In OEDP (Ovoot Early Development Plan) Definitive Feasibility Study (DFS) update, ASX listed Aspire Mining Limited (ASX:AKM) revealed on 9 October 2019 that the Company visited various steel mills in north-eastern (N.E.) China region as prospective customers. Also, it is worth mentioning that the steel mills companies validated they were earlier buying coking coal from Mongolia, mostly from traders and there exist logistics to transfer coal from the Gashuun Sukhait border into N.E. China. The pre-existing route may deliver great optimism benefitting from lower logistics cost.

Good Read: Aspire Mining’s Target Commodity Coking Coal and The Market Opportunity

The Company's Ovoot Coking Coal is anticipated to be exported from the border port of Erenhot, which is 350km nearer than the Gashuun Sukhait border and directly available through the Chinese rail solutions. In the milieu of which planning of internal Chinese logistics is quintessential to demonstrate the Aspire’s capacity to engage with these customers directly.

Mongolian Coking Coal Export Paths Map, Company’s ASX Announcement 9 October 2019

Do You Know Mongolia Will Overtake Australia in China’s Top Coking Coal Supplier?

In the latest Discover Mongolia Conference, Mr Chang Yijun - President of Fenwei Energy Information Services stated that Mongolia is likely to become largest coking coal supplier for the steel industry in China crossing Australia in mid to long term. Also, the recent 1,800km Haoji Railway project completion will render the most extensive bulk commodity railway line in China worth carrying capacity of 200Mtpa. Haoji Rail connects Inner Mongolia with southern provinces, making coal transport from Mongolia more cost-competitive than the other seaborne imports.

The cost-competitiveness of Mongolian coal is expected to give an edge to the Aspire Ovoot Coking Coal in securing the off-take agreement to the steelmaker directly than the traders.

Aspire Signed MoU with Sinosteel MECC

Having said that during December quarter 2019, Aspire signed Non-Binding Memorandum of Understanding (MOU) with Sinosteel Engineering and Equipment Co Ltd (Sinosteel MECC) encompassing prospective trade and EPC (Engineering Procurement and Construction) based funding opportunities for the OEDP. It is pertinent to mention that the Sinosteel MECC owns and operate its coking coal trading platform aiding AKM till the time of direct agreement with a steel manufacturer in China through potential funding instruments for an example coal presale and or a streaming funding facility.

OEDP – Update

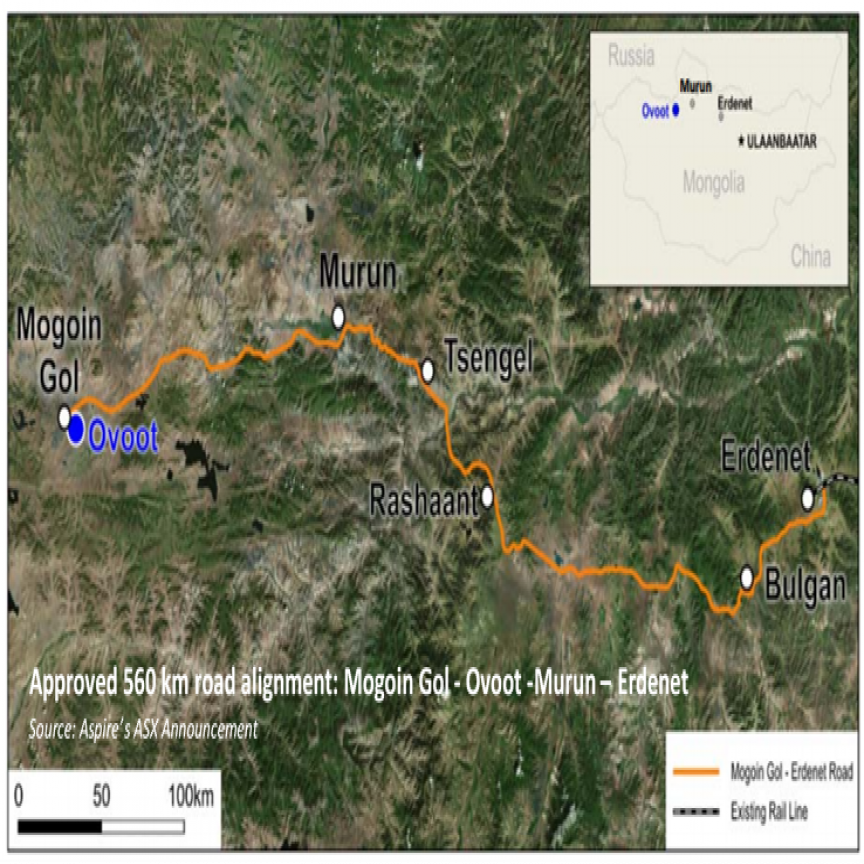

AKM is looking forward to the advancement of the OEDP which encompasses open-pit mine, truck for 4Mtpa washed coking coal to transport to its customer in both Russia and China. Which also includes anticipated road construction of 560km from Murun to Erdenet rail terminal and later by train to end market.

For the same, the Company is presently working toward the Definitive Environmental Impact Assessment (DEIA), a key approval requisite for OEDP Definitive Feasibility Study. DEIA approval is to be received from the Ministry of Environment which involve flora and fauna surveys, ethnological surveys, local stakeholder information sharing and engagement and social impact assessments.

Aspire Mining expects DEIA to be completed by June 2020 Quarter.

Do You Know Aspire to Benefit Community? Must Read: Aspire’s Ovoot Early Development Plan (OEDP) To Benefit Community

For any project presence of off-take agreement is quintessential for commercialisation and revenue generation. Existence of MoU with Sinosteel MECC along with road and rail transportation network toward China steel mills add to the positivity of the project apart from being anticipated low-cost producer, i.e. C1 Cash Costs of ~ US$76/tonne including rail plus border charges.

Aspire Mining – Company Detail

Stock Information – Buoyancy Doesn’t Stop at Ovoot Project Only

Aspire is a cash-backed bargain since the market cap of the Company is lower than the December quarter 2019 cash worth of A$42.2 million with no borrowing. In other words, the investor would be getting Ovoot Development Project for free. Therefore, the investors are expected to benefit from the fact that the market is not currently valuing the worth of world-class Ovoot development Project and so thus the growth potential of the Company.

Moreover, the presence of prominent investor like Mr Tserenpuntsag adds optimism around the project and Company.

To Know in Detail About Cash Backed Bargain, Do Read: Aspire Mining: A Cash Backed Bargain

The stock closed at A$0.072 on 10 March 2020 and has a market cap of ~A$35.53million. Its 52 weeks high and 52 weeks low stand at A$0.3 and A$0.065, respectively.