Highlights

- Both Visa and Mastercard are global leaders in the digital payments industry.

- Visa generated US$ 7,936 million in revenues for the quarter that ended December 31, 2022.

- For the last quarter of fiscal 2022, Mastercard’s revenue was US$ 5.8 billion.

When making a transaction today, whether offline or online, there is a good chance you will use a credit or debit card issued by either Visa or Mastercard. Even though digital wallets like PayPal, Google Pay, Apple Pay, and others are becoming increasingly popular, Visa and Mastercard still dominate the electronic payments market on a global scale.

Having said that, let’s see how Visa and Mastercard stocks have been performing lately:

Visa Inc. (NYSE:V)

With operations in more than 200 countries and territories, Visa Inc. is a global digital payment industry leader. The company helps facilitate payments between customers, businesses, financial institutions, and governmental bodies. As a digital payments company, Visa hopes to connect the world using its practical and secure payment gateways.

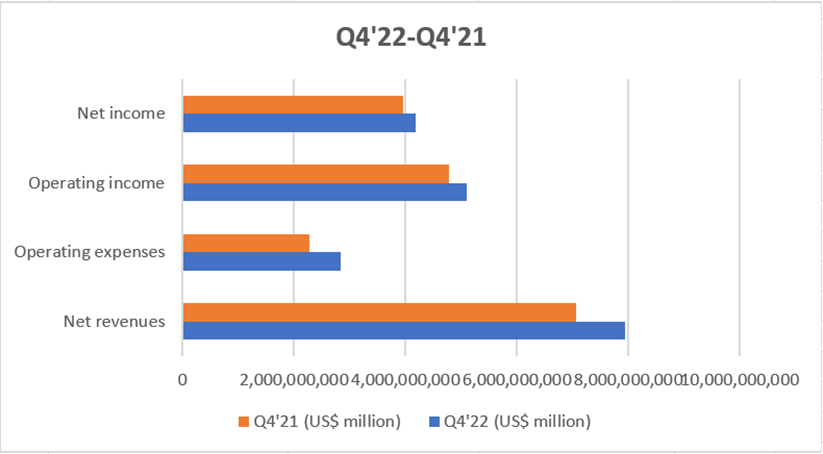

In the December 2022 quarter, Visa Inc. improved its net revenues from US$ 7,059 million in the prior comparable period to US$ 7,936 million.

Operating income and net income also grew in the quarter that ended December 31, 2022, from US$ 4,776 million and US$ 3,959 million in Q4’21 to US$ 5,090 million and US$ 4,179 million, respectively.

Additionally, the company had cash, cash equivalents, restricted cash, and restricted cash equivalents of US$ 18,383 million as of December 31, 2022.

The company’s financials are summarized in the table below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Mastercard Incorporated (NYSE:MA)

Intending to establish a safer and more secure digital economy, Mastercard poses itself as a world leader in the payments industry, with operations in over 210 countries and territories. The company uses its innovative solutions, secure data, and networks to enable people, governments, financial institutions, and businesses to reach their full potential.

Mastercard informed the market of generating a net income of US$ 2.5 billion alongside diluted earnings per share (EPS) of US$ 2.62 in the fourth quarter of 2022. Additionally, while adjusted net income remained the same (US$ 2.5 billion) in Q4, adjusted diluted EPS was US$ 2.65.

Meanwhile, the company made US$ 5.8 billion in revenue for the last quarter of 2022, which was a 12 per cent increase from the prior comparable period or 17 per cent on constant currency. Furthermore, Mastercard paid its shareholders US$ 473 million in dividends during the fourth quarter of 2022.

For the full year 2022, the company mentioned achieving net revenue of US$ 22.2 billion, up from US$ 18.9 billion in 2021. Net income for 2022, on the other hand, was US$ 9.9 billion, up from US$ 8.7 billion in the last year.

Bottom Line

It’s always better to conduct extensive market research before investing in the stock market rather than relying on past performances of stocks to predict future gains.