Highlights:

- American Tower Corporation (NYSE:AMT) revenue increased by more than 16.3 per cent in Q2 FY22.

- Global Net Lease, Inc. (NYSE:GNL) had a dividend yield of 12.03 per cent.

- P. Carey Inc. (NYSE:WPC) returned gains of over four per cent this year.

American Tower Corporation (NYSE: AMT), Global Net Lease, Inc. (NYSE:GNL), Sabra Health Care REIT, Inc. (NASDAQ:SBRA), W. P. Carey Inc. (NYSE:WPC), and Omega Healthcare Investors, Inc. (NYSE:OHI) are among the major players in the real estate sector. The companies also pay a dividend to the investors, which make them more attractive to some investors.

However, the American housing and real estate sectors have witnessed a catastrophic period in recent months, as the investors and buyers experienced notable headwinds due to the soaring home prices.

The flurry of macroeconomic concerns has dampened the traders' sentiment, with inflation hitting a decades-high level and higher interest rates to tackle it.

The Federal Reserve has been aggressive with the interest rates, the latest of which was a 75 basis point hike in July. Meanwhile, investors anticipate another similar point hike at Fed's September meeting.

On the other hand, the mortgage rates also surge to more than two percentage points since January, with a jump of 3.22 per cent to 5.81 per cent by June. This had also left the investors and the sound buyers in the cold.

However, the investors are still exploring opportunities in the real estate segment, given the higher dividends paid by the firms. In addition, the sector is also considered a hedge against inflation, and considering the red-hot level of inflation, the sector has attracted eyes in recent months.

Here Kalkine Media® explores the top five REITs stocks for investors exploring the sector to diversify their portfolios.

American Tower Corporation (NYSE:AMT)

American Tower Corporation is one of the leading US REITs firms. As the name suggests, it owns and operates wireless and other related communications infrastructure, and given the increasing demand for mobile and communication services, the sector also gained notable traction.

However, the year hasn't been steady for the major REIT stock. The AMT stock fell over 14 per cent year-over-year (YoY) while losing more than 12 per cent in 2022. In the current quarter, the AMT stock traded flat.

The stock of the US$ 119.73 billion market cap firm had an RSI of about 43, Refinitiv data showed, suggesting that the stock could be highly volatile at the moment. American Tower Corporation had a P/E ratio of 42.28. Its dividend yield was 2.28 per cent.

In the second quarter of fiscal 2022, the revenue of the Boston, Massachusetts-based firm was US$ 2.67 billion, noting a 16.3 per cent increase YoY. Its revenue from the property segment rose 17.1 per cent YoY to US$ 2.61 billion. American Tower's net income totalled US$ 891 million in Q2 FY22, a 19.1 per cent YoY jump.

Global Net Lease, Inc. (NYSE:GNL)

Global Net Lease is a REIT firm that operates a diversified portfolio of commercial properties. The company holds a market cap of over US$ 1.38 billion, and its P/E ratio is 8.13.

The stock of the firm also experienced a similar pressure in recent months. The GNL stock fell about 21 per cent in the last 12 months while declining more than 13 per cent year-to-date (YTD). In the current quarter, it lost about six per cent through September 7.

The RSI of Global Net Lease was about 28, as per Refinitiv data, suggesting that the stock could be in an overselling condition. However, it had a dividend yield of 12.03 per cent.

The company's second-quarter fiscal 2022 revenue was US$ 95.2 million, against US$ 99.6 million in the fiscal 2021 second quarter. The net loss attributable to common shareholders of the New York-based company was US$ 5.8 million in Q2 FY22, relative to a loss of US$ 2.4 million in the prior year's second quarter.

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

Sabra Health Care REIT, Inc. (NASDAQ:SBRA)

Sabra Health Care is a REIT firm, and as the name suggests, it owns and spends on the real estate segment that focuses on the healthcare sector. Its dividend yield was 8.13 per cent, and the US$ 3.38 billion market cap company had an annualized dividend of US$ 1.2.

The SBRA stock lost about ten per cent YoY while gaining nearly six per cent YTD. On a QTD basis, the stock of Sabra Health Care showed gains of about three per cent. According to Refinitiv data, it had an RSI of around 35.

