There is a huge market opportunity in the business, with wine consumption significantly growing across all regions in recent years. The global beverage market is likely to reach USD 423.59 billion by 2023, with a CAGR of approximately 6%. Australia produces aprrox. $6 billion wine and is growing at rate of approx. 3.6% per annum, having 2,500 wineries.

Investing in tech-driven businesses servicing the global wine and beverage industry, Digital Wine Ventures (ASX: DW8), is an emerging technology company. Led by start-up and wine industry veteran Dean Taylor, DW8 aims to connect key stakeholders using technology. This connection is offered by providing transparency, creating efficiency and releasing value.

Mr Dean, named as one of 50 Stars of Wine and amongst Top 50 People in Ecommerce, gave the company a new name, new business plan, new vision, as well as relocated the head office to Sydney.

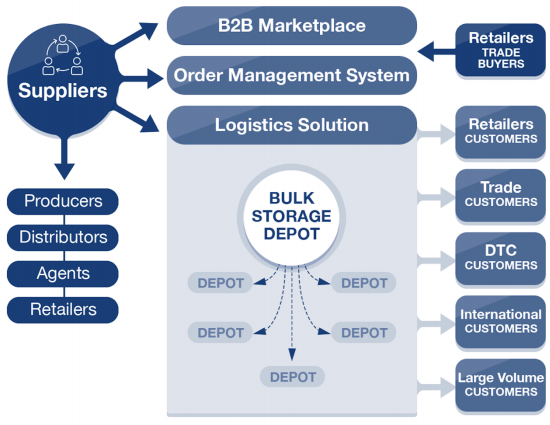

The Company serves as the gateway to capital, expertise as well as shared resources to early-stage tech-driven endeavors. Its areas of interest include B2B marketplaces and smart logistics, SaaS applications, POS and CRM systems, Digital marketing technology as well as e-Commerce.

DW8’s cornerstone investment- WINEDEPOT

A cloud-based SaaS platform acquired in May 2019 and launched on 17 September 2019, WINEDEPOT offers the wine industry with an integrated trading, an order management and a logistics solution crafted to shun costs and administration. The platform aids an integrated trading to pump online and DTC sales by providing a national same and next day delivery service- thus is an end-to-end supply chain solution for the wine industry.

DW8 Components (Source: DW8’s Report)

A partnership with Australia Post was made to establish its first four depots, fulfilling the need of a specialised wine distribution service. This was followed by another strategic alliance with Wine Storage and Logistics Pty Ltd to establish major wine storage and distribution center to service local and global markets.

The primary source of revenue for WINEDEPOT was from logistics fees (volume driven) and DW8 aims to have an established B2B marketplace in the next phase to generate Trading Fees (value driven).

To Read about WINEDEPOT’s Revenue generation model- READ HERE.

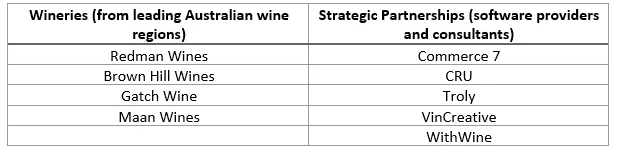

WINEDEPOT Progresses since launch

In DW8’s September 2019 Quarterly Report, CEO Dean Taylor had confirmed that the platform was likely to commence onboarding customers and generating revenue in the 2nd quarter of FY 2020. At the time of launch, there more than 150 suppliers interested in utilizing the platform and this number was 200 by 30 September 2019.

Few DW8 customers (Source: DW8’s Report)

So, how has the platform advanced in the last 3 months? Let’s find out-

· DW8 announced on 21 October 2019 that it has signed up industry heavyweight Casella Family Brands as its customer. Casella Family Brands is Australia’s largest and most successful family owned wine business. Under the agreement, Casella’s entire product portfolio would be managed by the platform through a range of domestic channels.

· On 9 October 2019, the Company notified about the appointment of wine industry professionals to the WINEDEPOT executive team- Ms Anna Donald, as Inventory & Operations Manager; Mr Richard Van Ruth, as Business Development Manager; and Mr Paul Evans joined the Board as a Non-Executive Director, effective 1 November 2019.

· In November, the platform successfully processed its first wave of orders, indicating that revenue generation will commence soon, in line with management’s expectations.

· On 27 November 2019, DW8 announced that it had signed its first craft spirit customer, Vodka Plus, an emerging craft spirit wine producer. This indicated the scalability of the Company’s business model into other verticals.

· On 11 December 2019, DW8 announced that WINEDEPOT finally had its first 1,000+ orders in a day, since its launch. Over 1,200 orders flowed after a customer ran a promotion through a major online retailers’ website.

Share Price Information

On 24 December 2019, DW8 quoted $0.007, with a market cap of $7.74 million. The stock has generated a YTD return of 40.99%.

With the recent milestone of over 1,200 orders in a single day, WINEDEPOT is likely to be the highlight of DW8’s success in the days to come.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.