Highlights

- Nasdaq Composite Index grew 0.12% in one year.

- The US GDP grew at an annual rate of 6.9% in the fourth quarter of 2021.

- The technology companies lead in market capitalization.

The Nasdaq Composite Index saw significant growth in 2021, rising by 23.2% despite the weight of the pandemic. This year, though, the index saw a sharp fall, plummeting 15.66% as of Jan 27.

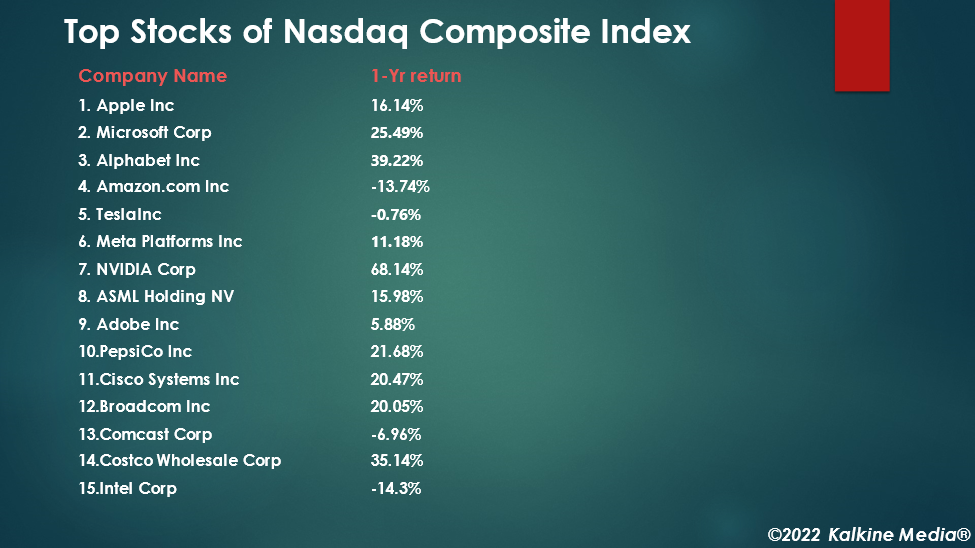

Here we discuss the top 50 stocks on Nasdaq based on their market capitalization.

- Apple Inc. (AAPL)

Market Cap: US$2.76 trillion

Closing price on January 27, 2022: US$159.22

One year return: 16.14%

The Cupertino, California-based Apple Inc., founded in 1977, offers popular products like iPhone, iPad, iPod, personal computers, operating systems, and services.

Apple posted revenue of US$123.94 billion and a net income of US$34.63 billion or US$2.10 per share diluted in the quarter ended December 25, 2021.

Its P/E ratio is 28.33, the forward P/E for one year is 27.36, the dividend yield is 0.55%, and the annualized dividend is US$0.88.

- Microsoft Corporation (MSFT)

Market Cap: US$2.24 trillion

Closing price on January 27, 2022: US$299.84

One year return: 25.49%

The Redmond, Washington-based company develops and licenses consumer and enterprise software. It has a broad user base for its Windows operating system and Office productivity suites.

Microsoft posted revenue of US$51.73 billion and a net income of US$18.77 billion or US$2.48 per share diluted in the three months ended December 31, 2021.

Its P/E ratio is 31.93, the forward P/E for one year is 32.49, the dividend yield is 0.84%, and the annualized dividend is US$2.48.

Also Read: Top five cloud computing stocks to explore in 2022

- Alphabet Inc. (GOOGL)

Market Cap: US$1.71 trillion

Closing price on January 27, 2022: US$2580.10

One year return: 39.22%

The Mountain View, California-headquartered Alphabet Inc. is a holding company. Search giant Google is its wholly-owned subsidiary.

Alphabet’s revenue was US$65.11 billion, and the net income came in at US$18.94 billion or US$27.99 share diluted for the quarter ended September 30, 2021.

Its P/E ratio is 24.85, and the forward P/E for one year is 23.83.

- Amazon.com, Inc. (AMZN)

Market Cap: US$1.41 trillion

Closing price on January 27, 2022: US$2,792.75

One year return: -13.74%

The Seattle, Washington-based company is an online retailer and e-commerce aggregator.

It reported net sales of US$110.8 billion and net income of US$3.16 billion or US$6.12 per share diluted for the September quarter of 2021.

The company will declare its Q4, 2021 results on February 3, 2022.

Its P/E ratio is 54.63, and the forward P/E for one year is 67.83.

