Definition

Related Definitions

Accidental Death Benefits

What is Accidental Death Benefits?

The accidental death benefit can be defined as the term that is commonly used in life insurance. It refers to the payment to the beneficiary in case of accidental death of the policyholder when connected to a clause.

The life insurance policy provider is primarily responsible for the accidental death payouts. It might even extend up to a year of the actual accident if the cause of death is that accident.

Image source: © Clewisleake | Megapixl.com

Summary

- The accidental death benefits can be defined as the additional amount of money paid to the beneficiary and the regular premium amount in case there is a death of the policyholder due to accidents.

- Accidental death benefits include accidents like a car crash, drowning, choking etc.

- Accidental death benefits are not applicable for death caused due to some prolonged disease, illegal activities, or some life-threatening activities.

- One can purchase accidental death benefit plans by adding some more amount to the standard life insurance policy.

Frequently Asked Questions (FAQ)

Which situations can be considered accidental death?

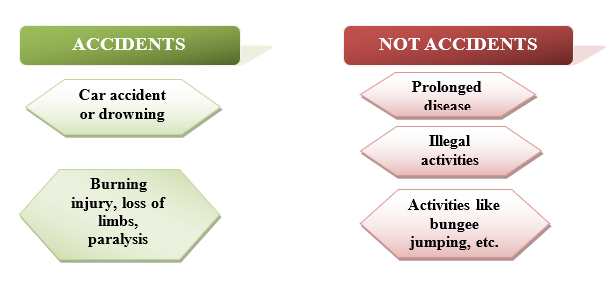

The insurance companies have specified few situations that are considered accidents, and accidental death benefits are given to the beneficiaries only if the cause of the death belongs to that specified list of accidents.

Deaths due to accidents such as car crash, slips, choking, drowning, machinery, and other unfortunate situations are uncontrollable and are regarded as accidental situations. In case of life-threatening accidents, there is a specified period of death mentioned in the policy. Accidental death benefits can only be claimed if death occurs within that specified period.

Some policies also cover accidental death and dismemberment (AD&D) insurance, i.e., accidents like burning, total or partial loss of limbs, paralysis or similar accidents.

However, accidental death benefits exclude deaths that occurred due to war or any illegal activities, any prolonged disease, or any harmful activities such as bungee jumping, paragliding, etc.

Image source: Copyright © 2021 Kalkine Media

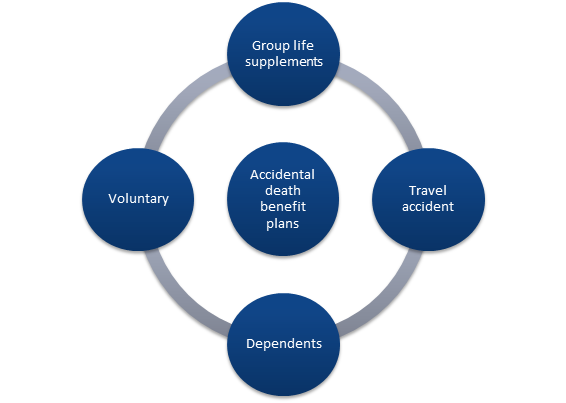

What are the different types of accidental death benefit plans?

- Group life supplements

In this type, the accidental death benefit plan is included in the group life contract given by the employer. The beneficiary of group life supplement benefits receives the same amount as the group life insurance.

- Voluntary

Often the accidental death benefit plans are offered to the employees as an elective plan by the employers. The premiums are to be paid by the employee regularly, chargeable from their payroll. Such plans cover the accidental loss of any employee during the job. This type of accidental death benefit pays for any accidental loss of the employee even if he/she is not on the job.

Image source: Copyright © 2021 Kalkine Media

- Travel accident

In this type of arrangement, the accidental death benefit insurance is offered through an employee benefit plan and provides supplemental employee protection when they go for work tours. It is slightly different from the voluntary insurance plan as the employer pays the entire premium in this case.

- Dependents

Some insurance company also cover dependents within the accidental death benefit plans.

What is the significance of accidental death benefits?

Accidental deaths are usually defined as the deaths solely caused because of accidents by the insurance companies. The accidental death benefit is a provision that is additionally included in the life insurance policies that offers a particular amount of compensation to the beneficiary along with the necessary premium amount after the death is caused due to an accident.

Accidents are unfortunate and unpredictable mishaps that can shatter a family financially. The accidental death benefits can save a family from getting broken after the death of an earning member of that family. Accidental death benefits are essential for those people who work in or around hazardous and life-threatening environments.

How to avail of the accidental death benefit along with regular life insurances?

One can pay some extra bucks and purchase the accidental death benefit as a part of his or her regular life insurance policy. Upon doing this, a simple life insurance policy of yours will cover for your death caused due to your unfortunate and unpredictable death of yours. However, the accidental death benefit plan gets automatically terminated when the policyholder reaches 70 years of age.

What is the basic difference between life insurance and accidental death benefit?

Life insurance policies protect one's family and provide financial backup to the family after the policyholder's death. The death could either be natural death or accidental death.

On the contrary, accidentally death benefits only provide support to the family members only if one loses his or her life to a sudden accident. It does not include death by prolonged disease in it.

Who are eligible for accidental death benefit insurances?

Usually, the employees and working people are eligible for accidental death benefit insurance to support and back up their families financially in their absence due to sudden accident.

Example of an accidental death benefit:

Let us assume that Alex has a life insurance policy worth $100,000 with a $500,000 accidental death benefit policy. If Alex dies due to a prolonged disease or heart attack, the beneficiary gets $100,000 from the insurance company. Whereas, if Alex dies due to some accident caused at his workplace, then the insurance company is bound to give $100,00 to the beneficiary as the regular life insurance benefit as well as $500,000 as an accidental death benefit to the beneficiary. There the beneficiary receives a total amount of $600,000 from the insurance company as life insurance benefits.