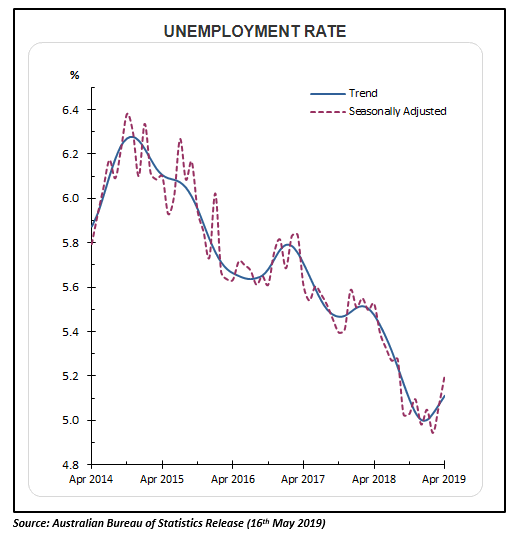

The seasonally adjusted unemployment rate in Australia rose to 5.2 per cent in April 2019, from an upwardly revised 5.1 per cent rate the month before, as per the labour force data released today by the Australian Bureau of Statistics (ABS). But the trend unemployment rate remained steady at 5.1 per cent in April. The jobless rate jumps to the highest in eight months.

However, the economy added more jobs in the market than forecasted during April 2019. Surpassing the expectations of a gain of 15,000 new jobs, the economy created 28,400 new jobs last month. In seasonally adjusted terms, the full-time employment decreased 6,300 while the part-time employment increased 34,700 in April. The trend monthly employment rose by 21,000 persons including full-time employment that advanced by 15,000 persons and part-time employment that increased by 6,000 persons.

However, the economy added more jobs in the market than forecasted during April 2019. Surpassing the expectations of a gain of 15,000 new jobs, the economy created 28,400 new jobs last month. In seasonally adjusted terms, the full-time employment decreased 6,300 while the part-time employment increased 34,700 in April. The trend monthly employment rose by 21,000 persons including full-time employment that advanced by 15,000 persons and part-time employment that increased by 6,000 persons.

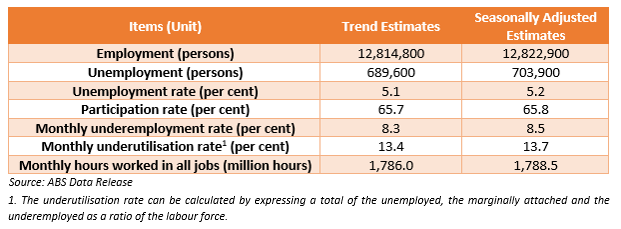

Official figures from the ABS showed that over the past year, trend employment rose by 311,000 persons, and the trend monthly underemployment rate fell by 0.2 percentage points. Also, the monthly trend underutilisation rate improved by 0.1 percentage points to 13.4 per cent in April but got reduced by 0.6 percentage points over the year.

In April 2019, the trend unemployment rate remained unchanged in South Australia, Western Australia and New South Wales. It rose in the Australian Capital Territory, Tasmania and Victoria while it fell in Northern Territory and Queensland.

In seasonally adjusted terms, the participation rate improved 0.2 percentage points in April 2019 to 65.8 per cent and the number of persons employed (Seasonally adjusted) rose by 28,000.

The table below highlights the trend estimates and seasonally adjusted estimates of labour force data in April 2019:

The current labour force data puts the RBA under more pressure to cut official interest rates. The bank kept the official cash rate steady at 1.5 per cent for the 30th time on 7th May 2019.

The speculations over a rate cut arose earlier after the data released by the ABS on 24th April 2019 indicated disappointing inflation in the March quarter 2019. However, the retail sales and trade surplus figures released by the ABS for March 2019 exceeded the expectations of the economists.

Afterwards, the RBA downgraded the near-term consumption and dwelling investment levels for Australia in a recent quarterly Statement on Monetary Policy (SoMP). The bank also reduced the economic growth target and the inflation target.

After the release of the labour force data, the economists now expect interest rates to be cut to 1.25 per cent next month. The anticipation is in line with the RBAâs statement that it will consider an interest rate cut below 1 per cent to get unemployment lower in the next 18 months.

With rising expectations of a rate cut, the Australian dollar fell 0.4 per cent to $0.6891. The S&P/ASX 200 is currently trading higher at 6292.5 points (at 1:42 PM on 16th May 2019), up by 0.1 per cent following the unemployment rises to 5.2 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.