Also Read: Coinbase stock slips 10% - Will the dip stop dipping?

- Tesla, Inc. (TSLA)

Market Cap: US$832.63 billion

Closing price on January 27, 2022: US$829.10

One year return: -0.76%

The Palo Alto, California-based Tesla is an electric vehicle company founded in 2003. It also sells solar panels, solar roofs, solar batteries, etc.

Tesla posted revenue of US$53.82 billion, up 71% YoY in fiscal 2021, and a net income (non-GAAP) of US$7.64 billion, up 211% over the previous year. Its EPS remained at US$6.78% for the fiscal year ended December 31, 2021.

On Wednesday, the EV maker said it expects vehicle deliveries to grow by more than 50% YoY in 2022, regardless of supply chain issues. CEO Elon Musk said the company would not roll out new models this year.

The stock has a P/E ratio of 169.2 and a forward P/E for one year of 116.77.

- Meta Platforms, Inc. (FB)

Market Cap: US$830.72 billion

Closing price on January 26, 2022: US$294.64

One year return: 11.18%

The Menlo Park, California-based Meta Platforms Inc, formerly Facebook, provides an online social networking platform. It is also developing a metaverse, a virtual reality platform, as an extension to its hugely popular social media site.

It will release its Q4 and full-year 2021 results on February 2, 2022. For the September quarter, 2021, its revenue was US$29 billion, and the net income was US$9.19 billion or US$3.22 per share diluted.

The technology company has a P/E ratio of 21.03 and a forward P/E for one year of 21.18.

Also Read: Netflix’s share plummets, subscriber growth slows

- NVIDIA Corporation (NVDA)

Market Cap: US$548.60 billion

Closing price on January 27, 2022: US$219.44

One year return: 68.14%

The Santa Clara, California-headquartered Nvidia designs graphics processing units (GPUs) for different end markets.

For the quarter ended October 31, 2021, the company reported a revenue of US$7.1 billion and a net income of US$2.46 billion, or US$0.97 per share diluted.

Its P/E ratio is 67.62, the forward P/E for one year is 60.62, the dividend yield is 0.07%, and the annualized dividend is US$0.16.

- ASML Holding N.V. New York Registry Shares (ASML)

Market Cap: US$257.97 billion

Closing Price on January 27, 2022: US$634.66

One year return: 15.98%

The company is based in the Netherlands. It is a leader in photolithography systems used in semiconductor manufacturing.

For the fiscal year ended December 31, 2021, its revenue was €18.6 billion (US$20.7 billion), and the net income was €5.88 billion (US$6.56 billion).

Its P/E ratio is 37.49, the forward P/E for one year is 35.03, the dividend yield is 0.54%, and the annualized dividend is US$3.543.

Also Read: REITs with over 5.5% dividend yield to explore

- Adobe Inc. (ADBE)

Market Cap: US$232.57 billion

Closing price on January 27, 2022: US$493.05

One year return: 5.88%

The company is based in San Jose, California. It provides content creation, document management, and digital marketing and advertising software and services.

The company earned revenue of US$15.78 billion and a net income of US$4.8 billion or US$10.02 per share diluted in the fiscal year ended December 2, 2021.

Its P/E ratio is 49.21, and the forward P/E for one year is 44.46.

- PepsiCo, Inc. (PEP)

Market Cap: US$234.17 billion

Closing price on January 27, 2022: US$169.37

One year return: 21.68%

PepsiCo is a food and beverage company with a worldwide presence. It is based in Purchase, New York.

The company will declare its fourth quarter and full-year earnings results ended December 25, 2021, on February 10, 2022.

For the September quarter, 2021, its revenue was US$20.2 billion, and the net income was US$2.2 billion or US$1.60 per share diluted.

The company has a P/E ratio of 28.85, the forward P/E for one year of 27.10, a dividend yield of 2.54%, and an annualized dividend of US$4.30.

Also Read: Top EdTech stocks to explore in first quarter of 2022

Also Read: Why Blue Star Foods (BSFC) stock skyrocketed 429% today?

- Cisco Systems, Inc. (CSCO)

Market Cap: US$230.36 billion

Closing price on January 27, 2022: US$54.62

One year return: 20.47%

The San Jose, California-headquartered Cisco Systems supplies hardware and software for the IT sector.

The technology company earned a net income of US$2.98 billion or US$0.70 per share diluted for the quarter ended October 30, 2021. Its revenue was US$12.9 billion in the October quarter.

Its P/E ratio is 20.3, the forward P/E for one year is 17.79, the dividend yield is 2.67%, and the annualized dividend is US$1.48.

