Introduction

The Pure-play metallurgical coal project developer, Aspire Mining Limited (ASX: AKM) is a metal & mining along with infrastructure development company. It has a critical world-class asset in Mongolia, i.e. 100% owned Ovoot Coking Coal Project. The Ovoot project is planned to develop along with associated rail and road infrastructure project in the Country. Aspire also owns 90% of Nuurstei Coking Coal Project along with 80% share in Northern Railways LLC.

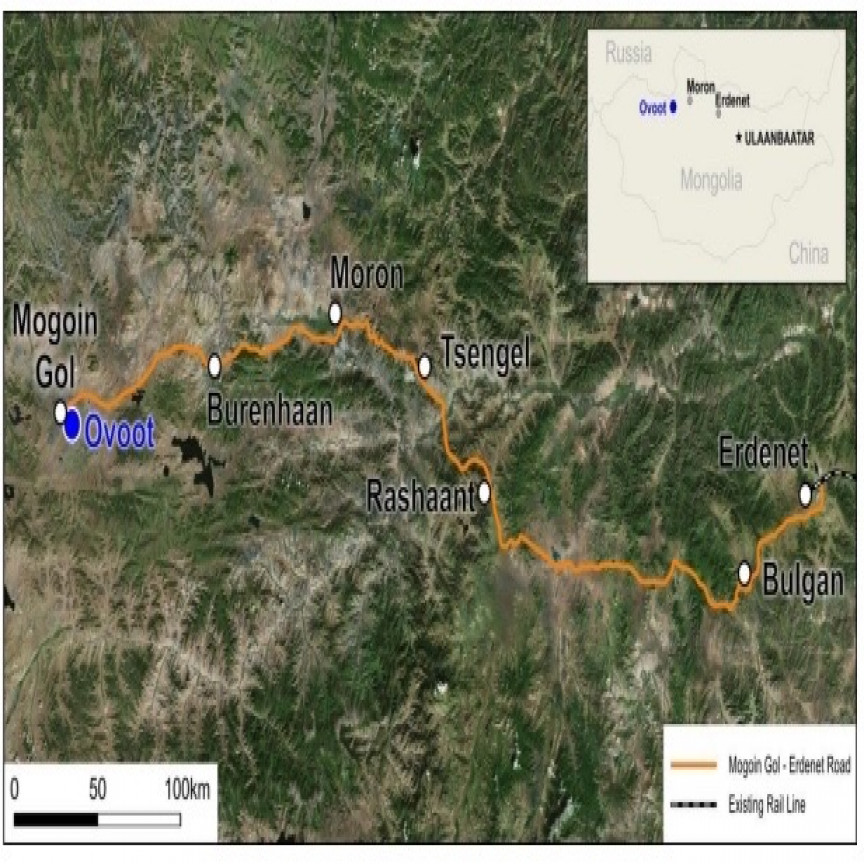

The Company is currently aiming for development of Ovoot Project, known as the Ovoot Early Development Plan (OEDP). The plan ranges from advancement Ovoot project as OP to truck and rail the output to deliver up to 4Mtpa to end markets, i.e. China or Russia via 560km anticipated construction of road from Murun to Erdenet and subsequently via rail to end consumers.

It is also notable to mention that the AKM in its recent announcement has shown interest to increase the Mongolian rail network through to Ovoot to 10Mtpa keeping in focus the future expansion of coal mine.

A Glance Through Aspire Mining Update, Click to Read.

Well! That’s Lot of Investment for The Company. Does AKM Have Any Investors and Partners?

Generally, the Company's future depends on its stakeholders and in this case, Aspire Mining seems to well place among the investor and partners. To mention few: -

- AKM has MoU with Sinosteel Engineering and Equipment Co Ltd (Sinosteel MECC). The MOU comprises of potential Coal trading platform and Engineering Procurement and Construction (EPC) based funding opportunities for the OEDP.

- Northern Railways has awarded Erdenet to Ovoot Railway provisional EPC Contract to China Gezhouba International Engineering Co Ltd and China Railway 20 Bureau Group Corporation.

- China Gezhouba Group exhibited interest to fund around US$5 million for pre-development activities such as land access permit and Definitive Environmental Impact Assessment (DEIA), etc. China Gezhouba also vouches to fund rail project in exchange of 50% interest in rail project subject to Mongolian Government approval for freight capacity expansion.

Interested in Deep Diving More on the Erdenet to Ovoot Rail Project? Click Here to Know More

- Lastly and most importantly, present of the renowned investor, Mr Tserenpuntsag owning 52.5% shareholding of AKM demonstrates significantly stronghold in the market. Mr Tserenpuntsag has also shown corporate guarantee commitment of around A$100 million to support future debt and or project financing to support OEDP development. Also, he aims to maintain his equity share in the Company by equivalent funding for the OEDP development.

Significance of Chinese Partnership

Sinosteel MECC: AKM acknowledges the significance of having a strong partnership with the Company, which play a crucial part in the Chinese steel industry, the primary market for high-quality coking coal product from Ovoot project.

It is also worth mentioning that the company has completed over 500 nationwide vital projects for big steel producers becoming major contributors in the Chinese metallurgical industry. The presence of the Company over more than 50 countries resulted in a high reputation in the overseas metallurgical engineering market.

Good Read: Management Change Completed – AKM Strategies on Track.

Still Mill End Users in China

China Gezhouba Group Corporation (CGGC): CGGC is one of the most capable Company in China since 1970. It has strong financial expertise along with EPC capable of meeting the need of customer around the world. CGGC is among the fastest-growing company in China, which has increased its presence overseas by doing business in 100 countries and region across the globe. Even Engineering News-Record (ENR) has ranked the company in the top 100 against 250 biggest international contractors in the world.

To mention the renowned work of Company, Three Gorges Project comes first, which is one of the largest dams in the world. CGGC keep the focus on livelihood improvement and fostering social development through construction and investment.

China Railway Construction Corporation Limited (CRCC): CRCC is a construction company managed by the SASAC (State-owned Assets Supervision and Administration Commission), China. It is one of the major integrated construction company in the world where it's ranking in China 500 in 2018 stand at 14, Fortune Global 500 in 2019 at 59 positions, and secured third positions out of 250 biggest international contractors in the world by ENR.

CRCC has formed its strong position in the field of railways, highways, bridges and tunnels project design and construction to mention few.

Mongolian Investor Significance

Mr Tserenpuntsag: He is a successful entrepreneur with an impressive track record of establishing large businesses in Mongolia. He is the owner of the largest internet provider of the Country and owns a majority stake in the Country's largest satellite business. He also has distributorship of Pepsi in Mongolia.

Most importantly, he has a robust bilateral political connection across all levels in the Government of Mongolia.

Hence, we can see that the company has all the required investment, EPC, Coal trading in place with logistic to support the commercialisation of the project. The Company anticipate starting construction of rail project post securing the Concession Agreement of 18 months to 18 September 2021.

To Know More About Extension, Please Click: Northern Railways Obtains Postponement of Rail Concession.

Stock Information

The share of Aspire Mining closed at A$0.087 on 17 April 2020 and has a market capitalisation of A$43.66 million.