S&P/ASX 100 Health Care sector index was launched on 2 July 2002. This index is considered as a benchmark by investors while considering health care companies.

S&P/ASX 100 Health Care sector index has emerged from S&P/ASX 100 index, which comprises of 100 large and mid-cap companies in Australia, with a market cap cut-off close to ~$ 1.7 billion.

S&P/ASX 100 Health Care sector index has delivered good returns of 48.87 percent, 31.21 percent and 22.36 percent in the last one, three and five years, respectively.

Let’s zoom our lens on three stocks that are part of the S&P/ASX 100 Healthcare index – CSL, ResMed and Cochlear.

CSL Limited (ASX: CSL)

ASX-listed biotechnology sector player, CSL Limited (ASX: CSL) has two businesses, namely, Seqirus and CSL Behring. The company, which was incorporated in 1916, currently employs 25,000 people with product distribution in more than 70 countries. CSL’s life-saving product portfolio includes vaccines to prevent influenza and medicines for the treatment of immune deficiencies and haemophilia.

Double-Digit Profit Growth in FY2019

In the financial year 2019 ended 30 June 2019, the company delivered double-digit profit growth against a strong comparative period. Additionally, CSL reported solid performances from its immunoglobulin, specialty products and influenza vaccines franchises.

Few major highlights of the year are:

- CSL achieved 24 product registrations or new indications for serious diseases, globally.

- To increase the efficiency, the company opened 30 new plasma collection centres in the US.

- Revenue and reported NPAT grew by 11 percent and 17 percent, respectively.

- Seqirus delivered strong growth in sales profit, with total sales increased by 19 percent.

For a detailed look on FY2019 results, please click here.

Presentation at JP Morgan Healthcare Conference 2020: On 14 January 2020, the company released its presentation at the 2020 JP Morgan Healthcare Conference.

In the presentation, the company discussed its position in the global biotech industry, key highlights of FY2019, product portfolio details, and innovative plans for future prospectus.

Interesting Read: Business Updates of a Global Biotech Giant- CSL Limited

Stock Performance: On 28 January 2020 (AEDT 02:30 PM), the stock of CSL was trading at $ 312.510, up 0.583 percent from its last close. The company had a market cap of $ 141.02 billion and approx. 453.88 million outstanding shares, while the stock delivered a positive return of 39.12 percent and 56.24 percent in last 6 months and one year, respectively.

The 52 weeks low and high price of the stock was noted at $ 184 and $ 313.59, respectively.

ResMed Inc. (ASX: RMD)

ASX-listed company, ResMed Inc. (ASX: RMD) is into the business of manufacturing, development, marketing and distribution of cloud-based software solutions and medical devices. The company’s solutions and products portfolios are targeted towards helping physicians and providers better manage chronic disease, enhancing patient’s quality life and lowering costs related to healthcare.

RMD currently employs nearly 7,200 people and its products are distributed in approx. 120 countries.

Double-digit Topline Revenue Growth in Q1 FY2020

During the first quarter of FY 2020 ended 30 September 2019, ResMed reported strong performance with double-digit topline revenue growth. Additionally, the company achieved balanced growth across the regions and business segments. Further improvements in operating leverage lead to double-digit growth at the bottom line.

Key highlights are as below:

- Revenue stood at $ 681.1 million, representing an increase of 16% year on year.

- Net operating profit grew by 19%

- Gross margin reached 59.5 percent, expanded 120 bps

- Diluted earnings per share reported at $ 0.83 and $ 0.93 for GAAP and Non-GAAP, respectively

The company is due to release the second quarter financial and operational results for FY2020 on 30 January 2020.

Interesting Read: Healthcare sector outlook 2020 and beyond; A Glance through Prospects of MVP, RMD

Stock Performance: On 28 January 2020 (AEDT 02:32 PM), the stock of RMD was trading at $ 24.010, moving upward by 1.737 percent, with outstanding market shares of approximately 1.45 billion. The company had a market capitalisation of nearly $ 34.13 billion, while the 52 weeks low and high price of the stock was noted at $ 12.65 and $ 24.1, respectively.

The stock has delivered positive return of 32.58 percent and 43.47 percent in the last 6 months and 1-year span, respectively.

Cochlear Limited (ASX: COH)

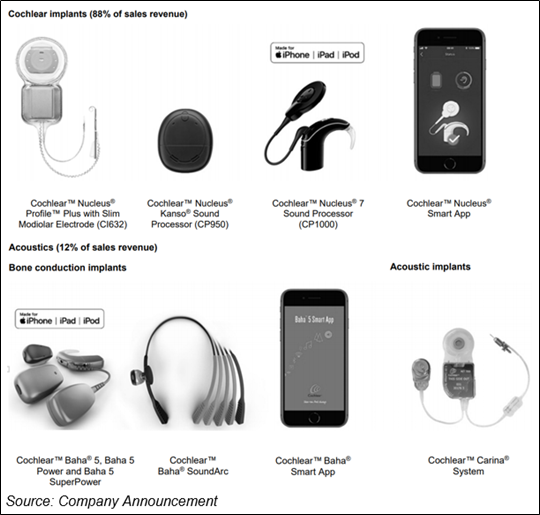

A medical device company, Cochlear Limited (ASX: COH) is into the business of providing a wide range of solutions for implantable hearing. Its products and solutions cover acoustic implant solutions, cochlear implants (Nucleus 6 System and others), Cochlear Codacs System and Bone conduction implants (Baha Attract and others).

7 Percent Sales Revenue Growth in FY2019

During the year, the company focused on building awareness and market access to cochlear implants, expanding marketing activities and customer servicing capability, and product innovation through investment in research and development.

- Sales revenue up by 7 percent to $ 1,446 million.

- Net Profit grew by 13% to $276.7 million.

- Increase of 10 percent in dividends per share to $ 3.3 (fully franked)

New Appointment on Board

In December 2019, the company announced a new appointment to the Board, with Mr Michael Grenfell Daniell joining as the Non-Executive Director from 01 January 2020.

Holding 40 years of experience in the medical device industry, Mr Daniell’s deep experience and expertise in product innovation and leveraging new technologies is expected to be invaluable to the Board.

After this joining, the company notified the market on 6 January 2020 that Mr Daniell holds 1,000 fully paid ordinary shares, which are jointly held with Ms Glenys Anne Daniell.

FDA Clearance for Cochlear™ Osia® 2 System

In November 2019, the company informed to have received the FDA approval for Cochlear™ Osia® 2 System, which is useful for children (age of 12 years and above) and adults suffering from single-sided sensorineural deafness, mixed hearing loss and conductive hearing loss.

This is the first active OSI (osseointegrated steady-state implant) in the global market that uses digital piezoelectric stimulation to bypass the areas of the natural hearing system that are damaged and sends sound vibration directly to the cochlea.

Also, the company mentioned that it intends to commercialise the product in the US during the second half period of FY2020. The product’s availability in other countries is subject to regulatory approvals.

Stock Performance: On 28 January 2020 (AEDT 02:34 PM), the stock of COH was trading at $ 235.270, moving downwards by 0.33 percent, with outstanding market shares of approximately 57.83 million. The company had a market capitalisation of nearly $ 13.65 billion, while the 52 weeks low and high price of the stock was noted at $ 164 and $ 242.76, respectively.

The stock has delivered a positive return of 6.67 percent and 20.65 percent in last 6 months and 1-year span, respectively.

Do Read: What Would be the Biggest Scientific Revolution in Healthcare in 2020?