US stocks closed in a sea of red on Thursday, January 20, as investors paused their bullish bets amid mixed signals from the economy.

The S&P 500 fell 1.10% to 4,482.73. The Dow Jones declined 0.89% to 34,715.39. The NASDAQ Composite was down 1.30% to 14,154.02, and the small-cap Russell 2000 fell 1.81% to 2,025.30.

On Thursday, the Labor Department said the weekly jobless claims rose by 55,000 to a seasonally adjusted 286,000, the highest increase since mid-October for the week ended January 15, 2022.

In a separate report, an industry body said that the existing US home sales fell by 7.1% in December year-on-year due to high prices and low inventory. However, home sales in 2021 were up 8.5% YoY to 6.12 million units, the biggest rise since 2006, according to the National Association of Realtors.

Barring utility, all other stock segments on the S&P 500 index stayed in the negative territory. The top losers were consumer discretionary, basic materials, and the industrial sectors.

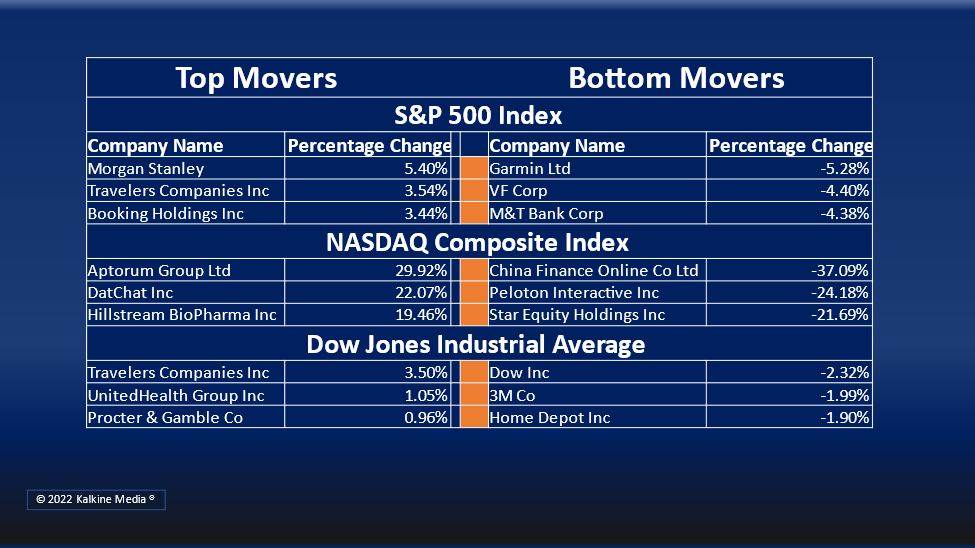

Shares of Peloton Interactive, Inc (PTON) fell more than 22% in intraday trading after media reports claimed the company is pausing its fitness equipment production amid a drop in consumer demand.

The Travelers Companies, Inc. (TRV) stock rose 3.95% after reporting quarterly results. Its net income rose to US$1.33 billion in the fourth quarter of FY2021 from US$1.31 billion a year ago.

In the utility sector, NextEra Energy Inc. (NEE) stock gained 1.59%, Duke Energy Corporation (DUK) rose 0.51%, and Dominion Energy (D) climbed 0.72%. Exelon Corporation (EXC) and American Electric Power Company Inc. (AEP) increased by 1.795 and 0.04%, respectively.

In the consumer discretionary sector, Amazon.com (AMZN) stock fell 1.47%, Home Depot Inc. (HD) fell 1.62%, and Nike Inc. (NKE) declined 0.35%. Lowe’s Companies Inc. (LOW) and Ford MTR Co. Del (F) were down 3.50% and 2.43%, respectively.

In the basic material sector, Linde Plc (LIN) stock fell 0.06%, Sherwin Williams Company (SHW) decreased by 2.04%, and Freeport-McMoran Inc. (FCX) was down 2.04%. Ecolab Inc. (ECL) declined 0.62%, and Newmont Corporation (NEM) fell 1.73%.

The global cryptocurrency market was up 1.92% to US$2.02 trillion, according to coinmarketcap.com. Bitcoin (BTC) rose 2.33% to US$42,750.52 in the last 24 hours to Thursday evening.

On Thursday, the US Securities and Exchange Commission rejected the filings by First Trust Advisors and SkyBridge for a spot bitcoin exchange-traded fund.

Also Read: Russia to ban mining and use of cryptocurrency

Also Read: Four Springs Capital Trust (FSPR) to debut on NYSE today - know details

Also Read: Pfizer covid vaccine for kids under five on the anvil

Futures & Commodities

Gold futures declined 0.29% to US$1,837.85 per ounce. Silver futures increased by 1.09% to US$24.495 per ounce, while copper rose 1.26% to US$4.5255.

Brent oil futures decreased by 1.22% to US$87.36 per barrel and WTI crude futures were down by 1.34% to US$84.65.

Bond Market

The 30-year Treasury bond yields decreased 0.42% to 2.130, while the 10-year bond yields fell 0.09% to 1.825.

US Dollar Futures Index surged 0.36% at US$95.845.

_(1).jpg)