- Broadcom Inc. (AVGO)

Market Cap: US$223.90 billion

Closing price on January 27, 2022: US$542.31

One year return: 20.05%

This semiconductor company is based in San Jose, California. It provides an assortment of solutions for industrial end markets, enterprise storage, and wired infrastructure.

For the fiscal year ended October 31, 2021, the company reported a net income of US$6.4 billion or US$15.00 per share diluted on revenue of US$27.45 billion.

Its P/E ratio is 36.15, the forward P/E for one year is 18.33, the dividend yield is 2.94%, and the annualized dividend is US$16.40.

Also Read: Top 5G stocks to explore as US rolls out the service

- Comcast Corporation (CMCSA)

Market Cap: US$219.35 billion

Closing price on January 27, 2022: US$48.01

One year return: -6.96%

The Philadelphia, Pennsylvania-based consumer service company owns cable networks such as CNBC, the NBC broadcast network, MSNBC Universal Studios, and theme parks.

For the quarter ended September 30, 2021, Comcast reported revenue of US$30.3 billion and a net income of US$3.93 billion or US$0.86 per share diluted.

Its P/E ratio is 15.49, the forward P/E for one year is 13.05, the dividend yield is 2.06%, and the annualized dividend is US$1.08.

- Costco Wholesale Corporation (COST)

Market Cap: US$213.96 billion

Closing price on January 27, 2022: US$482.52

One year return: 35.14%

The Issaquah, Washington-based Costco Wholesale, a warehouse club, caters to individual shoppers. Its average warehouse size is around 146,000 sq feet, and over 75% of its locations offer fuel.

Costco’s revenue was US$50.36 billion, and the net income attributable to the company was US$1.32 billion, or US$2.98 per share diluted for the three months ended November 21, 2021.

Its P/E ratio is 41.49, the forward P/E for one year is 38.23, the dividend yield is 0.65%, and the annualized dividend is US$3.16.

Also Read: Why Aptorum Group (APM) stock jumped 33% today?

- Intel Corporation (INTC)

Market Cap: US$195.41 billion

Closing price on January 27, 2022: US$48.05

One year return: -14.3%

The Santa Clara, California-based Intel designs and manufactures microprocessors for personal computer and data center markets.

For the quarter ended September 25, 2021, the company earned a net income of US$6.83 billion or US$1.67 per share diluted on revenue of US$19.19 billion.

Its P/E ratio is 9.89, the forward P/E for one year is 13.42, the dividend yield is 2.69%, and the annualized dividend is US$1.46.

- QUALCOMM Incorporated (QCOM)

Market Cap: US$181.36 billion

Closing price on January 27, 2022: US$161.20

One year return: 3.63%

The San Diego, California-based technology company Qualcomm designs chips for smartphones and develops and licenses wireless technology.

The company will release its Q1, 2022, earning results on February 2 after market close.

It earned revenue of US$33.57 billion and a net income of US$9.04 billion or US$7.87 per share diluted for the fiscal year ended on September 26, 2021.

Its P/E ratio is 20.48, the forward P/E for one year is 16.74, the dividend yield is 1.63%, and the annualized dividend is US$2.72.

Also Read: Top defense stocks to explore in 2022

- PayPal Holdings, Inc. (PYPL)

Market Cap: US$185.76 billion

Closing price on January 27, 2022: US$158.11

One year return: -33.51%

The San Jose, California-based PayPal was spun off from eBay in 2015. The company provides electronic payment solutions to merchants and consumers.

For the quarter ended September 30, 2021, the company earned revenue of US$6.18 billion and a net income of US$1.09 billion or US$0.92 per share diluted.

Its P/E ratio is 38.01, and the forward P/E for one year is 45.56.

- AstraZeneca PLC American Depositary Shares (AZN)

Market Cap: US$184.44 billion

Closing Price on January 27, 2022: US$59.52

One year return: 14.37%

The Cambridge, UK-based AstraZeneca sells branded drugs for different therapeutic classes, including gastrointestinal, cardiovascular, respiratory, cancer, diabetes, etc.

For Q3, 2021, the company earned revenue of US$9.87 billion, and loss after tax was US$1.65 billion or US$1.10 per share.

Its P/E ratio is 93, the forward P/E for one year is 22.98, the dividend yield is 2.4%, and the annualized dividend is US$1.37.

- Texas Instruments Incorporated (TXN)

Market Cap: US$161.52 billion

Closing Price on January 27, 2022: US$174.81

One year return: 3.3%

This Dallas, Texas-based company is a leading analog chipmaker in the world. Its chips process real-world signals, such as power and sounds.

