Definition

Related Definitions

Regular Stock Option

What is a regular stock option?

When an investor invests in a stock option, they get the right, not an obligation to sell or purchase the security on a future date at a pre-determined price. There are two types of stock options, namely, the call option and put option. In call option, the option holder gets the right to purchase the stock on or before the fixed future date on predetermined price. In put option, the holder gets the right to sell the security at the predetermined prices on or before the specified future date.

Highlights

- When an investor invests in a stock option, they get the right, not an obligation to sell or purchase the security on a future date at a pre-determined price.

- There are two types of stock options, namely, the call option and put option.

- Options are a type of a derivative, that is, the value of the options is derived from the underlying assets.

Frequently Asked Questions (FAQs)

What is the working of the stock options?

Options is a type of a derivative, in which the underlying asset is stocks.

Stock options can be described as an agreement between two parties to exchange the assets and cash at a predetermined price on a predetermined date.

The price and contract maturity are specified while writing the agreement. Moreover, the strike price is decided while writing the agreement. It is the price that must be achieved by the security to become “in the money”.

The value of the stock options is the difference between the underlying security price and strike price mentioned in the contract.

The option holder can exercise their right to buy or sell the stock on the date of maturity or before the maturity, depending upon the style of the contract.

Image source: © 204474 | Megapixl.com

What are the styles of stock options contracts?

There are two styles of stock options, namely, European and American. European options can only be exercised on the date of contract maturity, and are less common in the financial market. American options can be used before the expiration date also, unlike European options.

Since European options can only be exercised on the date of maturity, they are less expensive than American options.

What terminologies are important in the concept of stock options?

Expiration date – In stock options, it is not only about estimating the future price and betting on the same with the end motive to make a profit. It also involves deciding the period within which the investor is expected to see the upward or downward trend. The last date of the contract is known as the expiration date. The expiration date is a crucial component of a stock options contract as the value of the stock options is affected by the expiration date. For example, if an options contract expires in three months and another expires in six months, then the contract with 6 months of expiration will have a higher value as the holder will have higher chances to enter in “in the money”.

Strike price – Whether the stock option holder will exercise the option or not is dependent upon the strike price. The holder of the options contract expects that the stock’s price will go above or below the strike price before the expiration of the contract. If the trader holds a call option, then they will expect that the prices of the underlying stocks will go above the strike price. On other hand, if the put option holder will expect that the prices of the underlying security will go below the strike price. For example, if a trader expects that the price of a security will go above AU$10, he/she will purchase a call option with a strike price of AU$10.

Contracts – Contracts stands for the number of options contract an investor should buy or might be looking forward to buying. One option contract covers 100 shares of the underlying security. For example, an investor buys ten 3-month call options with the strike price of AU$10. When the option holder exercises the call option, then the contract holder will get 1000 shares by making the payment of 10xAU$10 = AU$100. Generally, a call option holder will exercise the contract only when the price of the underlying stock is above AU$10. If the price falls below AU$10, the contract will expire worthlessly.

Premium – Premium is the amount by the investor for purchasing the stock options. The premium amount to be paid is calculated by multiplying the call option value with the contracts bought by the investors and then after that multiplying it with 100. For example, if an investor buys 10 call options which are valued at $1 per contract, then the investor needs to spend $1000.

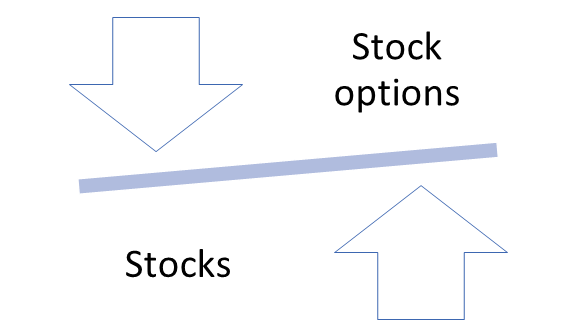

What is better, investing in options or stocks?

Both stock options and stocks add value to the portfolio in a different way. There are drawbacks and benefits that are associated with the option contracts and the stocks that needs to be considered before making the investment decision. Let’s dig deep into the benefits and drawbacks.

In case of the options trading, one of the biggest advantages is that the investor is not investing all of their funds to buy the stocks, the trader is only required to make payment of the premium amount and the rest of the payment can be made when the prices move as per their estimation.

The option traders are also benefited by the flexibility extended by the options. The holder has the right to choose the date on which they want to exercise their options contract. Moreover, the holder can make the estimation about the loss or profit he/she will make after entering the contract.

The downside of the option trading is that the trader might lose the bet on the movement of the prices of the underlying security. If the estimation turns out to be wrong, then the trader can lose the premium amount.

In stocks, there is risk of volatility, but the advantage offered by stocks is that there is no pressure of selling.

The stocks can be bought and sold as per the investors convenience and short terms gains can be enjoyed. The investor can also choose to hold the security for long term and then sell them as the prices goes up. It is not the case with the options as they have an expiration period.