Agriculture businesses largely fall under the essential service category, thus these businesses are continuing to operate amid COVID-19 crisis. According to the Department of Agriculture, Water & the Environment, Agriculture accounts for 58% of the Australian land, ex timber production.

Around 2/3rd of the total value of agriculture, fisheries and forestry production is exported, and the value of agriculture, fisheries and forestry exports have increased over the past twenty years.

Among the highest growth segments, meat and live animals exports grew 79% over the past two decades to 2017-18. And over the same period, forest products exports grew by 53% and fruit & vegetables grew by 52%.

It was noted that Australian farmers usually export a higher amount of production as compared to the US and the European Union. While the global agriculture demand has been growing, the competition has been growing as well, and Asia is the fastest growing region for the Australian agriculture exports.

Select Harvests Limited (ASX:SHV)

Select Harvests is a nut and health food company engaged in horticulture, orchards, processing, marketing and sales. It is one of the country’s largest almond producers with a vertically integrated business model.

Last month, the Company confirmed that its facilities and almond harvesting would continue to operate amid the COVID-19 crisis. The business is exempt from the Government imposed lockdowns and border restrictions.

It was noted that almond harvesting was completed 50% which was being transported to the Carina West processing facility with similar yield and quality like last year. SHV’s Thomastown and Carina West facilities are operating to meet the retail as well as export demand.

Earlier last month, the Company provided 2020 Crop and Market Update. Australian Almond Board had released the Australian January Export shipment report for the period March 2019 to January 2020, showing an increase of 40% in month-on-month terms and 26% over YTD shipments.

And the Californian Almond Board confirmed the 2019 crop would be around 2.55 billion pounds, and month-on-month basis shipments rose up by 7.9 percent while YTD shipments were up 5 percent with record domestic and export shipments in February.

It was understood that global demand from key almond importers as well as domestic customers continued to be strong. SHV noted that the Chinese customers had commenced production after the longer than usual Lunar New Year due to coronavirus.

SHV’s 2020 crop, in excess of 65 percent, was committed for sale within $8-$8.5/kg. However, cash flows have been delayed, as previously notified, the Company expected that 2020 crop shipments would commence this month.

On 9 April 2020, SHV was trading at $7.19, up by 1.554% (at AEST 11:44 AM).

Australian Agricultural Company Limited (ASX:AAC)

Founded in 1824, AAC claims to be Australia’s largest beef producer and a world leading beef and agricultural product producer. It operates a vertically integrated agribusiness underpinned by solid history.

In February, the Company secured an additional $50 million in borrowing capacity under the existing debt facilities, thus increasing the combined available capacity under facilities to $550 million.

It was noted that additional headroom in the debt facilities would enable the Company to weather any adverse seasonal conditions. Also, the cost of the funds remains consistent with the prior arrangements.

The amended terms under the additional capacity would apply only to Facility A, which is due in September 2022, and total drawdown under the facilities was $381 million out of the total $550 million.

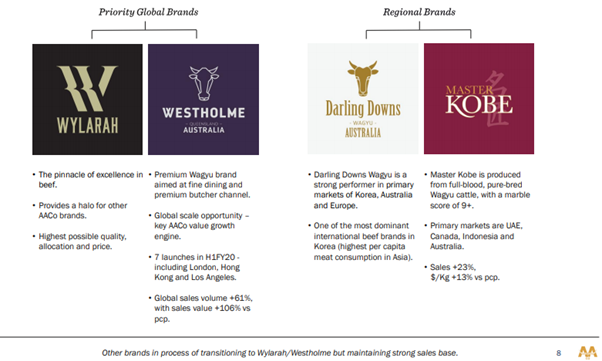

Portfolio Brands (Source: AAC HY Presentation, November 2019)

In November 2019, the Company released half-year results for the period ended 30 September 2019. AAC recorded strong half-year Wagyu meat sales numbers with sales growth of 10% as it continued to roll-out its premium branded beef strategy.

It was noted that the business recorded 8% growth in Asian sales, Europe and Middle East grew by around 26% and North American market recorded growth of 7%. It carried seven launches of premium brand Westholme during the period in London, Hong Kong, Los Angeles and Chicago.

During the period, the company also upgraded its distribution partnerships in Europe, the US and the UK. As a result of drought, the Company incurred expenses of $36 million, which increased by $11 million compared to the same period last year, and these expenses were related to production, feed and transport.

AAC said that the demand for Australian beef is robust and the Company is meeting the demand with superior value on the table while also looking for new opportunities. It was said that the business has built one of the largest Wagyu herds in the world having leading genetics and high quality.

On 9 April 2020, AAC was trading at $1.115, down by 0.446% (at AEST 11:42 AM).

Rural Funds Group (ASX:RFF)

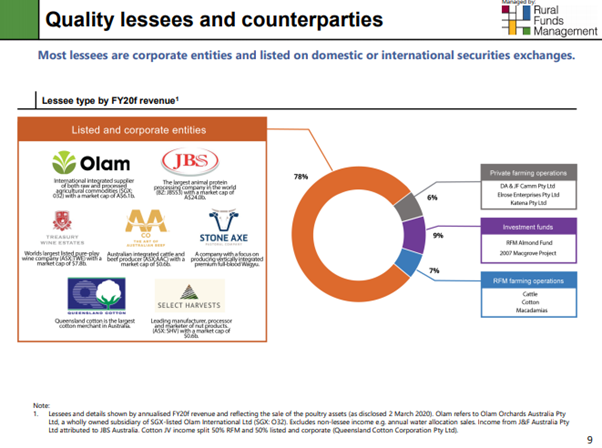

Rural Funds Group’s manager Rural Funds Management Limited claims to be one of the oldest agricultural fund managers in Australia. Founded in 1997, it manages over $1.3 billion in agriculture assets. Among its funds, RFF has a portfolio of $950.2 million in diversified agriculture assets.

Recently, the fund reported the verdict of the Supreme Court of NSW in relation to a report published by Bonitas in August last year, which resulted in substantial fall in the security price of the fund. Supreme of NSW has ordered Bonitas to pay around $900k, which includes damages as well as cost.

In March, the fund reaffirmed its full-year guidance, which includes adjusted funds from operations of 13.5 cents per unit, distribution of 10.85 cents per unit, and FY21 distribution guidance of 11.28 cents per unit, an increase of 4% on current year.

Source: RFF Presentation, April 2020

RFF also proposed an increase of the Guarantee to J&F Australia Pty Ltd. It notes that JBS feedlots and Guarantee have been a good investment. In August 2018, the fund raised equity to fund JBS cattle feedlots and limited Guarantee for J&F Australia.

Further, JBS requested a larger facility due to their business expanding, and bankers have approved an increase in the debt facility, on the basis that RFF increases its Guarantee proportionally.

On 14 April 2020, the fund would be seeking unitholder approval to increase the guarantee to $100 million from $75 million, which would allow the increase in debt facility to $333.3 million from $250 million.

RFF notes that an increase in guarantee is a good investment with high-quality counterpart, which was approved previously by Unitholders on 10 August 2018 with 99.8% votes in favour. The guarantee also maintains RFF’s REIT structure, and a return of 10.23% has been generated by the Guarantee. Also, an independent expert has concluded it is fair and reasonable to non-associated Unitholders.

On 9 April 2020, RFF was trading at $1.890, up by 1.613% (at AEST 11:43 AM).