For the three months ended September 30, 2021, its earned revenue of US$4.64 billion and a net income of US$1.95 billion or US$2.07 per share diluted.

Its P/E ratio is 21.16, the forward P/E for one year is 19.17, the dividend yield is 2.58%, and the annualized dividend is US$4.60.

Also Read: Five hot oil and gas stocks to explore now

- Netflix, Inc. (NFLX)

Market Cap: US$171.28 billion

Closing Price on January 27, 2022: US$386.70

One year return: -27.37%

The Los Gatos, California-based Netflix mainly earns from its streaming video-on-demand service. Its services are available in almost all countries except China, showing its popularity.

For the year ended December 31, 2021, the company earned revenue of US$29.69 billion and a net income of US$5.11 billion or US$11.24 per share diluted.

Its P/E ratio is 34.4, and the forward P/E for one year is 33.71.

- Intuit Inc. (INTU)

Market Cap: US$146.45 billion

Closing Price on January 27, 2022: US$517.22

One year return: 39.81%

The Mountain View, California-based Intuit provides small-business accounting software, personal tax solutions, and professional tax offerings.

Its net income was US$228 million or US$0.82 per share diluted on revenue of US$2.01 billion for the quarter ended October 31, 2021.

Its P/E ratio is 68.42, the forward P/E for one year is 66.57, the dividend yield is 0.54%, and the annualized dividend is US$2.72.

Also Read: Blink Charging (BLNK) to supply EV chargers to GM stores, stock up 7%

Also Read: Microsoft buys Activision Blizzard to become third-largest gaming firm

- Honeywell International Inc. (HON)

Market Cap: US$138.13 billion

Closing Price on January 27, 2022: US$200.65

One year return: -1.08%

The Charlotte, North Carolina-based Honeywell makes thermostats. But in 2019, it forayed into the enterprise performance-management software segment.

For the three months ended September 30, 2021, the company booked a net income of US$1.27 billion or US$1.80 per share diluted on net sales of US$8.47 billion.

Its P/E ratio is 25.79, the forward P/E for one year is 24.96, the dividend yield is 1.95%, and the annualized dividend is US$3.92.

- Advanced Micro Devices, Inc. (AMD)

Market Cap: US$123.90 billion

Closing Price on January 27, 2022: US$102.60

One year return: 17.23%

The Santa Clara-based AMD specializes in graphics, high-performing computing, and visualization technologies.

For the three months ended September 25, 2021, the company posted revenue of US$4.3 billion and a net income of US$923 million or US$0.75 per share diluted.

Its P/E ratio is 31.76, and the forward P/E for one year is 43.11.

Also Read: Top 2 cannabis stocks to watch in 2022

- Sanofi ADS (SNY)

Market Cap: US$132.41 billion

Closing Price on January 26, 2022: US$52.86

One year return: 11.12%

Sanofi is a healthcare company based in Paris, France. It develops and markets drugs for immunology, cardiovascular disease, diabetes, etc.

For the September quarter of FY2021, its revenue was €10.8 billion (US$12.1 billion), and the net income was €2.3 billion (US$2.58 billion) or €1.85 per share diluted.

Its P/E ratio is 18.04, the forward P/E for one year is 14.33, the dividend yield is 2.66%, and the annualized dividend is US$1.368.

- T-Mobile US, Inc. (TMUS)

Market Cap: US$132.43 billion

Price close on January 27, 2022: US$106.03

One year return: -17.01%

T-Mobile US is a wireless network operator based in Bellevue, Washington. It provides communication services to customers.

The company will report its fourth quarter and full fiscal 2021 results on February 2 after the closing bell.

The company’s total revenue surged 1.8% to US$19.62 billion in Q3, FY21. Its net income was US$691 million.

Its P/E ratio is 39.71, the forward P/E for one year is 47.55., and the EPS is US$2.67.

Also Read: 5 best US hospital stocks for 2022

Bottomline

The US stock market has slowed down in January this year after a robust performance in 2021. Factors such as the Omicron threat, impending interest rate hikes, and the continued supply shortages weighed on investors’ minds.

However, in the fourth quarter last year, the US gross domestic product (GDP) grew at an annual rate of 6.9%, the highest growth rate since 1984. It tripled from 2.9% in 2020.

This strong growth brought confidence despite covid uncertainties.

(Refer to the second part of the article for the remaining stocks on the top 50 Nasdaq list.)