Highlights

- Prudential Financial Inc. decreased its holdings in Cohu during the recent quarter.

- Franklin Resources Inc. and Thrivent Financial for Lutherans increased their positions.

- Financial indicators show operational challenges and liquidity strength.

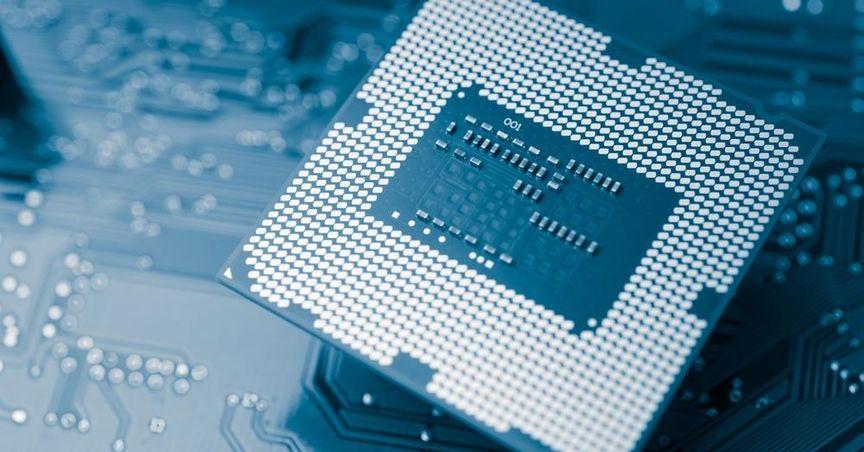

Cohu, Inc. operates in the semiconductor sector, supplying equipment and solutions for testing and inspection across various stages of integrated circuit production. The company serves manufacturers globally, focusing on the advancement of automated test equipment and handling systems used in quality control and semiconductor process assurance. This technology plays a critical role in ensuring consistency and performance in semiconductor production lines.

Institutional Activity and Stake Adjustments

Recent reports filed with regulatory authorities highlight multiple changes in institutional positions within Cohu, Inc. (NASDAQ:COHU). Prudential Financial Inc. reduced its equity stake in the company, reflecting a strategic reallocation of assets. Concurrently, firms such as Franklin Resources Inc. and Thrivent Financial for Lutherans expanded their holdings in the company, resulting in a diversified institutional response to Cohu’s business performance and sector conditions.

These developments indicate a mixed institutional approach to equity positioning in the semiconductor segment. Each adjustment reflects internal risk thresholds, sector rotation, or alignment with broader fund objectives tied to industrial and technology markets.

Market Performance and Trading Metrics

The company’s recent trading activity illustrates a moderate degree of volatility. Public data shows that Cohu's share price has experienced fluctuations aligned with broader market movement and sector pressures. Trading behavior remains influenced by external market signals, production cycles in global semiconductors, and reported financial data.

The range in valuation metrics suggests that price movements are being watched closely by firms allocating capital in equipment and technology providers. Despite varied sentiment, Cohu maintains an active presence in public equity portfolios with measurable turnover during the reporting period.

Financial Indicators and Liquidity Position

Available financial data outlines both strengths and headwinds in recent performance. While profitability metrics showed negative figures, liquidity remains sound. The company has maintained a current ratio that supports ongoing operations and supplier engagement.

These figures reflect management's approach to sustaining operations during periods of reduced demand or production lags in the semiconductor space. Operating with a flexible liquidity position allows the firm to manage obligations while aligning with shifting industry needs.

Business Focus and Sector Role

Cohu’s core focus remains on delivering test and inspection systems that support the production lifecycle of advanced semiconductor components. The company’s tools help optimize the functionality of integrated circuits, ensuring performance across consumer, automotive, and industrial applications.

Its role in the semiconductor industry connects it directly to hardware reliability, circuit precision, and efficient throughput in electronics manufacturing. By offering a portfolio that spans handlers, testers, and inspection solutions, Cohu continues to serve key suppliers in an evolving technology landscape.