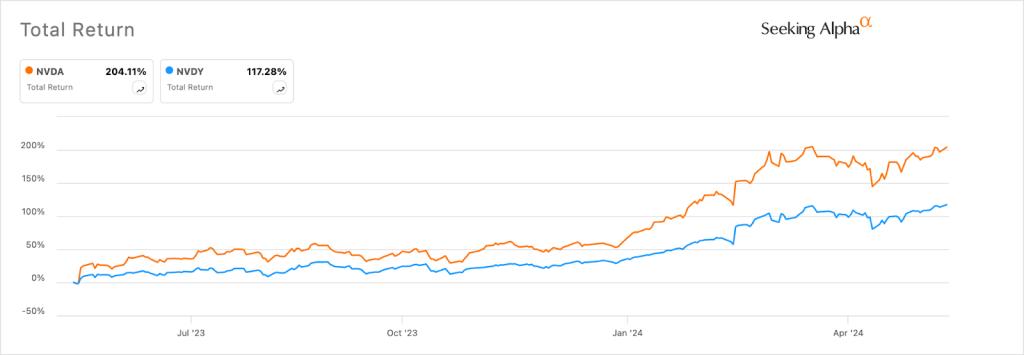

The YieldMax NVDA Option Income Strategy ETF (NVDY) has continued to underperform Nvidia (NASDAQ: NVDA) this year. Its total return – price and dividends – has risen to 63.20% this year while Nvidia has risen by over 91.40%.

NVDY ETF has lagged behind Nvidia’s stock

The ETF, which has a distribution rate of 53.50% and over $490 million in assets, will be in the spotlight this week as Nvidia publishes its financial results. As I wrote on Monday, analysts believe that Nvidia’s business did well in the first quarter.

The average estimate is that its revenue jumped by over 246% in Q1 to over $22.58 billion. The highest estimate is that its revenue rose to $24.66 billion while the lowest estimate is $21.72 billion. Its earnings per share is expected to come in at $51.2, higher than the 98 cents it made a year earlier.

NVDA vs NVDY stock chart

Nvidia’s performance is notable because it made $22 billion in the fourth quarter of 2024, higher than the $16.6 billion it made in 2021.

Nvidia’s business is thriving because of the rising demand for semiconductors to power large data centers for artificial intelligence (AI) applications. The company’s competitive advantage is that its chips are the most effective.

Spending for these semiconductors is expected to do well in the long term. A recent report by Deloitte showed that enterprise spending on Gen AI will jump by 30% to over $50 billion in the next two years. Another study showed that spending will get to over $81 billion this year.

Another reason is that Nvidia also runs Cuda, a popular software package for AI applications. It enables chips originally designed graphics to speed up AI applications. While Cuda is facing competition from Triton, analysts believe that it is in a pole position that will be difficult to pass.

Analysts are bullish on Nvidia’s stock

Analysts are generally bullish on Nvidia stock. 16 of the 38 analysts who track the company have a buy rating while 15 of them have a hold rating. Some of the most enthusiastic are analysts from Barclays, Susquehanna, Rosenblatt, Stifel, and Baird.

NVDY’s underperformance mirrors that of other covered call ETFs. As I wrote earlier, the TSLY ETF has lagged behind Tesla since its inception. Similarly, AMZY’s stock has risen by 47% in the past 12 months while Amazon has risen by 60%. Netflix’s NFLX has risen by 76% while NFLY has jumped by 27%.

For starters, NVDY and these other ETFs use covered call strategies that generate yields through the options premium. The fund starts by buying short-term US Treasuries, which are often seen as risk-free assets.

It then creates a synthetic long position on NVDA and then sells calls against the synthetic position. The goal is to harvest the option premium ETF and pay it to its investors through distributions. It benefits when Nvidia’s stock rises or when it moves sideways. Therefore, the NVDY ETF will likely be highly volatile when the company publishes its financial results.

The post NVDY: Is the NVDA Option Income Strategy ETF a good buy? appeared first on Invezz