Highlights

- VOC Energy Trust Units of Beneficial Interest (NYSE:VOC) has a P/E ratio of 11.57. Its current dividend yield is 17.09%.

- Lument Finance Trust, Inc. (NYSE:LFT) has a current dividend yield of 9.055%, with an annualized dividend of US$0.36.

- Permianville Royalty Trust (NYSE:PVL) dividend yield is 19.05%, and the annualized dividend is US$0.30.

Although penny stocks are typically risky, they have a considerable fan following because of their attractive prices. If they are evaluated carefully, some of them might be worth exploring.

Moreover, these stocks have the potential to grow at a faster rate than large-cap stocks.

To be on the safer side, though, investors should exercise due diligence before investing.

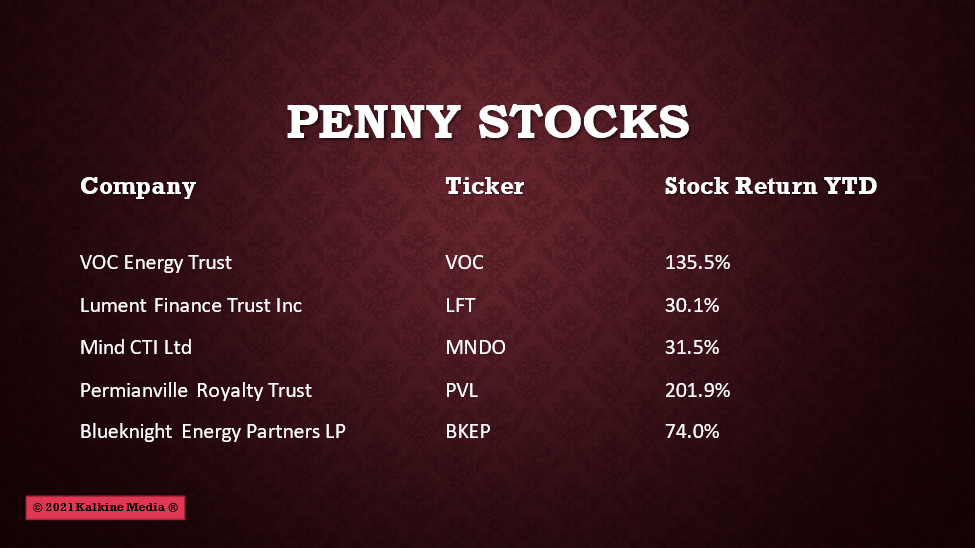

Here we list five penny stocks that gave a significant return in 2021 and might still be worth exploring in the new year.

Also Read: Yearender: Top 5 shipping and logistics stocks of 2021

VOC Energy Trust Units of Beneficial Interest (NYSE:VOC)

VOC Energy is a statutory trust. It earns revenue from selling oil and natural gas from its properties in Kansas and Texas.

For the nine months ended Sept 30, 2021, its gross proceeds from the sales of oil and natural gas were US$ 19.2 million compared to US$20.7 million for the same period in 2020.

The income from net profit interest was US$5.73 million for the first nine months of 2021, compared to US$3.51 million in the corresponding months of 2020.

The cash and cash equivalents were US$0.328 million as of Sept 30, 2021, versus US$0.603 million as of Dec 31, 2020.

The Houston, Texas-based company has a market capitalization of US$78.7 million and a P/E ratio of 11.57. Its current dividend yield is 17.09%, with an annualized dividend of US$0.80.

The stock traded in the range of US$5.38 to US$2.15 in the last 52 weeks and closed at US$4.63 on Dec 29, 2021.

Also Read: 5 best US oil & gas stocks that returned over 100% in 2021

Also Read: 2 US energy stocks with over 7% dividend yield

Lument Finance Trust, Inc. (NYSE:LFT)

The New York-based Lument is a real estate investment trust. It invests, finances, and manages commercial real estate debt assets.

The trust invests in transitional floating-rate commercial mortgage loans, commercial mortgage-backed securities, fixed-rate loans, construction loans, etc.

