DENVER, Colo., May 15, 2025 (SEND2PRESS NEWSWIRE) — ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the fourth quarter (Q4) and calendar year (CY) of 2024. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

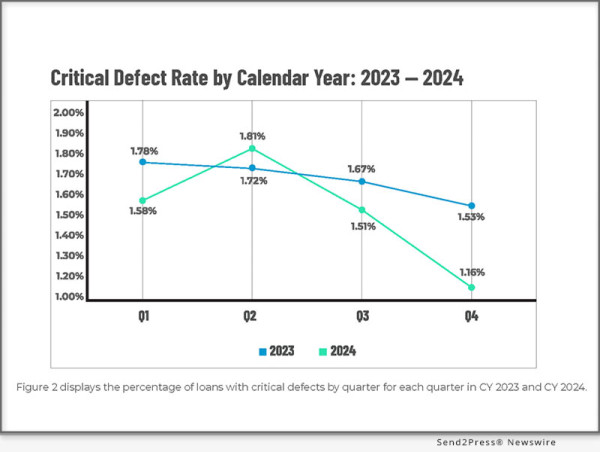

Image caption: Figure 2 from the Q4/CY 2024 ACES Mortgage QC Industry Trends report displays the percentage of loans with critical defects by quarter for each quarter in CY 2023 and CY 2024.

Key findings from the Q4/CY 2024 report include:

- The overall Q4 2024 critical defect rate was 1.16%, reflecting a 23.18% decrease from Q3 2024.

- CY 2024’s average critical defect rate was 1.52%, down 9.52% from CY 2023.

- Of the four major underwriting categories, Assets, Income/Employment and Credit improved in Q4 2024, while Legal/Regulatory/Compliance and Product Eligibility saw increases. On a year-over-year basis, only Income/Employment and Assets saw declines.

- In Q4 2024, Legal/Regulatory/Compliance emerged as the leading defect category, followed by a tie between Assets and Income/Employment.

- For CY 2024, Income/Employment and Assets were again the most cited defect categories, followed by Credit and Legal/Regulatory/Compliance.

- Sub-category analysis for Q4 2024 showed declines in Documentation and Calculation/Analysis defects within the Income/Employment category. Meanwhile, Eligibility-related defects increased in the Income/Employment, Assets, and Credit categories, and Documentation-related defects also rose in the Assets category.

- Refinance review share increased in Q4 2024, while purchase review share declined. Refinance defect share increased modestly, while purchase defect share fell.

- For CY 2024, FHA review share increased, with defect share decreasing from Q3 to Q4. Conventional review share remained steady, while USDA and VA volume remained low overall.

- In Q4, FHA defect share improved, while conventional defect share increased modestly. VA defect share was largely unchanged.

- For CY 2024, defect share declined for FHA and USDA loans, increased slightly for conventional loans, and remained flat for VA.

“Lenders made meaningful progress in loan quality in 2024, closing the year with one of the lowest quarterly critical defect rates we’ve ever observed,” said ACES Executive Vice President Nick Volpe. “However, continued volatility across the Legal / Regulatory / Compliance and Insurance categories, as well as within the Income/Employment Eligibility subcategory, highlights the importance of ongoing diligence in quality control efforts.”

Findings for the Q4/CY 2024 ACES Mortgage QC Industry Trends are based on post-closing quality control data derived from the ACES Quality Management and Control® benchmarking system and incorporate data from prior quarters and/or calendar years, where applicable. All reviews and defect data evaluated for the report were based on loan audits selected by lenders for full file reviews.

The Mortgage QC Industry Trends Reports are available for free download at https://www.acesquality.com/resources/reports.

About ACES Quality Management

ACES Quality Management is the leading provider of enterprise quality management and control software for the financial services industry. The nation’s most prominent lenders, servicers and financial institutions rely on ACES Quality Management & Control® Software to improve audit throughput and quality while controlling costs, including:

Over 70% of the top 20 independent mortgage lenders;

- 7 of the top 10 loan servicers;

- 11 of the top 30 banks; and

- 3 of the top 5 credit unions in the United States.

Unlike other quality control platforms, ACES Flexible Audit Technology® gives independent mortgage lenders and financial institutions the ability to easily manage and customize ACES to meet their business needs without having to rely on IT or other outside resources. Using a customer-centric approach, ACES clients get responsive support and access to our experts to maximize their investment. For more information, visit https://www.acesquality.com/ or call 1-800-858-1598.

News Source: ACES Quality Management

To view the original post, visit: https://www.send2press.com/wire/aces-q4-cy-2024-mortgage-qc-industry-trends-report-finds-quarterly-defect-rate-falls-to-1-16-as-annual-loan-quality-improves/.

This press release was issued by Send2Press® Newswire on behalf of the news source, who is solely responsible for its accuracy. www.send2press.com.