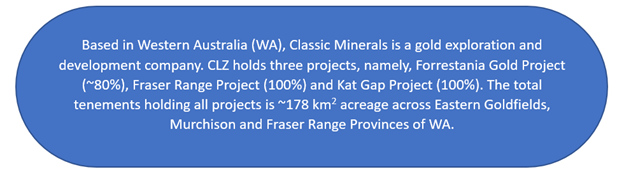

Classic Minerals Limited (ASX: CLZ) in its December 2019 quarterly update announced that the Company is likely to maintain RC drilling at Kat Gap along strike from existing drilling areas to the north and south of the granite-greenstone contact. Also, deeper RC drilling is intended to delve around the existing deeper holes to better understand the plunge component to the high-grade ore mineralisation.

Please Click The Link To Read: Classic December Quarterly Update: Successful Drilling Result at Forrestania Gold and Kat Gap Project

In the milieu of what the Company announced today, return of RC drilling at Kat Gap project. The main underline of the same are: -

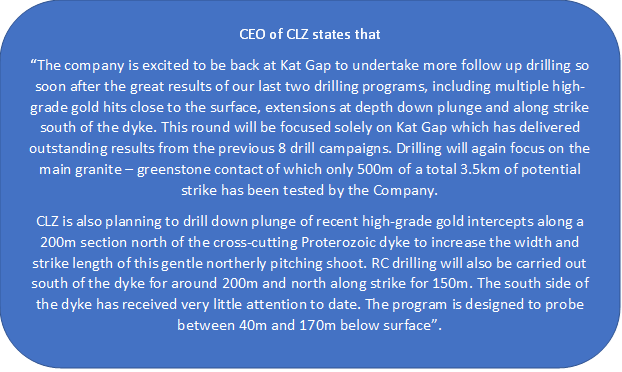

- The drilling programme is intended to assess the formerly examined granite-greenstone contact with deeper down-plunge high-grade mineralisation over a 200m strike length adjacent the cross-cutting Proterozoic dyke.

- The insight from the orientation of down-plunge high-grade gold mineralisation is anticipated to assist significantly in further drilling planning of the south side of the Proterozoic dyke.

- Further, testing of 200m along strike south of the cross-cutting Proterozoic dyke in addition to 150m north of current drill coverage is likely to bring total potential strike length of over 800m to the Kat Gap system.

For the same, up to 3500m of RC drilling is planned at Kat Gap with hole depths ranging from 40m to 170m, of which the assay result is expected to be available by mid-March 2020.

How was the previous drilling result of the Kat Gap?

During May 2018 to January 2020, a total of 143 holes for 11,044m was completed with all returning significant high-grade gold intercepts at Kat Gap Project. However, most of the previous drilling was 60m vertically below the surface, i.e. relatively shallower covering strike length along with granite-greenstone contact at length of ~500m.

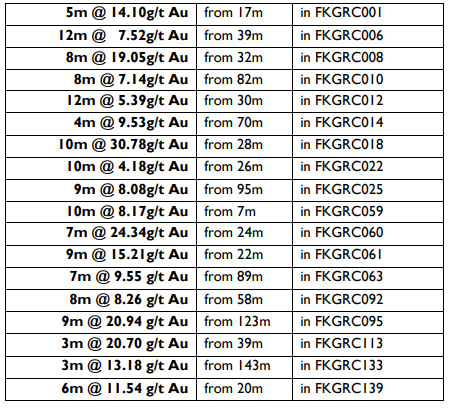

The result from shallower depth are: -

Source: Company’s ASX Announcement, 17 February 2020.

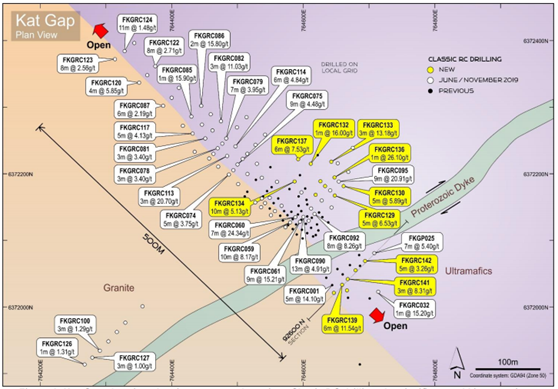

The contact of cross-cutting Proterozoic dyke intersecting with main granite-greenstone contact has been the key focused area of drilling by the Company. CLZ is aiming to focus on the same region on exploring, along with the deeper side to assess better knowhow of the plunge component to the high-grade ore and assaying the northerly and southerly extensions of the contacts.

To Know More About Drilling, Please Read: Share Price 50% Up Post KAT GAP Drilling Update: High-Grade Gold Intercept Continues

Kat Gap plan view with previous RC drilling and significant gold intersects

Source: Company’s ASX Announcement, 17 February 2020.

The optimism is gearing with the previous result along with the last scoping study of the nearby Forrestania Gold Project (FGP) demonstrating technical and economic viability. The deposit of Lady Magdalene and Lady Ada gold resources also registered a surge in gold metal contained in the deposit. The resources increased to 1.35 million tonnes at 1.37g/t gold grade for Lady Ada and 5.92 million tonnes at 1.32g/t gold grade for Lady Magdalene. Both are returning gold metal content of 59,700oz and 251,350oz from Lady Ada and Lady Magdalene deposit, respectively.

Interested in Forrestania Gold Project, Must Read: The Surge in Forrestania Gold Resources: A Glance Through Viability

The deeper drilling along with testing the northerly and southerly extensions along strike to assess the primary granite-greenstone contact as well as cross-cutting Proterozoic dyke contact may help the Company to evaluate Kat Gap project effectively which may smoothen the proceeding toward the commercialisation. Also, upcoming FGP scoping study in addition to JV plans for mining and treatment deals by professional miners. CLZ anticipates the completion of the plan mentioned above for FGP along with process ore by the first half of 2020.

Classic Minerals ability to deliver as planned may add positivity among the investors and could untangle the problem, if any, and may provide with ease due to its competence of on time.

Mr Dean Goodwin – Classic’s Chief Executive Officer Comments: -

Good Read: Equity Charmer, Gold's 2020 Outlook

Stock Price Information – The stock of CLZ ended the trading session at A$0.002 on 17 February 2020. Its 52 weeks high stand at A$0.004 and 52 weeks low at A$0.001 with a market cap of A$14.4 million.