Definition

Related Definitions

Accounts Receivable Financing

What is Accounts Receivable Financing?

Accounts Receivable Financing is one of the many methods a firm resort to for raising funds for short term needs. In this technique of raising funds, cash is obtained against the amounts owed to a firm by its credit sale customers. The outstanding balances on sale to them are called Accounts Receivable. Financing a business's receivables can result in quick cash, which can be utilised for operations or to invest in business progression and modernisation.

It is a type of financing agreement in which a corporation obtains funding for its accounts receivable balance. Such a financing arrangement can be organised in numerous ways, like an asset sale agreement or a factored loan. Terms and conditions depend on the quality of receivables and the financier. It arranges short-term funding in exchange for its receivables.

Summary

- Accounts receivable balance is often known to freeze cash flows for the short or medium term. Firms have to input extra efforts for collection as well. With a financing option on receivables, firms can avoid such a cash crunch.

- External financiers’ step in to fulfil the need for short-term operational cash needs by providing funds against receivable balance.

- Receivable financing deals can be in asset sales, factored loans or selective financing based on the quality of debt available with a firm.

Frequently Asked Questions (FAQ)-

How does Receivable Financing work?

Firms often sell goods on credit to customers. Although it is beneficial for the customer, it blocks the cash that the seller could have received. It can cause cash flow concerns in the future, making operations difficult. Sellers may face a cash shortage to fulfil other orders or invest in operations due to a fund crunch. The problem of short-term cash unavailability caused by credit sales is thus removed by receivables financing. It enables organisations to overcome this fund shortage. It allows early payment for invoices in advance of their due date. Therefore, companies utilise the receivables to reduce any operational delays.

Receivable’s financing can generally take place on a recourse or non-recourse mode. In a non-recourse agreement, the third-party financer assumes most of the customer's payment default risk. On the other hand, in a recourse agreement, the non-payment risk remains the primary responsibility of the seller even though receivables are exchanged for cash from the financier. Also, the original seller of goods and the financier of debt can keep their arrangement confidential or disclose it to the debtor. If kept secret, the firm will not inform the customers/ debtors.

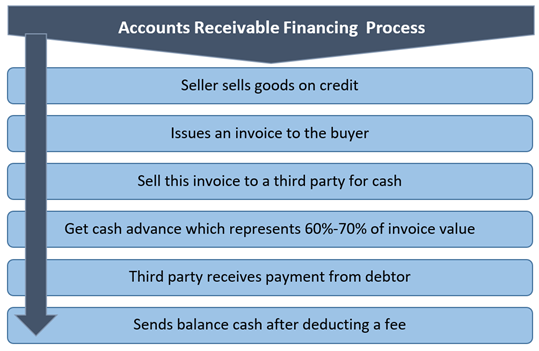

The process of obtaining funds via Accounts Receivable Financing is as follow-

Source: Copyright © 2021 Kalkine Media

Why do firms go for Receivable Financing?

- Accounts receivable financing is often a low-cost option as compared to traditional lending.

- It results in cash flow gains and avoids operational stress.

- It is usually not considered as a significant debt for analysing debt charges on a firm.

- Receivables financing generally does not have any effect on future lines of credit.

- Firms still have a choice to decide on a priority assigned to receivable repayment.

- Firms can undertake selective receivables financing to reduce financial stress.

- Seasonal demand for short term fund requirements is best fulfilled using receivable financing arrangements.

- Multiple financiers can come and finance chunks of receivables for a firm.

- Receivable financing is more favourable in terms of funding costs.

Image Source: © Adonis1969 | Megapixl.com

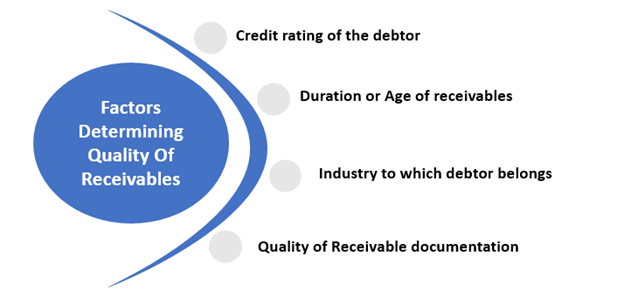

What factors determine the quality of receivables for financing?

The quality of receivables is critical in deciding whether funds will be made available for receivables. Given below are the factors used to determine the quality of receivables:

Source: Copyright © 2021 Kalkine Media

In the end, it is the debtor who makes the payment, so the credit rating of the debtor reduces the level of finance that will be made available. It is also the reason for increasing the cost of borrowings. If the quality of receivables is low, they are seen to be outstanding for a longer duration. The possibility of receiving payment also goes down if the debtor's track record is terrible.

If the industry trends are not favourable of the industry to which the debtor belongs, trade receivables chances of getting receivables financed go down. Even the quality of documentation provides clarity on the quality of receivables. Therefore, it is also a factor for determining the quality of receivables before financing them.

What are the Forms of Receivable Financing?

The most common methods of converting accounts receivable to quick cash are-

- Receivable Asset-based lending: it is a method to secure debt on the surety of assets. In the case of receivable financing, the assets are the accounts receivable balances with a firm. Financers decide the amount of loan based on the quality of receivables. It is a safer option for lenders too. The loans are based on loan to value ratios. It is a quicker and more accessible option for financing business operations.

- Receivable factoring: In this arrangement, a third party buys the receivables at a discount. It is also called invoice factoring. It helps a business to sell accounts receivable for loan processing fees. It is a more flexible approach that allows choosing the receivables they want to trade in. The funders fees may be high, and credit available may be comparatively lesser. All factored receivables are reflected on the firm's balance sheet as an unresolved liability.

- Selective financing: Selective receivables can be chosen for finance, allowing firms to pick which receivables will be used for cash exchange. In this approach, companies lock in forward payments for selected receivable balances. The financing rate is usually lower than the above two options. The method can also be considered debt in the firm's books, depending on the lending structure. It, therefore, doesn't impact the debt-equity ratio or future lines of credit.

What are the Pros & Cons of Receivable Financing?

Benefits-

- It allows firms to get instant cash in a short period.

- There is no need to plan out a repayment schedule or in case of receivable financing.

- Selling accounts receivables means there is no need to worry about collections.

Limitations-

- Receivable financing is costlier if the firm's credit score is poor.

- The spread paid for accounts receivables financing may sometimes result in a loss.

- Interest charged can be high or more than the value of possible discounts.