The coal industry is currently facing a dilemma over global demand dynamics. While countries such as the United States and Germany are phasing out coal-powered electricity generation, some economies such as Japan, China and India are relying substantially on coal-fired power generation.

Coal Usage trend in the United States:

Fossil Fuels account for a massive chunk for the power generation in the United States; however, the United States has strategically reduced its coal exposure over a decade.

The nation is decommissioning its coal-fired power plants as the plants are reaching retirement. As per the data, the companies in the United States announced the departure of over 546 coal-fired power units between 2010 to the first quarter of the year 2019.

These 546 coal-powered plants accounted for approx. 102 gigawatts of generating capacity, as per the U.S. Energy Information Administration (or EIA). The power plants in the United States intend to knock out 17 gigawatts of coal-fired capacity by 2025.

The decision to retire the coal-fired power is mainly due to the high competition provided by other energy generation plants, that run on either natural gas or renewables. As per the data, the plant owners in the United States retired over 13 gigawatts of coal-fired generation in 2018, which is almost near to the all-time high coal-fired retirement of 15 gigawatts in 2015.

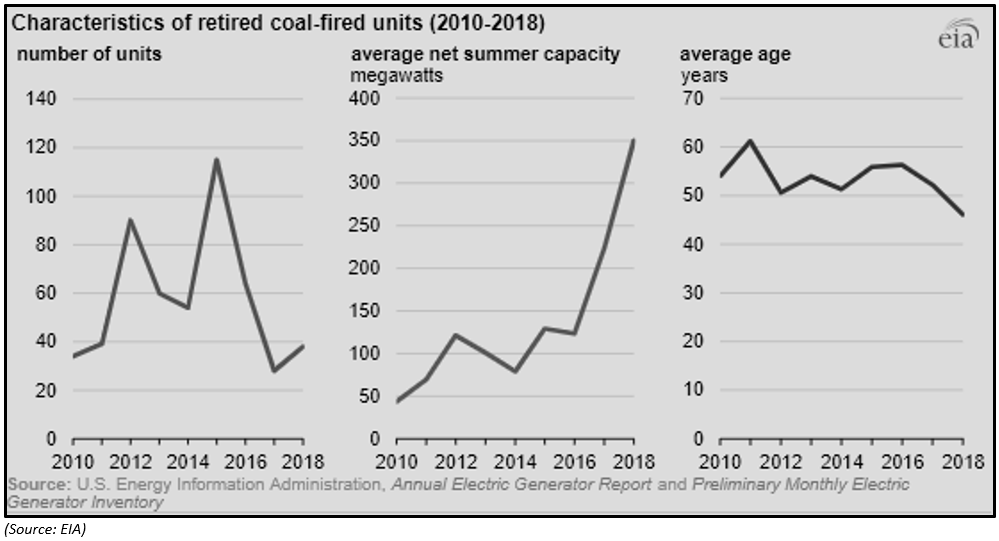

However, post-2015, the coal-fired power plants have witnessed an early retirement along with high production capacity.

As per the data from EIA, the coal units in the United States retired in 2018 had an average capacity of 350 megawatts with an average life of 46 years, which is high, as compared to the average capacity of only 129 megawatts and average age of 56 years of coal-fired power plants, which retired in 2015.

The increased stance to curb the carbon emissions along with the increase in the share of energy generation from different fossil fuels such as crude oil, Natural gas, and renewables have exerted significant pressure on coal usage in the energy sector, which in turn, has caused an early retirement of coal-fired power station in the United States.

While the coal-fired power units in the United States have witnessed a decline in numbers and the average age of retirement, which in turn, reduced the coal usage in the country, Japan has emerged as the worldâs third-largest coal importer.

Japanâs Coal Exposure:

Japan imported over 210 million short tons of coal in 2018, which in turn, made the country the worldâs third-largest coal importer. As per the statistics from the EIA, Japan supports approx. 33.33 per cent of its electricity generation and steel production through steam and metallurgical coal, respectively.