It earned a net interest income of US$14.5 million for the nine months ended Sept 30, 2021, compared to US$13.79 million for the corresponding nine months in the previous year.

Also Read: Top 3 US 5G stocks to watch in 2022

Its net income attributable to common stockholders was US$4.9 million or US$0.20 per share diluted, against US$5.97 million or US$0.24 per share diluted in the same period a year ago.

The trust had cash and cash equivalents of US$44.08 as of Sept 30, 2021, compared to US$11.38 million at the end of Dec 31, 2020.

LFT has a market capitalization of US$99 million, a P/E ratio of 13.23, and a forward P/E one year of 10.18. Its current dividend yield is 9.055%, and its annualized dividend is US$0.36.

The stock traded in the price range of US$4.48 to US$2.96 in the last 52 weeks and closed at US$3.97% on Dec 29, 2021.

Also Read: Top stocks under US$1,000 to explore in 2022

MIND C.T.I. Ltd. Ordinary Shares (NASDAQ:MNDO)

The Yoqneam, Israel-based Mind C.T.I. develops and markets convergent billing and customer care software solutions. The company provides solutions to communication providers like traditional wireline and wireless cable operators, broadband IP networks, etc. Its products also include call accounting and call management solutions.

Its revenue was US$20.4 million for the nine months ended Sept 30, 2021, compared to US$17.6 million in the same period in 2020, mainly backed by its messaging segment.

Also Read: Top 5 retail stocks to keep an eye on in 2022

The net income was US$4.4 million, or US$0.22 per share diluted, against US$4.0 million, or US$0.20 per share diluted a year ago. The cash flow from operations was US$4.4 million.

The technology company has a market capitalization of US$61.9 million. Its P/E ratio is 11.07, and the dividend yield is 8.61%, with an annualized dividend of US$0.26.

The stock traded in the range of US$3.80 to US$2.45 in the last 52 weeks and closed at US$3.10 on Dec 29, 2021.

Also Read: Top 2 cloud computing stocks to watch in 2022

Permianville Royalty Trust Units (NYSE:PVL)

The company is based in Houston, Texas. The statutory trust holds net profit interests from oil and natural gas sales from non-operated assets in Texas, Louisiana, New Mexico, and the Permian and Haynesville basins.

Its income from net profit interest rose in the nine months ended Sept 30, 2021, eliminating a shortfall of US$1.7 million recorded on Dec 31, 2020.

The total distributable income was US$0.429 million for the nine months ended Sept 30, 2021, compared to US$5.02 million in the same period of the previous year.

Its current market capitalization is US$69.6 million, the dividend yield is 19.05%, and the annualized dividend is US$0.30.

The stock traded in the range of US$2.39 to US$0.70 in the last 52 weeks and closed at US$2.11 on Dec 29, 2021.

Also Read: Yearender: Top 5 healthcare stocks that grabbed limelight in 2021

Source - Pixabay

Also Read: Yearender: Five S&P 500 stocks that gave over 100% return on equity

Blueknight Energy Partners L.P. (NASDAQ:BKEP)

Blueknight Energy is a limited partnership. It provides collection, storage, and distribution services to domestic transportation infrastructure markets.

The revenue was US$80.4 million in the nine months ended Sept 30, 2021, compared to US$85.2 million in the same period of 2020. Its net income was US$15.47 million or a loss of US$(0.08) per share diluted against US$101.5 million or US$1.89 per share diluted a year ago.

The Tulsa, Oklahoma-based company has a market capitalization of US$135 million and a P/E ratio of 3.02. It has a dividend yield of 4.8%, with an annualized dividend of US$0.16.

The stock price moved between US$4.26 and US$1.95 in the last 52 weeks and closed at US$3.26 on Dec 29, 2021.

Also Read: Yearender: A look at top 5 technology ETFs of 2021

Bottomline

Penny stocks are considered riskier than the established bluechip stocks. Hence, investors must exercise due diligence before investing in penny stocks.