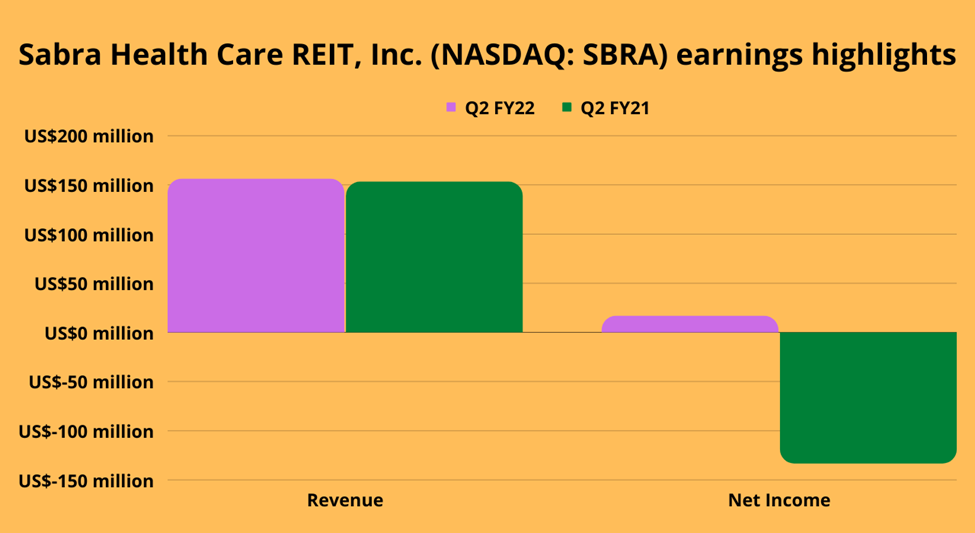

The Irvine, California-based company reported a revenue of US$ 155.95 million in Q2 FY22, comparatively up from US$ 152.93 million in the preceding year's Q2. Its net income was US$ 16.8 million in Q2 FY22 versus a loss of US$ 132.57 million in Q2 FY21.

W. P. Carey Inc. (NYSE:WPC)

This REIT has a market cap of over US$ 16.4 billion, and its dividend yield is 5.06 per cent. Meanwhile, the company had a P/E ratio of 31.21.

The WPC stock jumped over four per cent YTD while soaring nearly nine per cent in the last 52 weeks. Its price rose more than three per cent in the ongoing quarter. However, as of its trading price of September 7, it traded about four per cent below its 52-week high of US$ 89.63, noted on July 29, 2022.

The revenue, including reimbursable costs, of W. P. Carey in the fiscal 2022 second quarter was US$ 339.8 million, a surge of 7.9 per cent YoY. The company cited higher lease revenues from net acquisitions and rent escalations for the jump in its revenue.

The attributable net income of the New York-based firm also increased significantly to US$ 284.67 million in Q2 FY22, from an income of US$ 171.92 million in Q2 FY21.

Omega Healthcare Investors, Inc. (NYSE:OHI)

The healthcare industry-focused REIT firm Omega Healthcare had a dividend yield of 8.3 per cent. Its P/E ratio was 17.13, and its annualized dividend was US4 2.68.

The stock of the US$ 7 billion market cap firm lost about three per cent YoY. However, on a YoY basis, the OHI stock gained over nine per cent YTD and 14 per cent QTD.

The revenue of the Hunt Valley, Cockeysville, Maryland-based firm was US$ 244.64 million in Q2 FY22, down from US$ 257.42 million in Q2 FY21. Omega Healthcare's net income was US$ 91.91 million in the latest quarter, noting an improvement from US$ 86.86 million in Q2 FY21.

Bottom line

Several macroeconomic headwinds have affected the market, and it seems it has slightly cooled off recently. The higher borrowing costs helped bring applications down to their lowest level in about two decades. The existing home sales also appear to be cooling, with a fall for six consecutive months in July.

Meanwhile, the higher interest rates have also fuelled concerns over a potential recession, forcing the investors to shift their focus to some safer assets.

However, this year, the real estate sector was no exception amid choppy trading in the broader market. The S&P 500 real estate segment fell over 14 per cent YoY while declining over 19 per cent YTD. In the ongoing quarter, it managed to add nearly two per cent, which could be due to the summer rally of the stocks.