinson & Company Limited (WHSP) has an excellent track record of paying dividends as it has managed to increase both its interim dividend and final dividend every year since 2000 (refer below image).

(Source: Company Reports)

During the last financial year, the company witnessed a fall of 7% in its Statutory Profit and Regular Profit. Despite this, the company declared a final dividend of 34 cents per share, up 3.6% on pcp, taking the total full year dividend to 58 cents.

The company’s dividends increased from 10 cps for the FY 1999 y to 58cps in FY19, representing a compound annual growth rate of over 9% for 20 years. Notably, for the current financial year, the company intends to pay 82% of the net regular cash inflows from operations as dividends to its shareholders.

Transurban Group (ASX: TCL)

World’s leading toll-road operators, Transurban Group intends to pay a distribution of 31.0 cents per stapled security for the six months ending 31 December 2019 on 14 February 2019. During the last financial year, the company’s total Shareholder Return, that is, capital appreciation and distributions, for FY19 was 31 per cent.

The company seeks to consistently grow distributions year on year and, as such, the Board has issued distribution guidance of 62 cents per security for the year ending 30 June 2020, which implies growth of just over five per cent on the FY19 distribution. This distribution guidance demonstrates the Board’s confidence in the strength and consistency of Transurban’s underlying business and its capacity to effectively deliver the projects in its investment pipeline.

In the last one year, TCL stock has provided a return of 30.02% to its shareholders. By AEDT 2:58 PM, TCL stock was trading at $16.130, very near to its 52 weeks high price.

Helloworld Travel Limited (ASX: HLO)

Travel-distribution company Helloworld Travel Limited demonstrated strong growth in TTV, Revenue, EBITDA and Net Profit during the last financial year. Over the period, the company continued to increase its investment in its brands, products, technology and people to ensure that it is well positioned for sustainable long-term growth.

For FY19, the company declared and paid a record 20.5 cents per share fully-franked dividend for the FY19 year, its highest ever and up from 18.0 cents per share for FY18 and 14 cents per share for FY17.

In the first quarter of FY20, the company reported TTV of $1.878 billion while maintaining strong growth in its Australian retail network performance, Flights Systems B2C business and Australian wholesale businesses. BY AEDT 2:58 PM, HLO stock was trading at $4.220 with a market capitalization of $523.83 million.