Australia-based Aspire Mining Limited (ASX: AKM), the Leading pure-play metallurgical coal project developer currently advancing the first stage of its flagship asset - Ovoot Coking Coal Project (100%-owned) located in the Orkhon-Selenge Coal Basin of northern Mongolia, has announced its Quarterly Activities Report for the quarter ending 31 March 2020.

The company’s current portfolio includes Ovoot Coking Coal Project, Nuurstei Coking Coal Project (90%-owned) and a strategic infrastructure ownership of 80% in Northern Railways LLC.

March Quarter 2020 – Key Highlights

Aspire Mining closed the three globally challenging months with no borrowings but a strong cash and term deposits of A$ 43.8 million. Interestingly, the Company maintains majority of its cash in US dollars, and therefore, benefited in AUD terms from the substantial recent weakness in the AUD\USD exchange rates. The exchange rate at 31 March 2020 was USD 0.61 to AUD 1 which saw a foreign exchange gain of AUD 2.7 million for the quarter, which more than offset the quarterly expenditure.

Good Read: Aspire Mining: A Cash Backed Bargain

The main expenses during the quarter comprise payments to related parties of A$ 280,990, which included directors’ remuneration. The Environment, Social and Governance Policy Statement was also finalised and released by Aspire Mining during this period.

- Ovoot Early Development Project (OEDP)

This is the first stage of the Ovoot Project. During the reporting period, Aspire Mining spent around A$ 0.2 million on work related to OEDP. Although, expenditure was constrained as the Company progressed with local approvals for both the road connection to the Erdenet Rail Terminal and completion and approval for the Definitive Environmental Impact Assessment (DEIA), a crucial step before the ground activities can commence.

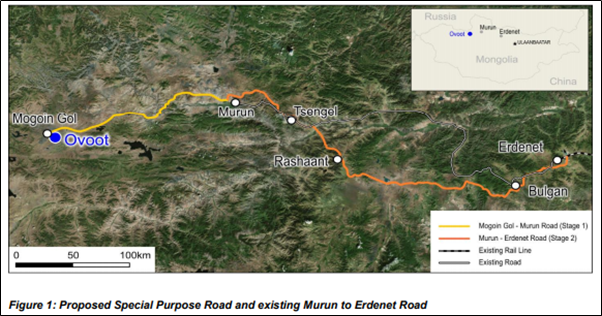

Special Purpose Road Progress: Under the OEDP, an open pit operations and trucking of ~4 Mtpa of washed coking coal through a 560 km special-purpose road connecting the proximal Erdenet rail station, are planned. The local communities would also benefit from this road as it would enable establishment of a 200-km sealed road connection between the Mogoin Gol community and the Khuvsgul’s capital Murun; and ensure that transportation of coal will only be along the purpose- built road, to avoid traffic on the existing sealed road dedicated to local and tourist traffic.

In hindsight, the OEDP Pre-Feasibility Study, updated in November 2019, had estimated construction cost of USD 165 million for the road which is nearly two third of the total OEDP development capital cost of USD 259 million.

Also, in March 2019, a definitive engineering study was started but field work was put to a halt. Though 13 soums along the expected road path approved the preferred route which included soums in Bulgan and Orkhan but 5 soums in the Khuvsgul airmag required additional approvals from the Khuvsgul airmag government for the path crossing the city. Subsequently, the Khuvsgul airmag government undertook a study of the Mogoin Gol -Erdenet road alignment which has now been incorporated in the airmag’s 2030 Road Development Plan (referring to the Figure below).

Although the approval is in place, the restrictions imposed by the Mongolian Government in response to COVID-19 such as ban on large gatherings, has delayed the necessary community consultation meetings.

Currently, Aspire Mining is also evaluating a phased development plan on the basis of initially building the road from Ovoot to Murun and then using small capacity trucks to deliver coal through the existing Murun to Erdenet Road. Meanwhile, the remaining special purpose road from Murun to Erdenet would be constructed for larger heavier vehicle movements. This plan would assist in cutting down some road investment required prior to commencing operations.

Definitive Environmental Impact Assessment (DEIA): The scope of this study includes addressing of International Finance Corporation’s (IFC) 10 “Equator Principles” that justify responsible and sustainable resource developments, a necessary step for international commercial and multi-lateral banks to provide funding for this project.

To advance the OEDP DFS, Aspire Mining is undertaking productive negotiations with the local Tsetserleg soum Government and communities settled around the project to obtain the necessary approvals. The Ministry of Environment’s approval is very crucial for DEIA and for which Aspire Mining would have to deliver local stakeholder information sharing and engagement; flora and fauna surveys; ethnological surveys as well as social impact assessments.

Meanwhile, the Company continues to make meaningful community contributions such as provision of 80 tonnes of feed for local herder communities that faced heavy snowfalls and a rather cold winter this year. Donations have also been made to local medical facilities for face masks, protective clothing and thermometers to help contain the spread of COVID-19.

Aspire Mining plans to submit management and mitigation plans for the OEDP in the approvals process and is targeting receiving all major approvals within the June 2020 Quarter.

- Northern Railways LLC

During the Quarter, Aspire Mining also held negotiations with the Mongolian Government, requesting for an extension of time required to complete the conditions precedent for the 30-year Concession for the Erdenet to Ovoot Railway Project. The Governments National Development Agency granted an extension from February 2020 to 8 September 2021 on 16 March 2020.

- Corporate

The Company’s Ulaanbaatar Office was restructured and reduced during the quarter to reflect the ongoing delay in commencing site-based activities while waiting for permitting approvals.

The AKM stock last traded at AUD 0.081, climbing up 1.25% at the end of session on 30 April 2020, with a market cap of ~ AUD 40.61 million.