The financial sector and the banking space of Australia had two interesting updates on 13 August 2019 that left the market experts contemplate the respective consequences. Magellan Financial Group Limited (ASX:MFG) posted its record breaking FY19 results, turning it into a hot stock. On the other side, one of the four biggies of the Australian banking space, Westpac Banking Corporation (ASX:WBC) rejoiced as the Federal Court dismissed allegations regarding the breach of lending laws filed by ASIC.

Let us familiarise ourselves with these significant events:

Magellan Financial Group Limited

Magellan Releases FY19 Results

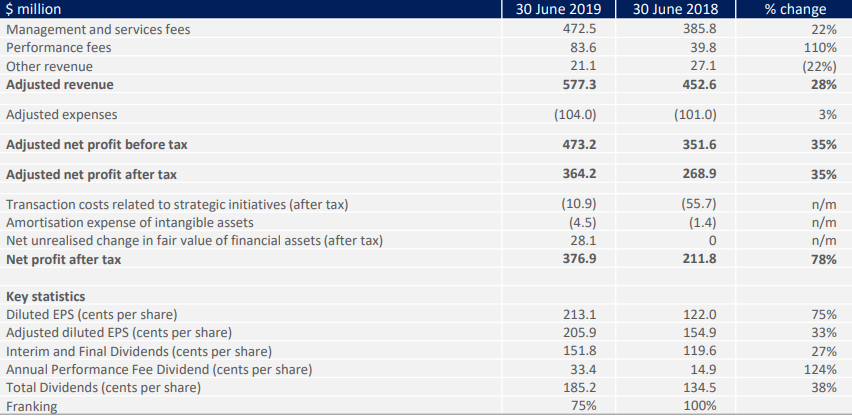

On 13 August 2019, MFG declared the results for FY 2019 for the period ending 30 June 2019 and pleasingly reported an adjusted NPAT of $364.2 million, which has surged up by 35% on pcp. The average FUM was up by 28% to $75.8 billion and PBT and performance fees of the FUM business was up by 29% to $376.2 million. The company attained these results amid challenging markets conditions, and its Total dividends for 2019 up 38% to 185.2 cents per share.

Ever since the company was established in 2006, it has generated approximately $55 billion in combined stakeholder value. As on 30 June 2019, MFGâs investment assets were worth $539.3 million. The cash position stood at $198.2 million and current receivables were at $123.8 million. Net assets were recorded at $734.0 million and liabilities stood at $66.3 million. The Group had no debts, but could avail a debt facility of $50 million, which presently stands undrawn.

MFGâs FY19 Results compared to pcp (Source: MFGâs Report)

MFGâs Growth Areas

The company was approaching its 3-year track records above the benchmark of ~US$20bn in theoretical capacity. On the infrastructure front, the term record and interest have a remaining capacity of ~US$6 billion. The retirement income segment was progressing, and there is continued emphasis on Magellan High Conviction Trust IPO, in partnership with investors.

Institutional Share Placement

With the objective to fund growth opportunities, the company has devised an institutional share placement of 4.98 million shares to raise $275 million, at $55.20 a share. The new issue represents approximately 2.7% of expanded issued capital. The funds raised through the placement, for which Macquarie Capital (Australia) Limited is enacting underwriter, would be utilised towards funding the Magellan High Conviction Trust IPO, supporting new retirement product ($50 million), future growth opportunities and new investment strategies along with funds currently under development.

Further, MFG would pay a final dividend of AUD1.114 ($197.3 million) on 29 August 2019, but the new issued shares would not be entitled to receive it.

Launch of Magellan High Conviction Trust

Besides the placement announcement, the launch of an IPO was another highlight of MFGâs FY19 update. The Group pleasingly announced that its main operating subsidiary, Magellan Asset Management Limited would undertake an IPO for ordinary units in Magellan High Conviction Trust, which would be a closed end investment trust listed on ASX. The Trust would invest in a portfolio of global companies of calibre, weighted towards Magellanâs best ideas and focus on delivering a Target Cash Distribution of 3% per annum to investors. The Trustâs strategy is in alignment with the investment strategy of Magellan High Conviction Fund which has delivered 16.6% per annum net of fees since it was incorporated on 1 July 2013 to 31 July 2019.

The IPO would consist of a priority offer, a wholesale offer and a general public offer.

Stock Performance and Returns

The securities of MFG last traded on 12 August 2019 at A$59.830, with A$10.6 billion market capitalisation and approximately 177 million outstanding shares. The stock has an EPS of A$1.892 and an annual dividend yield of 2.74%. In the last three and six months, it has delivered returns of 37.38% and 104.20%, while the YTD stands at 156.01%.

With the capital raise and new IPO on the cards, it would be interesting to see if the company continues to deliver its strong performance in the coming months.

Westpac Banking Corporation

Legal Action Against Westpac Dismissed

The Federal Court made a decision on 13 August 2019 that has inferences for the way lenders assess loan applications. Australiaâs financial regulator and corporate watchdog, Australian Securities and Investments Commission, lost a landmark lending case against banking conglomerate Westpac Banking Corporation (ASX:WBC).

What was the allegation?

ASIC had alleged WBC of breaching its responsible lending obligations over a three-year period (between December 2011 to March 2015) regarding the assessment of ~261,987 home loans. ASIC believed that the Bank solely relied on expenses benchmark and ignored the customers' declared living expenses and filed a case.

The Judgement By The Federal Court

However, it was noticed that the Bank did reflect on the consumerâs declared expenses, and further, the law required a credit provider to utilise the declared expenses mentioned above, though it was not agreed that a credit provider had to utilise the consumerâs declared expenses while doing so.

Furthermore, the Court stated that the use of the household expenditure measure (HEM), which was heavily criticised by the Royal Commission on grounds of it being an underestimation of living expenses, was still legally used as a measure by the Bank and lenders.

The Court supported the Bank and stated that the declared living expenses were not highly relevant to the consumerâs incapability to comply with loan obligations, as there is always a possibility for expenses to forego or reduce and meet repayments, if required.

What does the Bank Say?

Acknowledging the case in its favour, Chief Executive Westpac Consumer Division, Mr David Lindberg stated that the Bank has always taken its lending obligations seriously and seeks to lend responsibly to customers. The judgement was a needed clarity of this objective and would be welcoming as it clears the interpretation of responsible lending obligations.

Stock Performance and Returns

After the close of business on 13 August 2019 on the ASX, the WBC stock was quoted A$28.340, and was down by 0.24%, relative to its last trade. The market capitalisation of the company is A$99.15 billion and the stock traded with approximately 3.49 billion outstanding shares. With an annual dividend yield of 6.62%, the YTD return has been 16.05%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.