Summary

- Aspire Mining’s flagship asset Ovoot Coking Coal Project poised for development with PFS completed and local approvals being sought for the Erdenet Rail Terminal.

- Updated Extended Case of the Pre-Feasibility Study (PFS) for the OEDP revealed robust financial and economic outcomes such as reduction in minor gates costs, Up-front capital investment and so on.

- Ovoot project to largely benefit local communities over the course of Life of Mine.

Australian-based leading pure-play metallurgical coal focussed Aspire Mining Limited (ASX: AKM) has achieved significant progress in advancing the Ovoot Early Development Plan (OEDP), the first stage of its flagship Ovoot Coking Coal Project (100%-owned).

Metallurgical Coal (Coking coal) is known for its special caking ability and is used in production of coke, which is an important constituent in steel production. Different kinds of coal found globally include brown coal, lignite and anthracite.

Good Read: Economic Corridor and Three Countries: Mongolia-based Aspire Mining to Sit on Sweet Spot

Improved Financial Outcomes From updated OEDP PFS

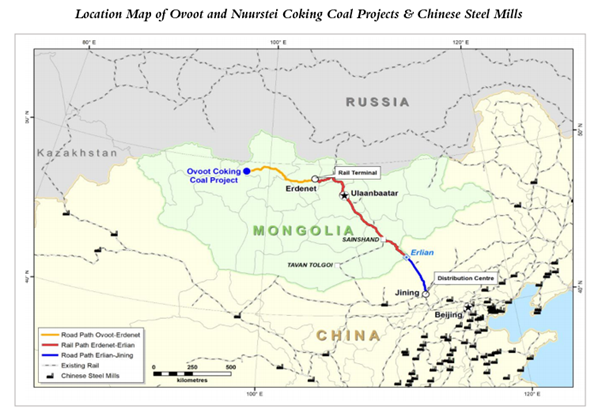

Under the first stage of the OEDP, construction of 560 km special-purpose haul road for delivery of up to 4 Mtpa coking coal to the nearest rail head at Erdenet and other end markets is planned. Currently, the Company is expediting local approvals for both road connection to Erdenet Rail Terminal and the Definitive Environmental Impact Assessment (DEIA), which have faced delays due to the restrictions imposed amid COVID-19.

In November 2019, the Updated Extended Case of the Pre-Feasibility Study (PFS) for the OEDP was announced, which presented improved financial outcomes, demonstrating the value that Aspire Mining intends to deliver for all shareholders.

Due to the updated mine schedule and mining cost quotes received from mining contractors for OEDP, there was:

- A reduction of 19% in mine gate costs per tonne from US$32.80/tonne down to US$26.40/tonne over life of mine (LOM).

- 34% reduction in Up-front capital investment from US$47 million down to US$31 million owing to lower mining costs and deferred capitalised waste removal until 2 years and 3 years of mining operations. Besides, the road capital expenditure valuations of US$165 million are subject to impending approval for the definitive engineering study and the final road alignment.

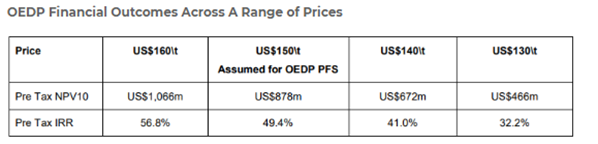

- Uptick in OEDP’s pre-tax NPV10 to US$ 878 million from US$ 758 million, depicting an improvement of US$120 million with all other assumptions remaining constant.

- Increase in pre-tax internal rate of return (IRR) to 49.4% from 44.5%.

For a detailed overview of the Updated PFS, Read - Aspire Mining declared Improved Financial Outcomes From updated OEDP PFS

The Company also added that the before tax NPV10 and IRR sensitivities had been calculated on a range of prices, giving testimony to the robustness of the OEDP Updated Extended Case as given below:

Thus, Aspire Mining is very encouraged to report better financial returns and lower forecast mining costs as outcomes from the updated PFS.

The Company is also striving to gain local community support and finalisation of a Community Development Agreement to advance mine development. In this regard, Aspire Mining indicated that the OEDP has the potential to employ ~450 people and create indirect employment opportunities, generating over 1200 new jobs with a total investment of US$275 million. Furthermore, around US$33 million worth of taxes and fees (over USD 850 million), payable by the project over the first 10 years of operations, would directly be channelized to the local community.

For latest updates, Read - Aspire Mining Closes An Eventful Q3FY20 With Strong Cash; Poised To Advance The OEDP Further

Stock Information: Aspire Mining has a market capitalisation of around AUD 43.66 million and the AKM stock settled the day’s trade at AUD 0.090 on 11 June 2020. AKM has generated positive returns of 19.44% in the last three months and 7.50% in the last one month.