Definition

Related Definitions

Variable Overhead Efficiency Variance

What is variable overhead efficiency variance?

The marginal costing approach considers variable overhead costs that can directly be linked with variable overhead efficiency. The cost managers or accountants set up standard rates per hour and budget the required time for an activity. The variable overhead efficiency variance considers this data and shows the variance inefficiency in variable overheads. The difference between the actual and budgeted hours worked are shown as the standard variable overhead rate per hour.

Summary

- The variable overhead efficiency variance shows the difference between the actual and budgeted hours worked, applied to a standard variable overhead rate per hour.

- It is a variance used to analyse how efficiently the resources have been utilised.

- It is handy for managers. With careful monitoring, the management may find idle work hours to remove adverse variances.

Frequently Asked Questions (FAQ)

How is the variance in variable overhead efficiency computed?

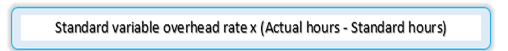

The formula for computing variable overhead efficiency variance is:

Source: Copyright © 2021 Kalkine Media

A favourable variance indicates that the operations were efficient and actual hours worked were lesser than the budgeted. It reduces the variable overhead expenses as the application of the standard overhead rate is across a lesser number of hours. It means that there was an improvement in the allocation base used to apply variable overheads. It accumulates the production expense data from the production department and labour hours budgeted at capacity levels. The set standard number of labour hours result in a variance representing actual performance. Variable overhead efficiency variance also chalks out the errors in budgeting time.

Source: © Andyoskirko | Megapixl.com

Variable overhead efficiency is not just a calculation; an entity must interpret it with the total inputs utilisation ratio to achieve higher levels of output. The variable overhead rate variance must be used to analyse how efficiently the resources have been utilised.

With careful monitoring, the management may find idle work hours to remove adverse variances. An entity may even opt to provide incentives to the operational managers and skilled labour to become efficient.

Example of variable overhead efficiency variance.

Based on past labour trends, the cost accountant at XYL design studio estimates that the tailors in the studio should work 30,000 hours in a month and incur AU$900,000 of variable overhead costs. Thus, from this data, he determines a variable overhead rate of AU$30 per hour. In June, XYL design studios incur some capital expenditure and install a new automated cutting machine to boost its production efficiency. The installation reduces the hours taken by tailors to 25,000 during the month.

Now, the cost accountant will utilise the above formula for computation. Thus, the variable overhead efficiency variance for June will be computed as follows:

AU$30 of Standard overhead rate/hour multiplied by the difference of 25,000 hours worked over the 30,000 hours of standard budgeted work hours.

It would result in a variable overhead efficiency variance of AU$150,000.

What are the possible reasons for a favourable variance?

A favourable variable overhead efficiency variance means fewer production hours expended during the period under consideration. As a result, there is a saving in the hours worked compared to the standard hours required for the produced level of output. The causes of such a favourable variance include:

- Optimal use of an easy-to-use raw material results in fewer hours wasted in production due to bad raw materials.

- A highly efficient and higher skilled workforce also helps in finishing the work faster.

- Improvement in the existing workforce skills because of training and development initiatives, leading to improved productivity levels.

- Installation of new and efficient equipment result in speedy operations.

- Budgeting or planning error, i.e., underestimating learning curve effects on productivity of the workforce.

What are the possible reasons for an adverse variance?

An unfavourable/adverse variable overhead efficiency variance reflects that the production department used more manufacturing hours during the period. As a result, production was less efficient, and the standard hours required for actual production were not enough in reality. The possible reasons for such adverse variance may include:

Source: © Artistashmita | Megapixl.com

- Use of a low-quality raw material making it difficult for labour to work.

- Inefficient production because of the less experienced or lower-skilled workforce.

- Decline in the productivity levels of production equipment due to them becoming obsolete or due to technical problems.

- Overestimating the impact of a learning curve on the workforce and budgeting lower standard hours might also result in adverse variance.

- Often the production department is considered as the responsible entity for any adverse variable overhead efficiency variance.

What are the benefits of calculating variable overhead efficiency variance?

Overhead rate variances offer several insights to the management and cost controllers. Some of the entailing benefits of this computation are:

- It is a valuable input for computing the total overhead variance and the overhead expenditure adjustments to budgeted numbers.

- The calculation helps cost controllers identify process inefficiencies. These can be then taken up for improvements.

- The budgeted numbers used here are standards derived; these motivate managers and skilled labourers to achieve favourable variances.

- Management can distinguish from the total variance whether the efficiency caused was due to labour or material.

- It helps management set internal standards for adopting a TQM or JIT approach to production and inventory management.

What is the limitation of calculating variable overhead efficiency variance?

Since Variable overhead efficiency has so many benefits, it also has a few limitations. These should be kept in mind by the cost managers. A few of these are:

- Overhead rate variance can sometimes show faulty results depending on the several input factors considered for calculation.

- Cost controllers cannot take it solely to understand the actual variable overhead variance; results need to be taken in conjunction with other OH expenditure variances.

- The selection of costing method also affects results achieved in an overhead rate variance analysis. For example, if absorption costing is used instead of activity-based costing, the variance interpretation will be different.