The country imports nearly 100 per cent of its coal consumption capacity and Australia is the primary exporter of coal to Japan. As per the data, Australia supplied 128 million short tons of coal to Japan in 2018, which represents almost 61 per cent of Japanâs 2018 coal demand.

Such high imports make Japan a key market for Australian coal, and Japan relies heavily on high-grade coal for its power generation. The country produced about 317 billion kilowatts of electricity from more than 90 coal-fired power plants in 2018.

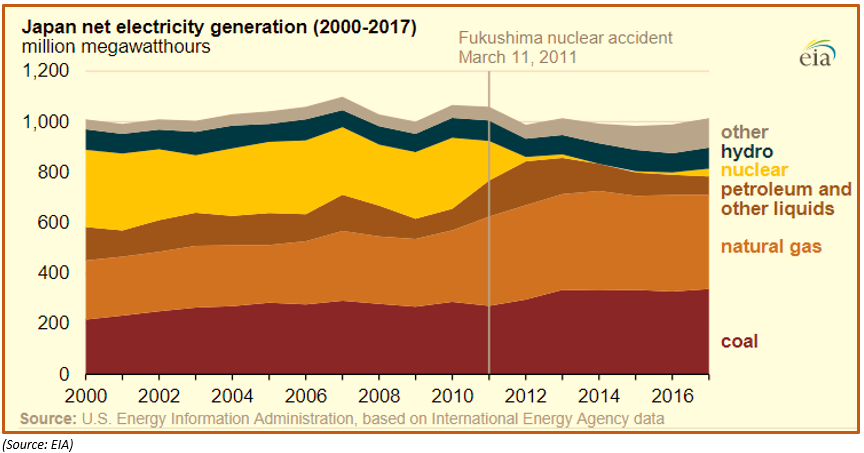

Japan, a decade ago, relied more on the nuclear generation; however, the nation witnessed a decline in nuclear energy generation and an increase in coal-powered electricity generation post the Fukushima nuclear accident in 2011. As per the data, in 2018, coal accounted for only 25 per cent of the electricity generation in Japan.

Japanâs Ministry of Economy, Trade and Industry (or MET) projects that coal-fired power generation would account for 26 per cent of total electricity generation by 2030, while nuclear, renewables and natural gas would capture 20-22 per cent, 22-24 per cent, and 27 per cent share respectively of the power generation by 2030. The 20-22 per cent nuclear energy could also support the Australian resource industry as Australia supplies a significant piece of Uranium to power the nuclear stations.

As per the EIA, Japan is planning to construct a 20-gigawatt coal-fired power plant over the next decade; however, the development of the plant would depend upon the number of suspended nuclear reactors.

Australia and Coal:

China and India are supporting the coal consumption; however, local policies of China that impose a high restriction on coal import places a disadvantage over the international and especially over the Australian coal industry, as China remains a crucial importer of the Australian coal supply.

However, in the status quo, the coal miners in Australia, in the potential absence of stimulus from China are actively diverting their coal production towards Japan, where the nation is consuming the high coal supply. The lack of any substantial coal production in the local market, the high demand for coal in Japan is providing cushion to the coal industry.

The particular issues over coal mining, such as the negative impact of the surrounding areas coupled with the occupational hazards, remain a crucial problem for the coal industry. Over such issues, many states or nations have put strict curbs over the mining activities, which, in turn, poses a great challenge for coal miners.

The popular ASX-listed names such as BHP Billiton (ASX: BHP) and Rio Tinto (ASX RIO) have either decided to quit the coal business or had already dropped the coal business from their portfolio. While Rio Tinto exited the coal business long ago, BHP is now looking to exit, and the company is actively seeing potential buyers for its Mt Arthur coal mine in Australia.

In a nutshell, the coal market is in an ambivalent situation; while few nations such as the United States and Germany are phasing out coal-fired powered plants actively, few nations such as Japan, India, and China are actively relying on coal.

However, the local policies of China are dampening the sentiments of the Australian coal market where the local government is adopting stricter policies to promote the domestic coal market. However, the steel mills could still favour the Australian coal as the coal from Australian players contains superior price advantage as compared to the Chinese Coal.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.