Highlights

- Alchemy Resources (ASX:ALY) advanced its arsenal of potentially “company making” deposits in FY22.

- Soil sampling data at Karonie recorded the presence of multi-element lithium and pathfinder anomalism.

- Drilling across the Karonie project returned high-grade gold intercepts.

- The company has planned major exploration activities across its projects in the coming year.

- The period saw capital raising programs, boosting the company’s financial position.

The last financial year FY22 has been an action-packed period for Alchemy Resources Limited (ASX:ALY), an Australian gold, lithium, base metals, and nickel-cobalt exploration company.

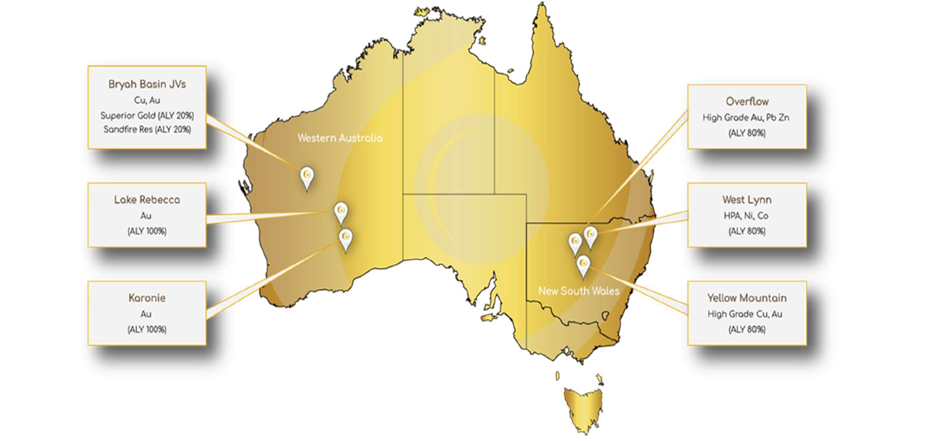

The period saw successful completion of multiple exploration activities at the company’s Western Australian projects. Moreover, the company made strides in advancing its project portfolio in New South Wales towards drill testing.

The company believes that all its projects based in Australia’s mining friendly provinces have the potential to host “company making” deposits.

Project location (Source: ALY update)

Lithium potential at Karonie Project

One of the major developments of FY22 ended 30 June 2022 was the recognition of the potential for lithium at the company’s wholly owned Karonie Project. Mapping and surface sampling work outlined a prospective mineralised corridor extending over 50km, never explored for lithium, across the project.

The in-depth review of existing soil sampling data revealed multi-element lithium and pathfinder anomalism over a large portion of the tenement package, with Cherry, Hickory, Mesquite and Pecan being the most advanced prospects. For recent updates regarding lithium potential at Karonie, click here.

Gold exploration across projects

Karonie Project: Alchemy undertook several drilling programs at its Karonie Project (WA) designed to build on the inferred gold resource estimate of 111,110oz (announced by the company on 31 August 2021). The results from the Taupo, KZ5 and Parmelia prospects returned high-grade gold intercepts, which remain open at depth and along strike of all three zones.

The company has recommended further work as several anomalous gold intercepts were recorded.

Bryah Basin JV Project: The JV partner Superior Gold continued to evaluate the potential to include 114,000oz Hermes South deposit as open pit feed for their Plutonic Mine on the Hermes and Hermes South deposits.

Meanwhile, the project with JV partner Sandfire Resources NL (ASX:SFR), lying along strike from the DeGrussa copper-gold mine, also saw aggressive exploration events, including drilling and geophysical surveys.

Lachlan/Cobar Basin: Alchemy completed a heritage survey with local aboriginal communities at a base metal and gold-containing Yellow Mountain target. The survey aimed at progressing land access agreements for exploration and upcoming drill programs in the area.

Alchemy’s financial footing

The company raised nearly AU$1.85 million (before costs) via a placement of 168.06 million ordinary fully paid shares in October last year. Additionally, over AU$1.23 million (before costs) was raised through a 1 for 6 entitlement offer in November 2021.

At the end of the period, the company had cash and cash equivalents of over AU$2 million.

Drill programs to delineate lithium and gold targets

Subsequent to the reported period, the company signed two native title Heritage Protection Agreements over 17 exploration licences at the Karonie and Lake Rebecca Projects in Western Australia.

Based on the encouraging results at Karonie, Alchemy plans to execute targeted drill programs to delineate significant gold and lithium targets.

There are plans for systematic exploration and targeted drill campaigns to unlock the Lachlan/Cobar Projects' gold, base metal and battery metal potential. The campaigns will focus on the Yellow Mountain, Overflow, Melrose and West Lynn Projects.

On the JV front, the company plans to closely monitor the exploration and other activities within the Bryah Basin JV. The Bryah Basin JV will undergo reviews and detailed reporting of Sandfire-funded exploration for gold and base metals deposits.

Additionally, the company will be recommencing exploration activities in NSW.

ALY shares were trading at AU$0.026 in the early hours of trading on 14 October 2022.